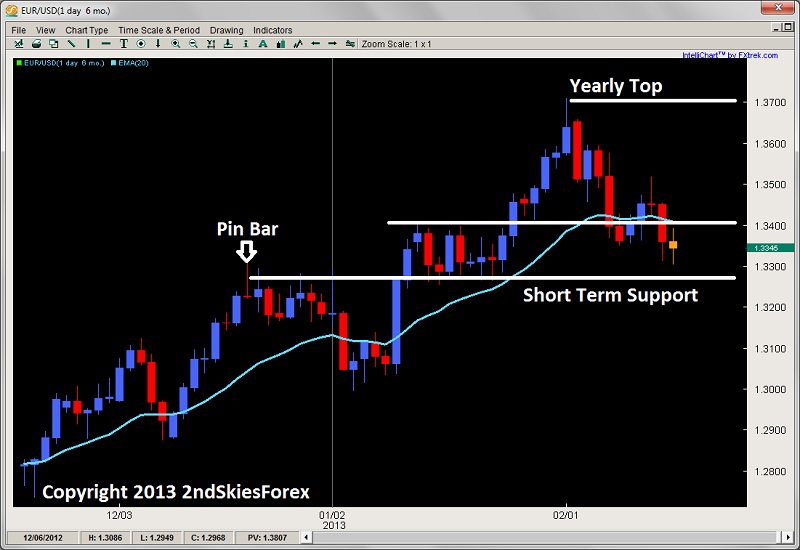

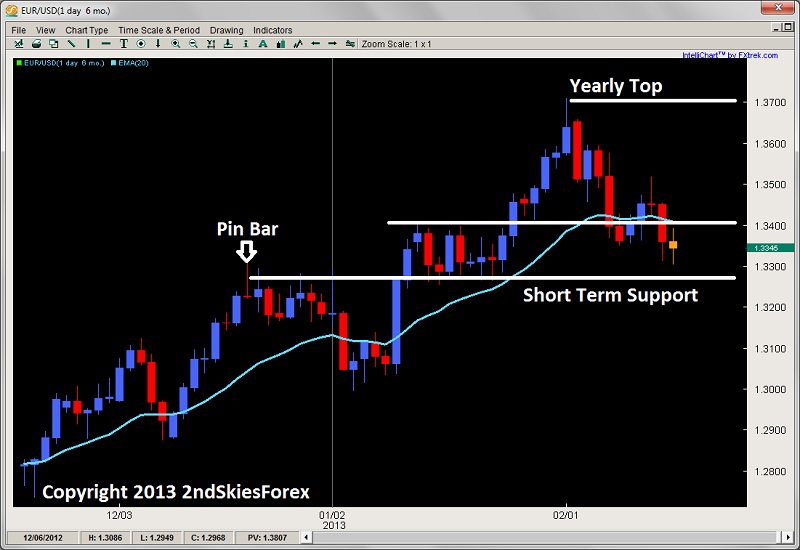

EUR/USD

Ever since touching 1.37 this year, the Euro has sold off 7 of the last 10 days, with the largest bear candle since then being over 133% larger than the largest bull candle. Overall, the selling pressure has been on, but there is still the presence of bulls from the prior uptrend. The LH’s (lower highs) and LL’s (lower lows) in the recent down swing, is leaning on the bulls.

Key support for them comes in around 1.3252. Should this level give way, then support does not come in for another 125 pips south. Short term resistance for the bulls is 1.34 and 1.35. But I would’t want to get in till the 1.3252 buy level, or selling at 1.3500, so I’ll watch for price action signals at these levels.

EUR/USD" title="EUR/USD" width="626" height="695">

EUR/USD" title="EUR/USD" width="626" height="695">

EUR/JPY

Holding serve for now, the EUR/JPY has staved off a bearish attempt to take out the daily 20ema on Friday, to close above it forming a bullish pin bar. In doing so, it also completed a 2 legged pullback, so another attack on the upside and yearly highs may be on deck. This is the largest consolidation of the trend for the year, but we have no full fledged signs of a reversal yet.

So bears can look for weakness in the intraday price action heading into the yearly highs around 127.40. A break above this sets up a potential breakout pullback setup. For bulls, they will need to hold the 20ema and dynamic support on the dailies to not trigger technical selling or profit taking.

EUR/JPY" title="EUR/JPY" width="1024" height="435">

EUR/JPY" title="EUR/JPY" width="1024" height="435">

WTI Crude Oil

Following Thursday’s inside bar, the commodity ended the week under selling pressure, initially dropping $2 on the day, only to find buyers just above the key support at $95. The range between $95 and $98 is still in play, so watch for price action signals on both sides, but a break below $95 will likely trigger some stops and selling, while corrective weakness heading into the level will likely attract buyers wanting to get back into the uptrend.

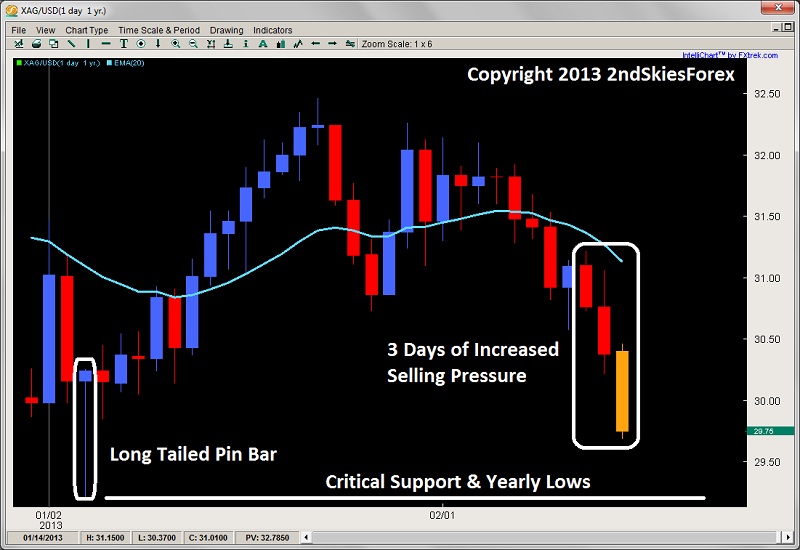

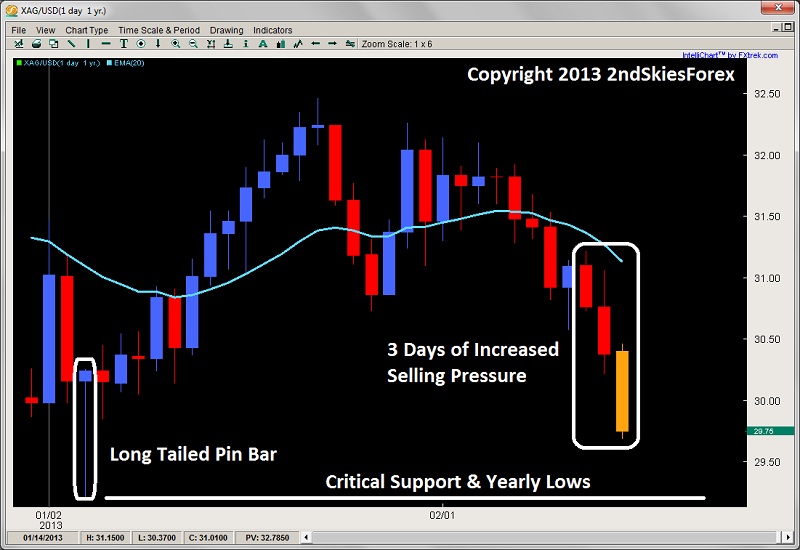

Silver

Getting hammered for the last 7 out of 8 days, the precious metal has lost over 7% in the last 8 days. You will notice that over the last three days, the bear bars are getting larger, suggesting the selling pressure has been increasing. Friday’s bar had a tiny wick to the upside, communicating the selling pressure was pretty much from the open.

The pair is rapidly approaching the yearly low at $29.25 which is also the lows of a large tailed pin bar. My suspicion is below this, there are likely stops parked just under $29.25. If this gives, then we could see aggressive follow through selling, so watch for price action clues here.

Original post

Ever since touching 1.37 this year, the Euro has sold off 7 of the last 10 days, with the largest bear candle since then being over 133% larger than the largest bull candle. Overall, the selling pressure has been on, but there is still the presence of bulls from the prior uptrend. The LH’s (lower highs) and LL’s (lower lows) in the recent down swing, is leaning on the bulls.

Key support for them comes in around 1.3252. Should this level give way, then support does not come in for another 125 pips south. Short term resistance for the bulls is 1.34 and 1.35. But I would’t want to get in till the 1.3252 buy level, or selling at 1.3500, so I’ll watch for price action signals at these levels.

EUR/USD" title="EUR/USD" width="626" height="695">

EUR/USD" title="EUR/USD" width="626" height="695">EUR/JPY

Holding serve for now, the EUR/JPY has staved off a bearish attempt to take out the daily 20ema on Friday, to close above it forming a bullish pin bar. In doing so, it also completed a 2 legged pullback, so another attack on the upside and yearly highs may be on deck. This is the largest consolidation of the trend for the year, but we have no full fledged signs of a reversal yet.

So bears can look for weakness in the intraday price action heading into the yearly highs around 127.40. A break above this sets up a potential breakout pullback setup. For bulls, they will need to hold the 20ema and dynamic support on the dailies to not trigger technical selling or profit taking.

EUR/JPY" title="EUR/JPY" width="1024" height="435">

EUR/JPY" title="EUR/JPY" width="1024" height="435">WTI Crude Oil

Following Thursday’s inside bar, the commodity ended the week under selling pressure, initially dropping $2 on the day, only to find buyers just above the key support at $95. The range between $95 and $98 is still in play, so watch for price action signals on both sides, but a break below $95 will likely trigger some stops and selling, while corrective weakness heading into the level will likely attract buyers wanting to get back into the uptrend.

Silver

Getting hammered for the last 7 out of 8 days, the precious metal has lost over 7% in the last 8 days. You will notice that over the last three days, the bear bars are getting larger, suggesting the selling pressure has been increasing. Friday’s bar had a tiny wick to the upside, communicating the selling pressure was pretty much from the open.

The pair is rapidly approaching the yearly low at $29.25 which is also the lows of a large tailed pin bar. My suspicion is below this, there are likely stops parked just under $29.25. If this gives, then we could see aggressive follow through selling, so watch for price action clues here.

Original post