Investing.com’s stocks of the week

Looking at yield differentials alone we can assume over the longer-term the bearish trend should prevail. While the Kiwi has had the worst month out of many recently, this may begin to change as it approaches key levels of S/R against the majors.

The NZD/USD has been unravelling against the Major crosses for the past 5 weeks. The original trigger came when weak Dairy prices were followed by increased geo-political risks, and then poor CPI q/q. Investors continued to close their carry trades and book profits which only accelerated when RBNZ gave a Dovish statement following their rate hike to signal there is not likely to be any further rate increases this year.

At time of writing the NZD/USD is clinging onto key support against JPY and coming very close to breaking below 0.84 against the Greenback. However take note that bearish momentum has reduced, the Greenback appears technically due a pullback (which would support the NZD/USD), and if we see Geo political risks reduce then we can expect this to help support the NZD/JPY.

While I am not one to 'bottom fish' there is an argument that the Kiwi is oversold, and that we may soon see money flow back into the Kiwi to take advantage of Yields (which remain the highest among G10 currencies).

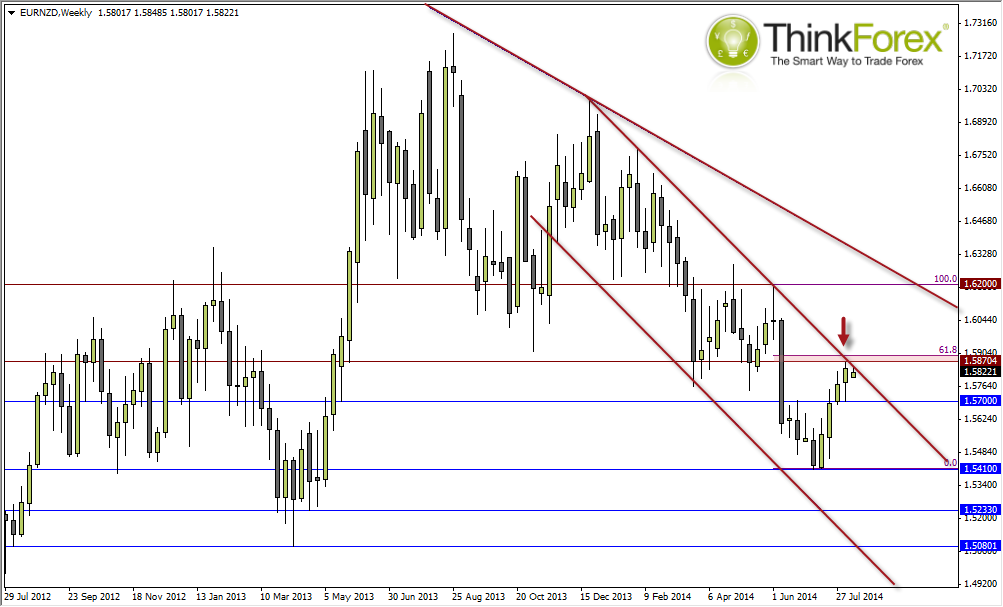

With poor data continuing to come out of the Eurozone and bearing then we may be able to use EUR/NZD as a proxy for overall Kiwi Strength.

- Hanging Man Reversal stalls beneath several technical levels (Upper bearish channel; 61.8% retracement; Horizontal Resistance).

- Intraday price action has become more volatile below this resistance zone to suggest a potential topping pattern. Look out for an ending diagonal / triple top etc.

- The bearish trendline / Channel is never an exact science so allow for breathing room. However a relatively good reward to risk ratio may be achieved assuming the predominant bearish trend remains valid.

- Initial target is 1.5584, followed by 1.54 and beyond