Focus Of The Day

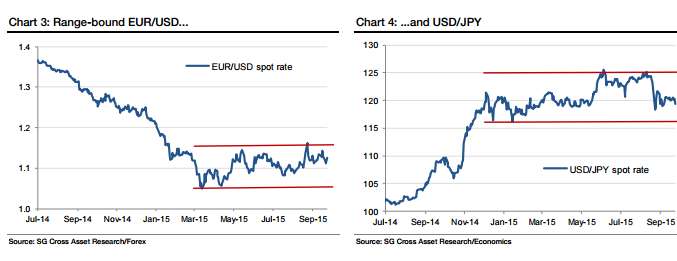

Market volatility has been elevated following the Chinese FX regime shift and has remained so despite the Fed delaying its rate lift-off. Pressures on risk assets have persisted and the fragile market sentiment is restraining G3 bond yields, which are in turn constraining EUR/USD and USD/JPY in tight ranges.

As for near-term risk-reward, we favour shorts in NZD against AUD for relative value and against the yen for the extra ‘oomph’ we get if global markets catch fright.

We like shorts in CHF/SEK as the case for such negative rates in Sweden slowly fades.

We like long-term shorts in GBP/JPY as the UK growth rate crests and Brexit risk flares higher.

Being short the G10 economies with the biggest current account deficits appeals too. USD/CAD and EUR/NOK are too oil-sensitive to have conviction about here. For choice, we like to be short NOK and CAD in the very short-term.

As for EUR/USD, it’s barely worth trading. It fell this week with the VW share price, and having a view on where it goes next is way outside my skill set.