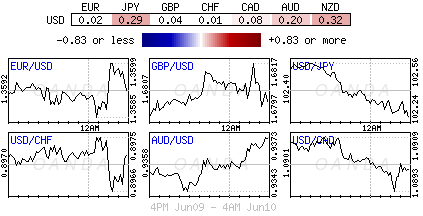

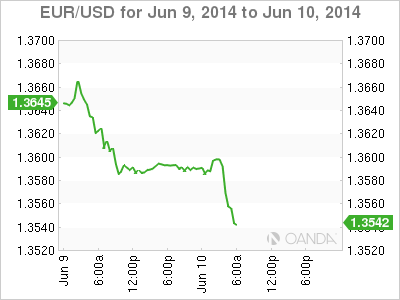

Historically, the first full trading day after a US jobs release tends to be the quietest day of the month. Let's hopes that this morning's forex moves are a good omen despite having to compete with a month of football starting on Thursday. In positional terms, the market has been relatively neutral, the EUR heading into the post-ECB announcement late last week. It's reason enough for why the single currency has found it difficult to find traction in either direction. However, it seems the tides are turning due to the 'speculator' wanting to create more waves as they test some interesting price levels. Many had hoped to sell a EUR rally, but with little bounce in either yesterdays or Asia's overnight session, instead have to be content to sell this morning's technical break.

Both forex volume and volatility have taken a massive hit since the onslaught of low interest rate policies by G7 central banks. What the FX market needs, and has been looking for, is a divergence in monetary policy. The ECB's policy action last week means that over the next year there will be some divergent monetary policy between the eurozone, the US, and the UK. The lack of market volatility is an ally for the "carry" trade. The ECB's actions last week further promote using the EUR as a vehicle to funding so-called trades. The likelihood that the ECB was not going to be aggressive enough would have squeezed some of the more popular of these trades. Nevertheless, committing to throw the whole 'tool bag' at EU deflation worries and growth concerns is further supporting the hunt for "carry." Currencies like the KRW and TRY are the emerging markets outperformers, while AUD looks to be the contender for the G10 title.

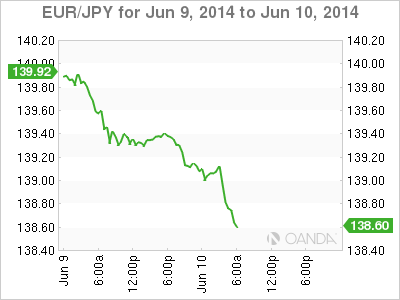

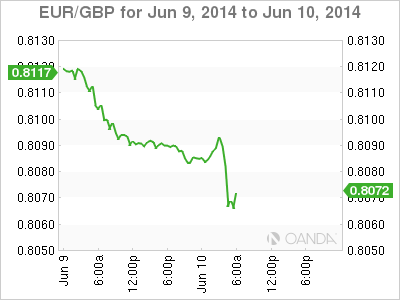

This morning's Euro session has been dominated by leveraged account selling and has managed to trigger some key levels in the EUR outright (€1.3575) and on the crosses. With periphery yields backing up for the first time in four sessions is providing further incentive. The outright 200-DMA at €1.3650 continues to act as resistance and is holding firm. In EUR/JPY, pressure is on the 200-DMA at €138.70 and a move below here opens the gateway towards €136.20. A change in EUR/CHF below €1.2220 targets last May's low of €1.2113, while EUR/GBP is now trading at a fresh 18-month low (€0.8065), under pressure from outright selling and stronger UK production numbers. With a fresh three-day print under its belt, technically there is no further support for the EUR now until the post-ECB four month low of €1.3503 seen last Thursday.

The EUR has been in demand to 'fund' buying of peripheral eurozone debt as none euro-zone investors hunt for yield. Do not be surprised to see investors beginning to be squeezed as peripheral banks buy their own sovereign debt, using the funding of cheap liquidity provided by last week's ECB ease. There is even a suggestion that EU banks with US operations may want to convert EUR's to earn the reserve interest rate differentials – further undermining the EUR's strength. However, the main flows are speculators as outright "short" EUR positions have been negligible after the post ECB squeeze.

In the UK, British factory output was stronger than expected in April (+0.4% m/m and +4.4% y/y) and added proof that the UK economy is spreading beyond consumer spending. The UK economy is one the IMF got wrong, admitting so over the weekend. This morning's gains in the UK's industrial sector would suggest a healthy start for Q2 and will certainly be welcome news for Governor Carney and the UK government. Both parties continue to express the need for the manufacture and export of goods to increase in order to ensure the sustainability of the UK's economic recovery. Sterling outright caught a natural bid, however, the failing EUR has managed to push the GBP needle after testing its 18-month lows in the Euro session. The market should expect negative EUR momentum to further support the 'pounds' cause.

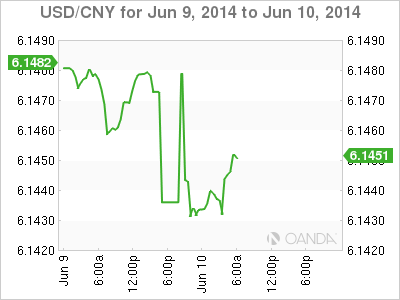

Elsewhere, the latest CPI data out of China have further diminished the prospects for a broader and bolder system-wide liquidity injection. Last night's price release is working to lessen some market concerns over deflation that followed April's +1.8% print (lowest since Oct 2012). May CPI hit a four-month high of +2.5% (expectations of +2.4%), as the food CPI component spiked by +4.1% (fruit rose a massive +20%). The non-food CPI component was up a relatively tame +1.7% y/y, and inline with expectations. Also in the overnight session, the PBoC announced targeted reserve requirement ratio (RRR) cut of -50bps for certain qualified entities, covering +65% of urban banks and +80% of rural banks. Chinese policy makers have also warned that the direction of their monetary policy has not changed, and that it would maintain a prudent policy approach.

It worth noting that the ANZ job ads slump out of Australia last night was the biggest decline in three-years years and does not necessarily bode particularly well for the release of Australia's official employment data on Wednesday (+10.3k expected). The Aussie NAB business confidence surprisingly held up, helping briefly lift the AUD/USD pair above $0.9360. From a "carry" perspective the AUD is looking to be the G10 darling, supported by foreigners demand for Aussie AAA grade paper. The AUD remains well supported on pullbacks with some analysts looking for AUD/USD parity by year-end.