EUR/USD continues to have an uneventful week, as the pair trades at the 1.0940 line in the European session. On the release front, German PPI posted a decline of 0.5%, below the estimate. We could see some stronger movement from the pair, as the US releases consumer inflation reports, as well as Building Permits later in the day. On Thursday, the US will release two key events, Unemployment Claims and the Philly Fed Manufacturing Index.

On Tuesday, Eurozone economic sentiment reports were a mix. German ZEW Economic Sentiment softened to 10.2 points, marking a 3-month low. Still, this beat the estimate of 8.2 points. Eurozone ZEW Economic Sentiment slipped to 22.7 points, down from 33.9 points a month earlier, and well off the forecast of 27.9 points. Meanwhile European inflation levels remain weak, as underscored by Eurozone CPI, which remained unchanged at 0.2%. Germany is not immune from the problem, as PPI posted a decline of 0.5%, its sixth decline in seven months. The markets will be keeping a close eye on the upcoming ECB policy meeting on Thursday, and if Mario Draghi and Co. decide to implement further monetary easing, we can expect the euro to lose ground.

The US is also affected by weak inflation levels, and this remains a concern for Federal Reserve policymakers, who must decide whether another rate hike would be appropriate in early 2016. The Federal Reserve raised interest rates in December for the first time in nine years, and hinted that this move was the first of a series in 2016. There is speculation that the Fed could make a move in March, contingent on the US economy continuing to show strong numbers. At the same time, minutes from the Federal Reserve Policy meeting in December indicated that some policymakers are concerned that the inflation picture may not improve anytime soon, and it would be premature to raise rates again before the inflation levels improve. CPI, the primary gauge of consumer inflation, will be released later on Wednesday, so this release could be an important factor with regard to monetary policy.

EUR/USD Fundamentals

Wednesday (Jan. 20)

- 2:00 German PPI. Estimate -0.3%. Actual -0.5%

- 8:30 US CPI. Estimate 0.0%

- 8:30 US Building Permits. Estimate 1.20M

- 8:30 US Core CPI. Estimate 0.2%

- 8:30 US Housing Starts. Estimate 1.19M

- 10:30 US Crude Oil Inventories. Estimate 3.3M

Upcoming Key Events

Thursday (Jan. 21)

- 7:45 ECB Minimum Bid Rate. Estimate 0.05%

- 8:30 ECB Press Conference

- 8:30 US Philly Fed Manufacturing Index. Estimate -3.1 points

- 8:30 US Unemployment Claims. Estimate 281K

*Key events are in bold

*All release times are EST

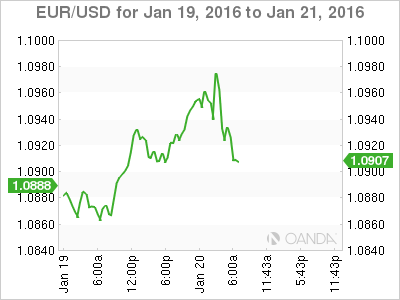

EUR/USD for Wednesday, January 20, 2016

EUR/USD January 20 at 5:55 EST

Open: 1.0910 Low: 1.0910 High: 1.0976 Close: 1.0933

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 | 1.1172 |

- EUR/USD has posted gains in the Asian session and is choppy in European trade

- 1.0941 was tested earlier and remains a weak resistance line. It could break during the day.

- 1.0847 is providing support

- Current range: 1.0847 to 1.0941

Further levels in both directions:

- Below: 1.0847, 1.0732, 1.0659 and 1.0537

- Above: 1.0941, 1.1087 and 1.1172

OANDA’s Open Positions Ratio

EUR/USD ratio is showing movement towards short positions, which command a strong majority (59%). This is indicative of trader bias towards the euro moving downwards.