GBP/JPY Daily Outlook

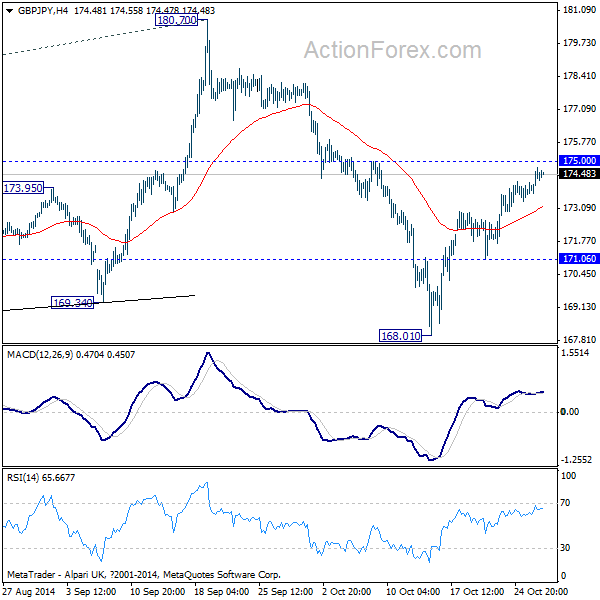

Daily Pivots: (S1) 173.34; (P) 173.80; (R1) 174.24;

The recovery from 168.01 extended higher and could continue. But again, near term outlook stays cautiously bearish as long as 175.00 resistance holds and we'd expect further fall ahead. Prior break of 169.34 support was taken as an indication of medium term topping at 180.70. Below 171.06 minor support will turn bias back to the downside for 168.01 first. Break will target 163.87 support next. Nonetheless, break of 175.00 will dampen this bearish view and target a test on 180.70 high instead.

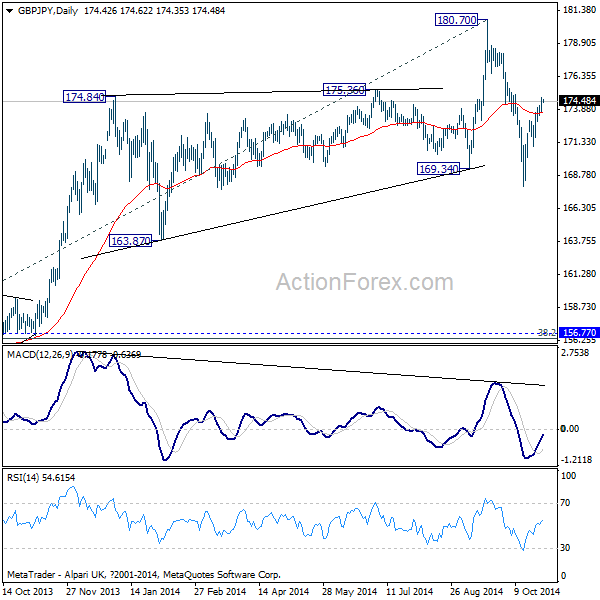

In the bigger picture, the break of 169.34 support indicates that the up trend from 116.83 low has made a medium term top at 180.70 already, on bearish divergence condition in daily and weekly MACD. Deeper correction should be seen to 38.2% retracement of 116.83 to 180.70 at 156.30 first. While we'd expect this up trend to resume later, there should be a lengthy medium term consolidation first.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 137.12; (P) 137.46; (R1) 138.04;

The rebound from 134.13 extended higher and could continue. But again, as long as 137.93 resistance holds, deeper decline is still expected. Prior break of 135.50 support was taken as an indication of medium term trend reversal. Below 135.20 minor support will turn bias to the downside for 134.13 first. Break will extend the larger fall to 131.21 support next. However, break of 137.93 will dampen this bearish view and turn bias back to the upside for 141.21 resistance.

In the bigger picture, sustained break of 135.50 key support level will indicate that up trend from 94.11 long term bottom has made a medium term top. In the case, deeper correction should be seen to 38.2% retracement of 94.11 to 145.68 at 125.98. On the upside, above 141.21 resistance will extend the up trend to 76.4% retracement of 169.96 to 94.11 at 152.59 instead.