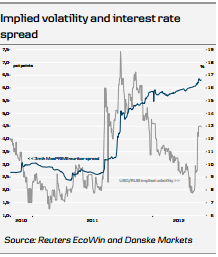

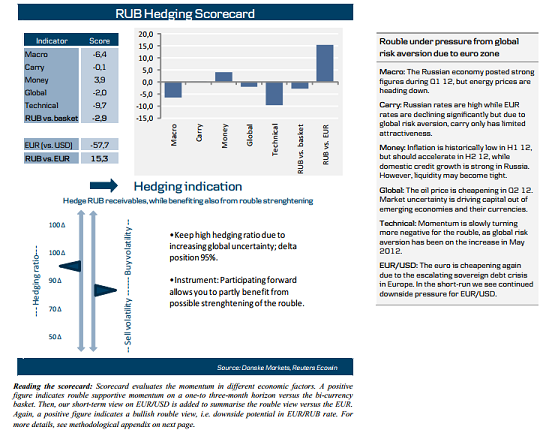

- Rouble outlook: Russian macro fundamentals remained strong in Q1 12 and the political situation looks clear with the new old president and the brand new government. However, the global outlook seems very cloudy in the short run and the rouble has started to lose momentum. Yet, we expect rouble volatility to stay moderate during Q2 and Q3 12.

- EUR/USD outlook: As the European debt crisis is escalating and the ECB is expected to cut further interest rates and even add liquidity through a new LTRO, we see the euro depreciating further in June 2012 against the US dollar.

- EUR/RUB recommendation: Due to global uncertainty, we recommend keeping a high hedging ratio, despite the fact that current data points to moderation in rouble volatility.

We again recommend using participating forwards to hedge rouble receivables. While this gives a full hedge against a weakening of the rouble, it would allow the investor to benefit in part from rouble strengthening.

Methodological Appendix

Variables included in the scorecard are listed below. Momentum of these variables is measured on a daily or monthly basis depending on the publication frequency. Each variable has a subjectively determined fixed weighting in the scorecard factor.

Macro: Retail trade, Fixed capital investments, Industrial production, trade balance

Carry: US Libor and Euribor rate spread vs. the Moscow Prime Offered Rate (MosPrime) in 3-month period, Russia CDS

Money: Russian CPI, outstanding private sector bank loans, CBR deposit account balance

Global: Brent crude oil, S&P 500, ISM index, VIX index

Technical: RUB basket rate moving average for 20, 50 and 100 days.

EUR/USD: Dans ke 1 and 3-month forecasts, EUR/USD 20-day moving average Weights of these factors for the final EUR/RUB score are determined partly endogenously.

Macro: Weight varies between 10% and 15% depending on market conditions

Carry: Weight varies between 10% and 15% depending on market conditions

Money: 10% fixed weighting

Global: Weight varies between 20% and 30% depending on market conditions

Technical: 10% fixed weighting

EUR/USD: 30% fixed weighting

Hedging Indication

In choosing hedging ratio and volatility position, we take a rather conservative approach concentrating on strategies where the worst case is always fully known. Hedging ratio is chosen based on market uncertainty, i.e. rouble and global volatility together with rouble outlook. Ratio varies between 50% and 100%. Optimal volatility position is determined by the absolute level of rouble-implied volatilities together with our rouble and volatility outlook.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.