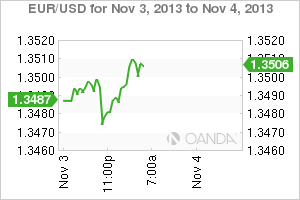

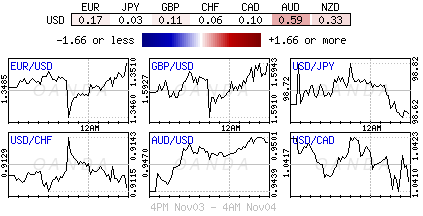

This is a jammed packed week in Capital Markets. Investors get to review three-key central banks policy meeting this week, starting with the Reserve Bank of Australia, the Bank of England - "Old Lady"- and Draghi's ECB. All the while this market continues to play catch up from the US's recent 16-day hiatus. On the economic calendar are manufacturing, services and composite purchasing managers’ indices in Europe and Asia. To round the 'heavy week' off would not be the same without a couple of important employment reports for the US, Canada and Australia. EUR/USD" border="0" height="200" width="300">

EUR/USD" border="0" height="200" width="300">

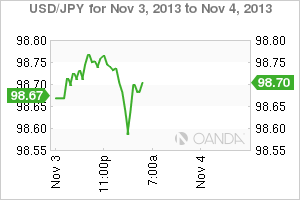

The week's obvious highlight is the US delayed shutdown employment report for October. After some softer BLS numbers for September and a sluggish ADP print for October, will the market get to see enough improvement in the details this coming Friday morning to allow the FED to begin to tighten the liquidity taps (taper - $85b monthly bond program) as early as next-month? USD/JPY" border="0" height="200" width="300">

USD/JPY" border="0" height="200" width="300">

The typical global investor has had to weigh several factors last week to aid in their short term trading strategy decisions going forward. Initially, there was a plethora of continuous stream of global earnings reports, which were mixed. There was a pickup in the fundamental distribution from the US – Capital Markets are still trying to catch up from the government’s partial closure last month. Finally, the biggie, the dollars prime supporter over the past five-trading sessions is that potential Fed Reserve ‘tapering’ has once again resurfaced after last weeks FOMC 'powwow.'  XAU/USD" border="0" height="200" width="300">

XAU/USD" border="0" height="200" width="300">

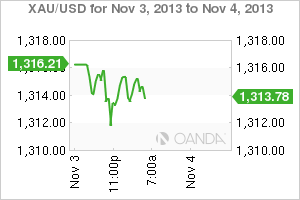

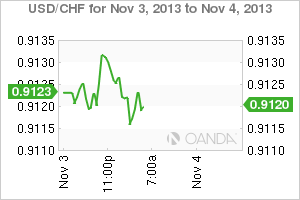

Prior to last weeks Fed meet, the dollar bears had been expecting that US policy makers would have had a more pessimistic view on their own economy. Some investors were looking for US policy makers to downgrade their economic outlook after the U.S. government's partial shutdown and budget impasse early last month.  USD/CHF" border="0" height="200" width="300">

USD/CHF" border="0" height="200" width="300">

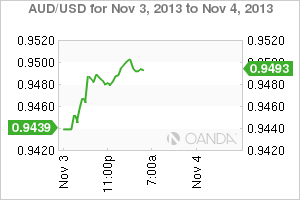

Previously, policy members found it easy to point the finger towards the "hill" as a reason for many ills. However, the market did not get the negativity required that compels QE to stay around a little while longer. The fairly unchanged FOMC statement that allowed investors bets - that the dollar would fall much further – to be prudently closed out for the time being. The fact that Bernanke and his fellow cohorts did not completely rule out a December taper has been supporting a dollar buy-back program. The question now will be whether a few "dirty" data points also support that same concept? This market will be relying on this Friday's non-farm payroll to reveal all. AUD/USD" border="0" height="200" width="300">

AUD/USD" border="0" height="200" width="300">

Earlier this morning down-under, Federal Reserve Bank of Dallas President Richard Fisher (hawk, voter in 2014) said in a Sydney speech that the Fed "will have to slow QE at some point and he doesn’t see Fed balance sheet growth exceeding market estimates." He added that the fiscal blow-up risk was not part of the September decision not to tape. Employment numbers have been the Fed's mantra and this week's job report will outline policy for the next quarter. Prior to last week the market was merrily pricing in next March as the beginning to taper month – expect a few disclaimers between here and Friday.

With global inflation predominately a benign story, further monetary easing is a possibility for few Central Banks, despite denying it. Both copy and rhetoric from policy makers should be expected to get more headlines going forward. Too much of a dollar demise, or a EUR strength brings out the more vocal "currency war" advocate – if you are the loudest then it’s the easiest PR this particular cause can acquire.

Eurozone data this morning revealed that factory activity edged higher last month (51.3 vs. 51.1), thanks to a modest strength in Germany and other northern economies. The figures continue to highlight the chasm between the strong north and weak south – an issue that's not going away any time soon. Analysts note that the survey included sign's that the 17-country bloc's growth, while geographically uneven, may pick up further in the coming months. This print may mean that the ECB will keep rates on hold this Thursday (+0.5%) – some investors had been pricing in further easing after last months inflation fell. ECB's Asmussen stated that interest rates were too low in Germany as the country was viewed as a safe haven with capital inflows.

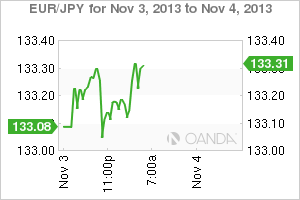

The ECB could wait until December to implement a rate cut – Policy makers would possesses updated staff projections on growth and inflation which would provide a better basis for an further policy easing. EUR/JPY" border="0" height="200" width="300">

EUR/JPY" border="0" height="200" width="300">

Sterling this morning (£1.5960) managed to get a boost higher on the back of UK construction PMI rising to a six-year high (59.4 in September). Tomorrow, the UK economy gets to see the services PMI (a stalwart for growth). Middle east and Asian investors seem to be getting ahead of the curve and supporting GBP on dips. The pound, along with some other G10 currency pairs have the potential to break out of their multi-month consolidation range as year-end approaches. The last six-week of the calendar year is historically a trending period in FX. Expect this to commence once investors get a better handle on the ECB and Fed's mandates this week. Better Eurozone data has dragged the 17-member single currency higher this morning. The EUR outright has managed to test its 6-week lows and held a 4-month uptrend line in Asia before rebounding back over the psychological 1.35 handle. Has the currency got more room for improvement?

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR Storm Turns Calm As Dollar Backs Down

Published 11/04/2013, 06:38 AM

Updated 07/09/2023, 06:31 AM

EUR Storm Turns Calm As Dollar Backs Down

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.