Market Brief

The ECB unveiled the much expected QE program yesterday. In addition to its private bond purchases introduced in the last quarter of 2014, the ECB will start buying 60 billion euros government debt and European institutional debt starting from March 2015 to September 2016. The total amount of the program sums up to 1.1 trillion euros, which exceeds the already aggressive market expectations (750 billion to 1 trillion euros anticipated with NCBs being part of the program). The NCBs will hold 80% of domestic bonds, while the 20% of risk will be shared. “I am surprised the risk sharing issue has become the most important aspect of the effectiveness of our monetary policy. » said Draghi as such framework brought a level of fragmentation in the heart of the Euro-zone’s single monetary system. The euro sold aggressively after the announcement, taking out the 2005 low (1.1460). Asian traders pulled EUR/USD down to 1.1315 for the first time since September 2003. The heavy unwind deepened the oversold conditions (RSI at 19.5%).The sentiment is comfortably negative. We believe short-covering is underway yet decent option barriers should limit the upside attempts pre-weekend. Large put expiries are seen at 1.1450, 1.1400, 1.1350 and 1.1300. EUR/GBP extended losses to 0.75523 (beginning of 2008 levels). Large option barriers at 0.76 should keep the selling pressures tight on the cross before the week’s closing bell.

EUR/JPY tumbled down to 133.95, therefore fully writing-off Oct-Dec gains. Decent JPY demand verse EUR limited gains on the entire JPY-complex. USD/JPY made a timid step above its daily Ichimoku cloud top (118.47). A week close above 118.58 (MACD pivot) should call for short-term bullish reversal. Option bets are positively skewed above 118.35/50 zone today.

Danish National bank cut its deposit rate from -0.20% to -0.35% post ECB QE announcement, signaling further stress on the EUR/DKK peg. While DNB still has room to defend the peg, we believe that two interventions in a week has just attracted speculators’ attention, and might push the bank toward more aggressively defensive strategies in the coming weeks, months.

AUD/USD stepped below 80 cent as the cheap liquidity environment and persistent weakness in commodity prices increase speculations for an RBA cut on February 3rd meeting. Failure to close above 0.8050/54 (MACD pivot & intraday high) should signal the end of the bullish correction era. From next week, the option barriers are solid at 0.80+.

The Cable clears support at 1.50. Next support stands at 1.4814 (2013 low). The GBP/USD 1-month risk reversal steadily slides lower confirming the broad negative bias following the dovish shift in the heart of the BoE.

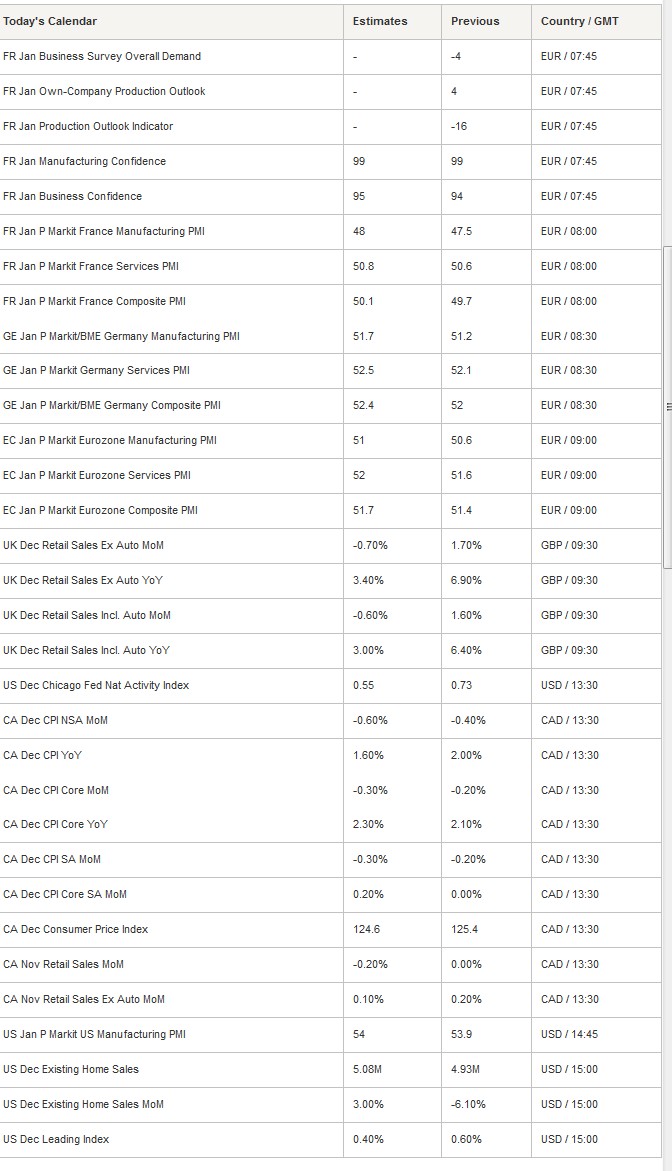

Today’s economic calendar: French January Manufacturing and Business Confidence, French, German and Euro-zone’s January (Prelim) Manufacturing, Services and Composite PMI, UK December Retail Sales, Chicago Fed’s National Activity Index in December, Canadian December CPI m/m & y/y and November Retail Sales m/m, US January (Prelim) Manufacturing PMI, US December Existing Home Sales m/m and US December Leading Index.

| Today's Calendar | Estimates | Previous | Country / GMT |

|---|---|---|---|

| FR Jan Business Survey Overall Demand | - | -4 | EUR / 07:45 |

| FR Jan Own-Company Production Outlook | - | 4 | EUR / 07:45 |

| FR Jan Production Outlook Indicator | - | -16 | EUR / 07:45 |

| FR Jan Manufacturing Confidence | 99 | 99 | EUR / 07:45 |

| FR Jan Business Confidence | 95 | 94 | EUR / 07:45 |

| FR Jan P Markit France Manufacturing PMI | 48 | 47.5 | EUR / 08:00 |

| FR Jan P Markit France Services PMI | 50.8 | 50.6 | EUR / 08:00 |

| FR Jan P Markit France Composite PMI | 50.1 | 49.7 | EUR / 08:00 |

| GE Jan P Markit/BME Germany Manufacturing PMI | 51.7 | 51.2 | EUR / 08:30 |

| GE Jan P Markit Germany Services PMI | 52.5 | 52.1 | EUR / 08:30 |

| GE Jan P Markit/BME Germany Composite PMI | 52.4 | 52 | EUR / 08:30 |

| EC Jan P Markit Eurozone Manufacturing PMI | 51 | 50.6 | EUR / 09:00 |

| EC Jan P Markit Eurozone Services PMI | 52 | 51.6 | EUR / 09:00 |

| EC Jan P Markit Eurozone Composite PMI | 51.7 | 51.4 | EUR / 09:00 |

| UK Dec Retail Sales Ex Auto MoM | -0.70% | 1.70% | GBP / 09:30 |

| UK Dec Retail Sales Ex Auto YoY | 3.40% | 6.90% | GBP / 09:30 |

| UK Dec Retail Sales Incl. Auto MoM | -0.60% | 1.60% | GBP / 09:30 |

| UK Dec Retail Sales Incl. Auto YoY | 3.00% | 6.40% | GBP / 09:30 |

| US Dec Chicago Fed Nat Activity Index | 0.55 | 0.73 | USD / 13:30 |

| CA Dec CPI NSA MoM | -0.60% | -0.40% | CAD / 13:30 |

| CA Dec CPI YoY | 1.60% | 2.00% | CAD / 13:30 |

| CA Dec CPI Core MoM | -0.30% | -0.20% | CAD / 13:30 |

| CA Dec CPI Core YoY | 2.30% | 2.10% | CAD / 13:30 |

| CA Dec CPI SA MoM | -0.30% | -0.20% | CAD / 13:30 |

| CA Dec CPI Core SA MoM | 0.20% | 0.00% | CAD / 13:30 |

| CA Dec Consumer Price Index | 124.6 | 125.4 | CAD / 13:30 |

| CA Nov Retail Sales MoM | -0.20% | 0.00% | CAD / 13:30 |

| CA Nov Retail Sales Ex Auto MoM | 0.10% | 0.20% | CAD / 13:30 |

| US Jan P Markit US Manufacturing PMI | 54 | 53.9 | USD / 14:45 |

| US Dec Existing Home Sales | 5.08M | 4.93M | USD / 15:00 |

| US Dec Existing Home Sales MoM | 3.00% | -6.10% | USD / 15:00 |

| US Dec Leading Index | 0.40% | 0.60% | USD / 15:00 |

Currency Tech

EUR/USD

R 2: 1.1679

R 1: 1.1460

CURRENT: 1.1348

S 1: 1.1290

S 2: 1.1083

GBP/USD

R 2: 1.5269

R 1: 1.5035

CURRENT: 1.4988

S 1: 1.4817

S 2: 1.4784

USD/JPY

R 2: 120.83

R 1: 119.32

CURRENT: 118.20

S 1: 116.90

S 2: 115.86

USD/CHF

R 2: 0.9132

R 1: 0.8838

CURRENT: 0.8705

S 1: 0.8500

S 2: 0.8353