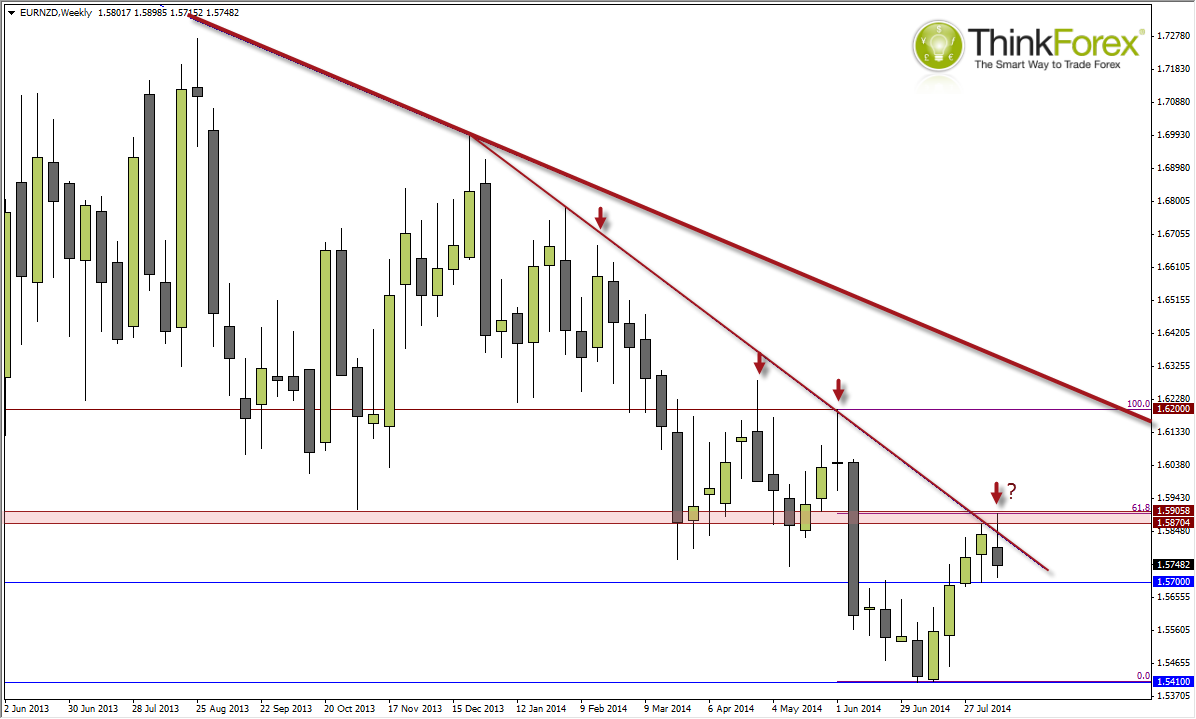

There is a strong possibility we could see EUR/NZD losses resume over the coming weeks, taking into account the dominant bearish trend, yield differentials, and respect of key resistance levels.

SUMMARY:

- Potential for market top is unfolding on W1

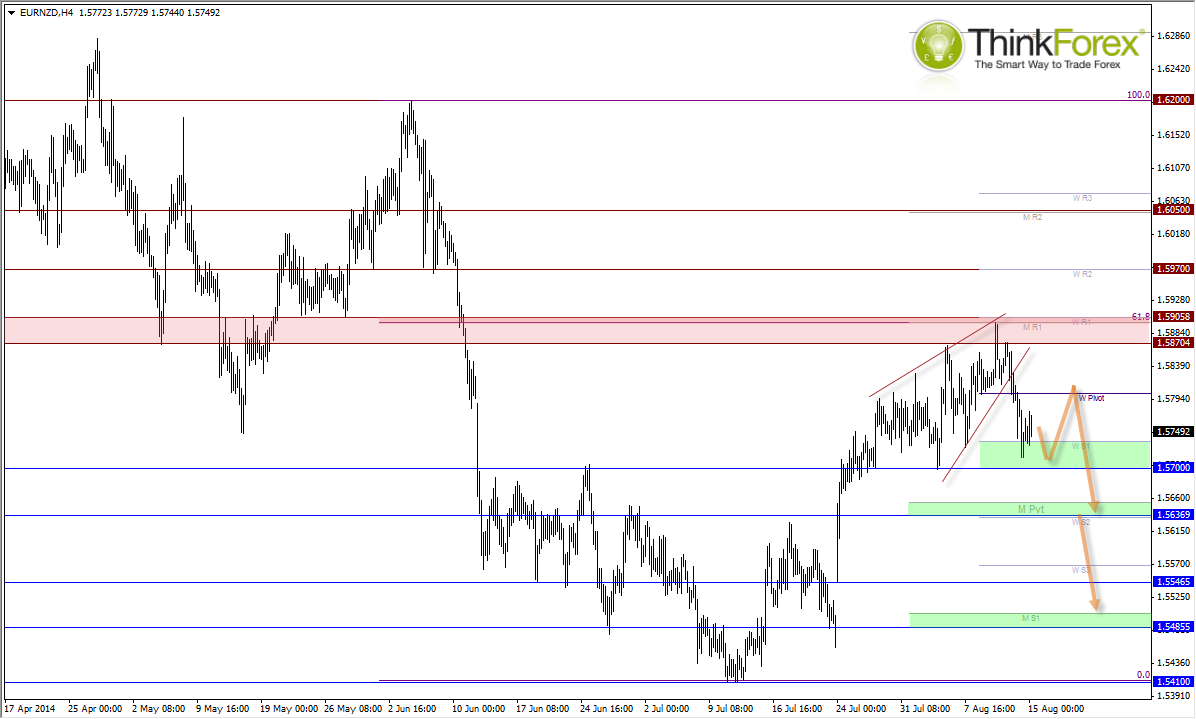

- Declines form 1.59 appear impulsive on intraday timeframes

- Intraday traders could consider a move down to 1.57 before the weekend but be aware of Bank Holiday in France and Italy

- Seeking bearish setups next week to fade any rallies

A weekly close around current levels will provide a Shooting Star Reversal which respected the 61.8% retracement highlighted previously (almost within a pip). However also take note we are above support and the single candle pattern does not guarantee a reversal and could result in sideways trading over the next few weeks. But due to the interest rate differential and the primary downtrend at this stage I have to assume the continuation of the bearish trend over the coming weeks / months.

While not picture perfect I do suspect we have seen the Ending Diagonal which would target the 1.57 low. This may provide intraday shorting opportunities going into the weekend but take note that Italy and France have Bank Holidays today so we can expect lower volumes. The Weekly Pivots will also be recalculated next week so these levels apply for today’s session only.

The decline from the 1.59 high has come hard and fast (so probably impulsive) to add further suggestion of a market top in place. The distance between the 1.59 high and current prices is around 170 pips, so I am going to wait until next week to short any rallies to [hopefully] increase my reward to risk ratio for the suspected downtrend.

An added bonus is that overnight swaps are favourable for longer-term bearish positions (assuming the trader correctly trades the trend).