The Euro has not gained a lot ground against many of its major trading partners, however, the EURNZD is one pair where it has. The upward movement is seeing something of a consolidation at present and a breakout is likely, especially with the news coming up this week.

The recent bullish trend is largely thanks to the weakness in the NZ dollar on the back of softer commodity prices. Daily prices have fallen almost 50% since the beginning of the year and the NZ dollar has felt the effects. This week (Wed 15th) will once again see another dairy auction and if the past is anything to go by, expect another fall. In fact 14 of the last 16 dairy auctions have seen a fall in the price. It is difficult to see this trend reversing any time soon, as demand lags behind supply.

From the EU side of things we will see the German ZEW Economic sentiment figures, which are expected to come in just a shade above zero at 0.5. This survey has fallen from 62.0 in December 2013 to just 6.9 last month and could dip into negative territory. Inflation figures are also due out for France, Spain, Italy, Germany and the EU this week and will give the Euro plenty of direction as traders place their bets on how likely more stimulus is from the ECB. Indeed, we will hear it from the horse’s mouth, so to speak, as Draghi is due to deliver another speech on Wednesday.

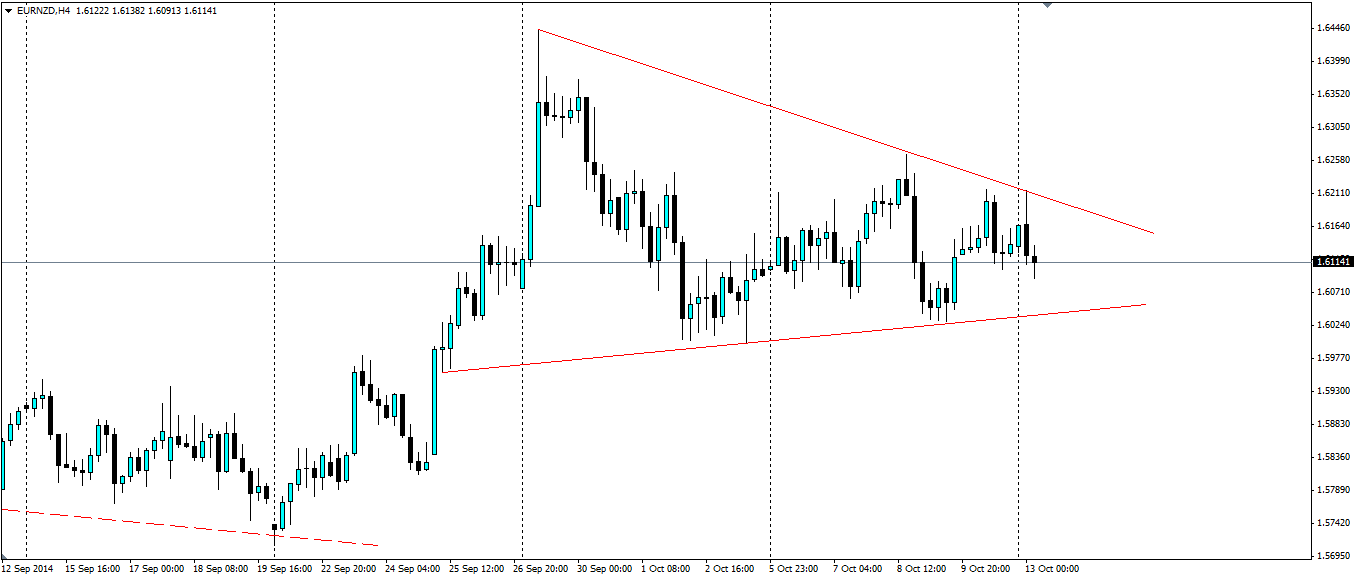

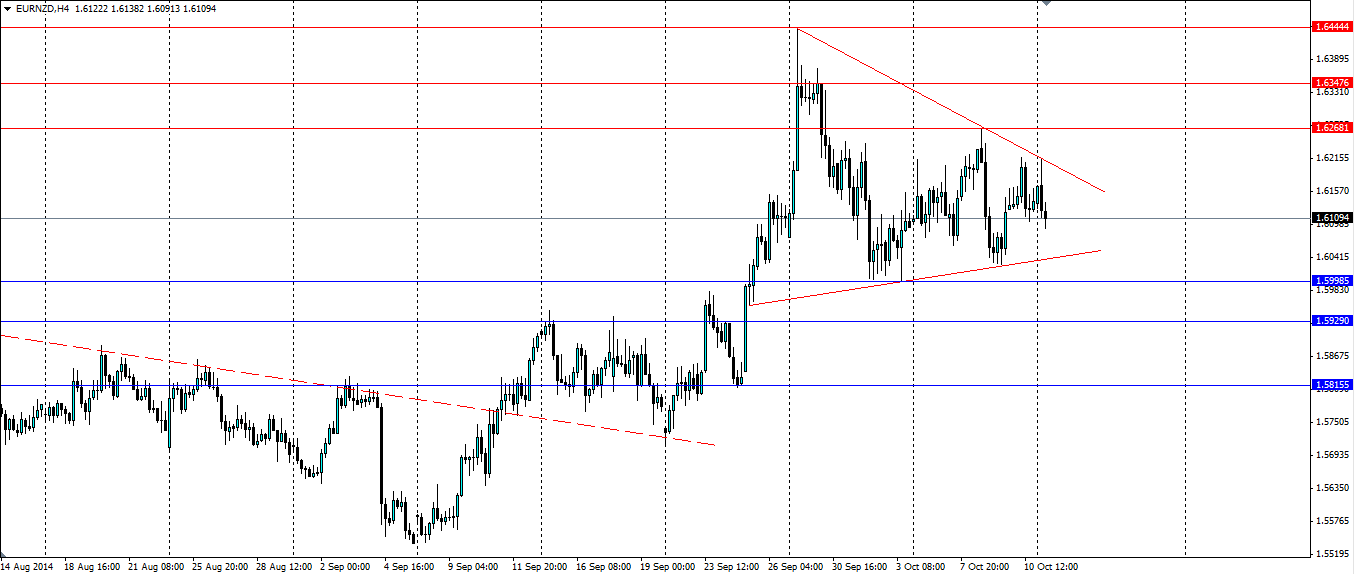

A breakout to the upside, as is expected in this setup, would find resistance at 1.6268, 1.6347 and 1.6444. A bearish breakout would look for support at 1.5998, 1.5929 and 1.5815. I may pay to set up two trades to take advantage of the momentum from a breakout, regardless of direction.

Conventional wisdom would suggest a pennant shape in an uptrend would result in an upside breakout and a continuation of the trend, however, with so much market moving news out this week, it will depend on who has the least disappointing news. Expect fireworks nonetheless.