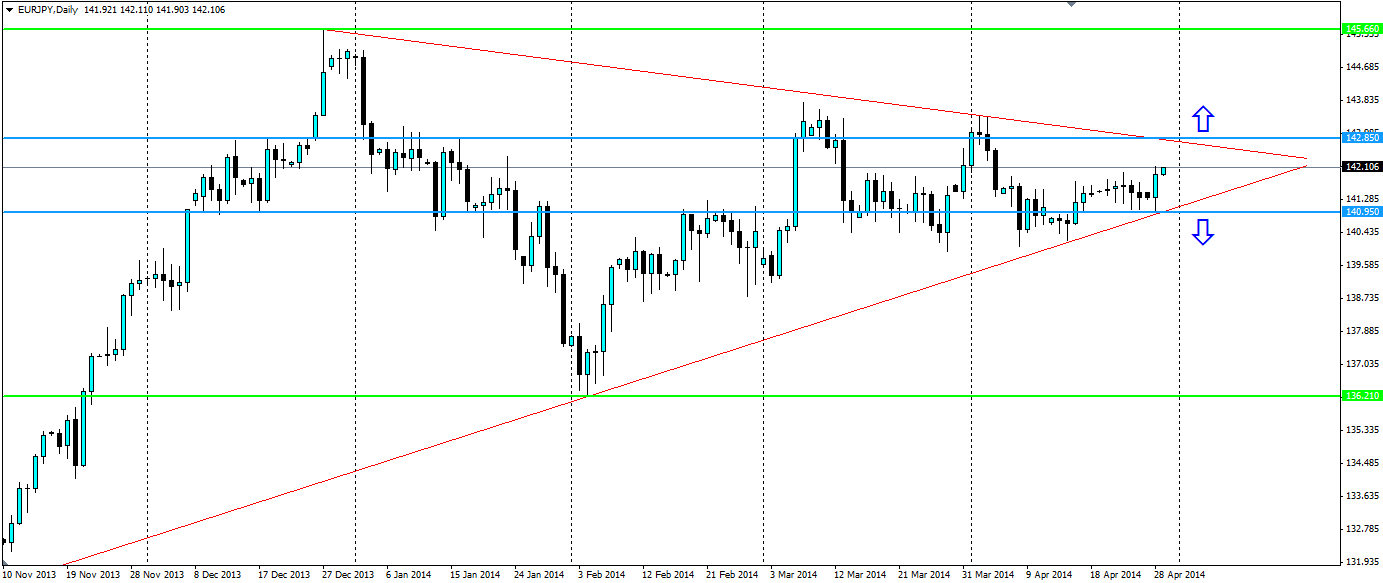

Europe and Japan are two economies that are facing similar situations. Deflation and stimulus are two buzz words for these major economies as they both look to kick start their respective economies. Looking at the chart we see a nice pennant forming that reflects the situation.

As I have spoken about in a previous article, Japan and Europe are in a virtual staring contest.

Japan

Japan is attempting to pull itself out of decades of deflation through Abenomics. The BoJ has said it will expand the money supply and it is going to expand its asset purchase programme however it has not specified when this will occur. Many traders are expecting this by July and any hint from the BoJ will send the Yen tumbling. At this stage the BoJis likely waiting on data to show overall health and for the recent sales tax increase to work its way through the economy.

Latest CPI figures show prices expanding 1.6% year on year, not quite at the targeted 2.0%, but certainly heading in the right direction for the BoJ. If things continue this way we may not see an increase to their QE programme.

Europe

On the other hand, Europe’s latest figure has seen a CPI increase at just 0.5% year on year. This is a significant slide from the 1.7% inflation rate seen this time last year. The President of the ECB Mario Draghi has reiterated his stance that they are prepared to help with any necessary measures, however, he also told German lawmakers yesterday that a Quantitative Easing programme isn’t imminent. There is even some in the market who believe this is all just a bluff and he has no plans to actually act. They point to the Eurozone crisis in 2012 that didn’t end up in a breakup of the zone. Back then he pledged “whatever it takes”, however, he didn’t end up having to do much.

If, however, Draghi does enact an asset buying programme, it may not have the desired impact. When Japan and the US enacted theirs, equity prices were extremely depressed and the news was a positive shock to the market. Having talked for quite some time about it, QE may not have as big an impact as Draghi is hoping. He may well be aware of this fact, so might try to double bluff the market with the timing or size of it, however, this is all just speculation at this stage.

Either way the market will be looking for any sign from the upcoming economic data to show the direction of both economies. If this cross rate starts to move, it could fundamentally shift.

Pennant

A potential exists here for a strategy to profit from either economy making a move on Quantitative Easing. An entry can be set to either buy just above the top of the shape at 142.85 or to sell just below at 140.95. That way once the price exits the constricting trend lines and continues in that direction, one of these entries will be triggered to follow it. Initial targets will be the resistance at the top of the chart at 145.66 and the support found when the price touched the bullish trend at 136.21. The all-important stop losses should be set just outside the shape on the opposite side, around where the entry for the other trade is, that way we minimise our losses if a false breakout occurs.

The beauty of this trade setup is that we can follow the price inwards. That is, the difference between our entry trades will get tighter the longer the price stays within the pennant as we will move our entries along the trend lines. If we maintain our targets, the risk/reward ratio for this setup will only improve.