Markets responded favourably to the bond buying programme for a second consecutive day. For the first time in recent memory EUR movement had some teeth. The common currency vibed positively to the strong progress that's been made in the bond markets. Yields on Spanish and Italian debt fell to 5.6% and 5.0% respectively (down 2% in 6 weeks and over 0.5% in the last couple days).

GBP/EUR fell below 1.25 (a two month low) briefly just before US markets closed on Friday. EUR/USD posted its own 4 month high resting north of 1.28. Hopefully this time around the common currency will gain a bit of traction. Too often in the past we have seen EUR movements fail to last the weekend. Hopefully this time will be different.

There is no reason why we can’t see the EUR stabilise around these levels in the short term. Positive inroads have been made as there is a more structured feel to progress. The EZ can build on this foundation as we enter a week destined to provide more structural support. This week sees the unveiling of the European Union’s Banking Union plan as well as the ruling from the German Constitutional Court on the ESM. These two announcements will serve to steady the ship. All going well we could really see the EU make some progress, and see EUR gain some legs.

However, before I get carried away and let slip that the EUR has been saved, I should point out the very real possibility that we will see Spain request a bailout in the near future, which will of course set EUR back in its tracks.

GBP/USD was dragged higher as the USD sell-off on Friday saw cable pass 1.60 (yet another 4 month high), aided by US data. The only real data point on Friday was the lack lustre US non-farm payroll figures which saw less than 96k jobs created in August, compared to the 141k we saw last month. Those figures will not be welcomed by President Obama as election promises to improve jobs hits a further bump in the road. Enter the FED to save the day when they meet this Thursday.

Trade balance figures for China this morning saw a 500m trade balance surplus as the Chinese cut imports by 7%, and increased exports by just under 2%, as it continues to move towards more domestic consumption to battle the stagnant growth. Further monetary easing is expected from the PBOC in the coming days.

A quiet day today data wise with the main points of interest this week the FED meeting, the EU banking union plan and the ruling on the ESM.

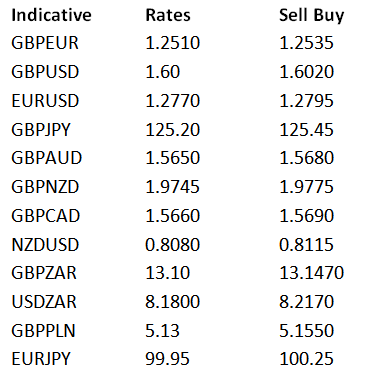

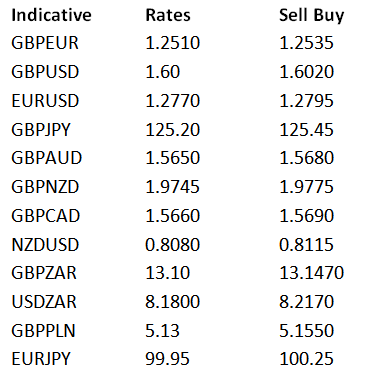

Latest exchange rates at time of writing:

GBP/EUR fell below 1.25 (a two month low) briefly just before US markets closed on Friday. EUR/USD posted its own 4 month high resting north of 1.28. Hopefully this time around the common currency will gain a bit of traction. Too often in the past we have seen EUR movements fail to last the weekend. Hopefully this time will be different.

There is no reason why we can’t see the EUR stabilise around these levels in the short term. Positive inroads have been made as there is a more structured feel to progress. The EZ can build on this foundation as we enter a week destined to provide more structural support. This week sees the unveiling of the European Union’s Banking Union plan as well as the ruling from the German Constitutional Court on the ESM. These two announcements will serve to steady the ship. All going well we could really see the EU make some progress, and see EUR gain some legs.

However, before I get carried away and let slip that the EUR has been saved, I should point out the very real possibility that we will see Spain request a bailout in the near future, which will of course set EUR back in its tracks.

GBP/USD was dragged higher as the USD sell-off on Friday saw cable pass 1.60 (yet another 4 month high), aided by US data. The only real data point on Friday was the lack lustre US non-farm payroll figures which saw less than 96k jobs created in August, compared to the 141k we saw last month. Those figures will not be welcomed by President Obama as election promises to improve jobs hits a further bump in the road. Enter the FED to save the day when they meet this Thursday.

Trade balance figures for China this morning saw a 500m trade balance surplus as the Chinese cut imports by 7%, and increased exports by just under 2%, as it continues to move towards more domestic consumption to battle the stagnant growth. Further monetary easing is expected from the PBOC in the coming days.

A quiet day today data wise with the main points of interest this week the FED meeting, the EU banking union plan and the ruling on the ESM.

Latest exchange rates at time of writing: