EUR/USD is steady on Thursday, as the pair trades at the 1.09 line in the European session. In economic news, currency markets did not display much reaction to the Federal Reserve, which maintained interest rate levels and issued a cautious policy statement. Later in the day, Germany will publish Preliminary CPI, and the US releases Core Durable Goods and Unemployment Claims. On Friday there are key events, Eurozone CPI and US Advance GDP.

As widely expected, the Federal Reserve opted to hold interest rates at 0.25%. The Fed statement was dovish in tone, as policymakers noted that there are soft spots in the economy, such as consumer spending and exports. The inflation picture remains problematic, with the Fed saying that inflation levels will remain low, and may not reach the target of 2.0% until 2018. At the same time, the Fed emphasized that the US labor market remains strong. Will we see another rate hike in March? That’s a tough question to answer, as the central bank hasn't provided any strong hints on its next move. Given the Fed’s continuing concerns about a lack of inflation, it’s hard to foresee another rate hike in March absent a strong improvement in key US indicators.

Weak inflation levels are not just a concern in the US, as the Eurozone economy has been hobbled by a lack of inflation. The ECB opted not to increase its quantitative easing program earlier this month, but Mario Draghi has put the markets on notice that he “reserves the right” to act in March if necessary. We’ll get a look at some important inflation numbers before the week is over, with the release of German Preliminary CPI later on Thursday, followed by Eurozone CPI on Friday. Disappointing readings from these indicators could increase speculation that the ECB will increase easing in March, and this could weaken the euro.

Thursday (Jan. 28)

- 2:00 German Import Prices. Estimate -1.0%. Actual -1.2%

- All Day – German Preliminary CPI. Estimate -0.8%

- 3:00 Spanish Unemployment Rate. Estimate 21.1%. Actual 20.9%

- Tentative – Italian 10-year Bond Auction

- 8:30 US Core Durable Goods Orders. Estimate -0.1%

- 8:30 US Unemployment Claims. Estimate 281K

- 8:30 US Durable Goods Orders. Estimate -0.6%

- 10:00 US Pending Home Sales. Estimate 1.0%

- 10:30 US Natural Gas Storage. Estimate -215B

Upcoming Key Events

Friday (Jan. 29)

- 5:00 Eurozone CPI Flash Estimate. Estimate 0.4%.

- 8:30 US Advance GDP. Estimate 0.8%

*Key events are in bold

*All release times are EST

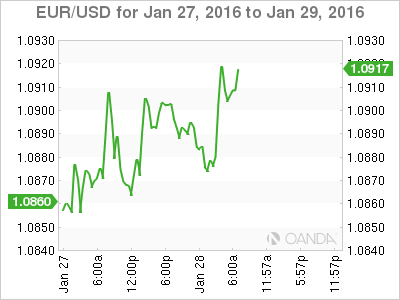

EUR/USD for Thursday, January 28, 2016

EUR/USD January 28 at 4:00 EST

Open: 1.0902 Low: 1.0869 High: 1.0907 Close: 1.0900

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0659 | 1.0732 | 1.0847 | 1.0941 | 1.1087 | 1.1172 |

- EUR/USD has been marked by choppy trading in the Asian and European sessions

- 1.0847 continues to provide support, but is a weak line.

- There is resistance at 1.0941

- Current range: 1.0847 to 1.0941

Further levels in both directions:

- Below: 1.0847, 1.0732, 1.0659 and 1.0537

- Above: 1.0941, 1.1087 and 1.1172

OANDA’s Open Positions Ratio

EUR/USD ratio is almost unchanged, reflective of the lack of movement from the pair. Currently, short positions have a majority of positions (57%). This points to trader bias towards the pair moving lower.