The current situations of the European and Japanese economies are not making any other major economies envious. Talk of deflation, stagnation, stimulation and growth expectations show the parallels between these two giants. The question is, who will blink first?

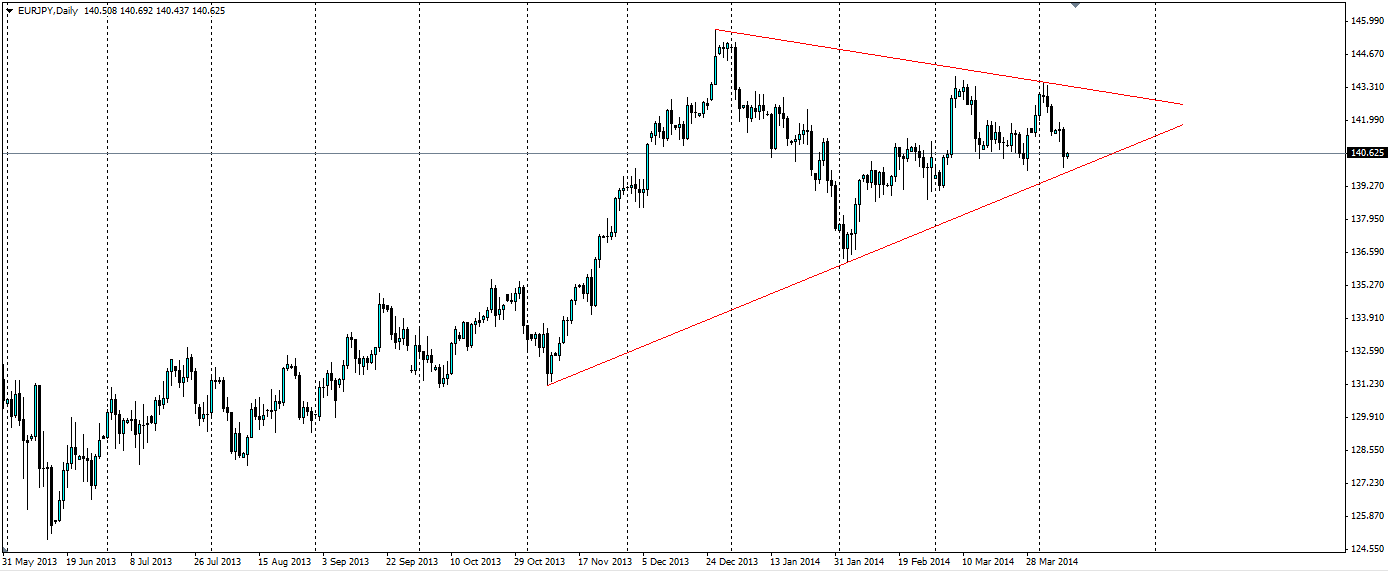

To add to what is already an intriguing situation, if we examine the EUR/JPY D1 exchange rate chart, we can clearly see a bullish pennant forming. This volatile mix is surely set to make the EUR/JPY cross rate one to watch in the coming weeks.

Source: Blackwell Trader

Japan

The goal of Abenomics was to end decades of devastating inflation through unprecedented stimulus. The Bank of Japan (BoJ) has reaffirmed the pledge to expand the monetary base by up to ¥70Tn per year. Further to this, many economists expect the BoJ to add an expansive policy to their arsenal in the fight to boost inflation by July. This expectation comes about as the effect of the Sales Tax introduced last month will be felt.

At this stage, the BoJ has remained bullish about the impact of the tax but will have to wait and see as it looks to upcoming data as to the extent of the sales tax impact. The sales tax is likely to have an adverse impact of the recovery and what the government is trying to achieve through Abenomics, however, it has so far remained upbeat, saying companies are seeing prices and wages increasing and the economy picking up any slack. Any news to the contrary will mean there is a good chance it will look to ramp up its asset purchases. It is hoping to double the monetary base in 2 years, an incredible feat given the size of the Japanese economy

Japan’s Money Supply (M3)

Japan’s economy expanded just 0.2% for the final quarter of 2013 and prices rose 1.5% for the year, well below Government targets. Furthermore, the Nikkei has shed almost 9% in the March 2014 quarter. These are the first signals that Abenomics may be faltering and leading to the market expectation that more stimulus is necessary before the end of the year. However, if the market is expecting stimulus, it will then have less of an impact than if the BoJ surprised the market. Therefore,we should expect the unexpected, or at least be prepared for the BoJ to pre-emptively start another round of stimulus.

Either way, there is not a lot that could positively impact the Yen at the moment. There is far more downside risk than upside.

News to watch out for coming out of Japan includes Machinery Orders, Industrial Production and CPI figures. If these show continued weakness, we could see the BoJ make a move on the stimulus. The Nikkei itself is a major indicator to watch. If we see a sustained sell-off as investors’ appetite for risk diminishes, then we will most definitely see strength return to the Yen and a move lower in the cross pairs with the Yen.

Europe

The economic problems in Europe are similar to those in Japan, albeit to a lesser extent and do not extend back almost 2 decades. Unemployment has been a very real issue for the Euro-zone as it sits painfully high at 11.9%, having drifted lower from 12.0%.

GDP growth in the Euro-zone as a whole is looking very flat for the near term, with January and February's reading coming in at 0.3%. February’s GDP result was only 0.5% higher than February 2013. Despite these flat readings, it's certainly an improvement on the previous quarter which showed negative results. Forecasts show GDP lifting for the Euro-zone over 2014 and 2015, however, these could change if any weak data comes out in the upcoming months.

Inflation, or rather Deflation, has been the other major headache for the European Central Bank (ECB). Prices in March showed a mere 0.5% growth from a year earlier, well below the ECB’s target of 2.0% inflation. This is perilously close to dipping into deflation and something the ECB is desperate to avoid. Mario Draghi, the ECB President, has made it clear the bank has some unconventional measures at its disposal to combat deflation. Negative interest rates and quantitative easing are some of the measures being discussed. So far, this talk has been just that, talk, and the market is reacting less and less to it. So don’t be surprised if we see some action from the ECB if any other data comes out showing further signs of weakness.

Euro-zone CPI Year on Year

News to watch out for in the coming month on the economic front include, of course, the CPI figures, also Economic Growth expectations and Consumer Confidence will give an indication of whether or not the ECB will intervene. The ECB is also releasing their monthly report on 10th April at 08:00 GMT which will give an indication of where they stand. Look for comments to become more dovish as the likelihood of stimulus becomes more real, however, the ECB may see things more differently in the market and may yet again hold off the stimulus.

The Pennant

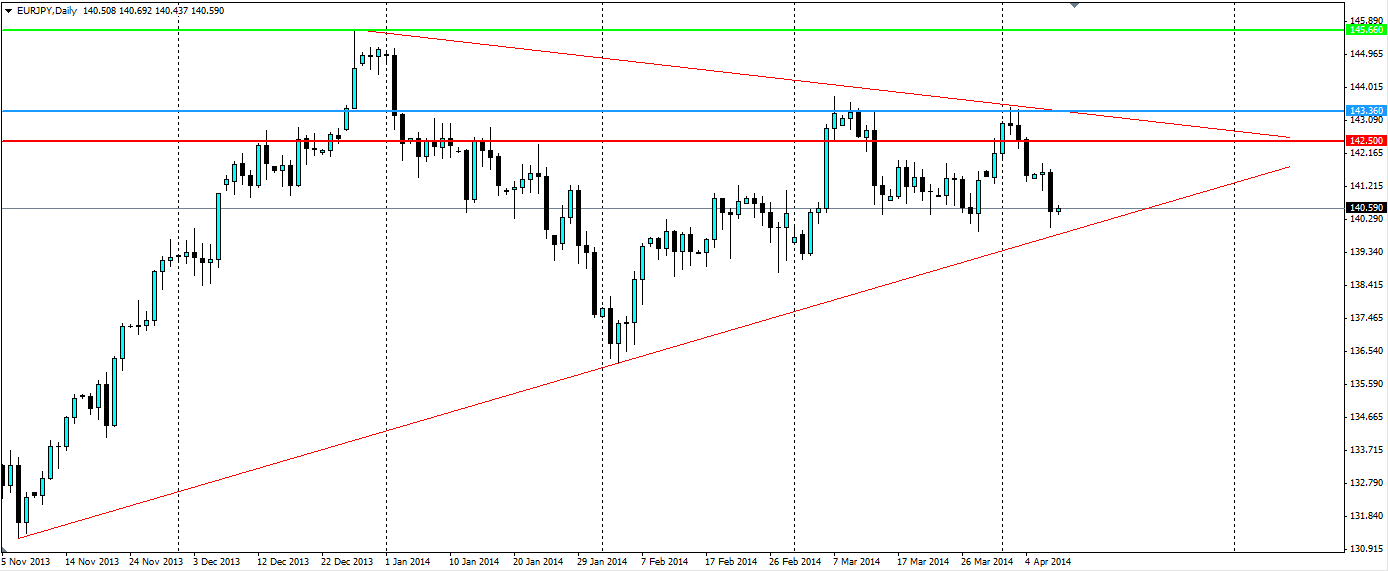

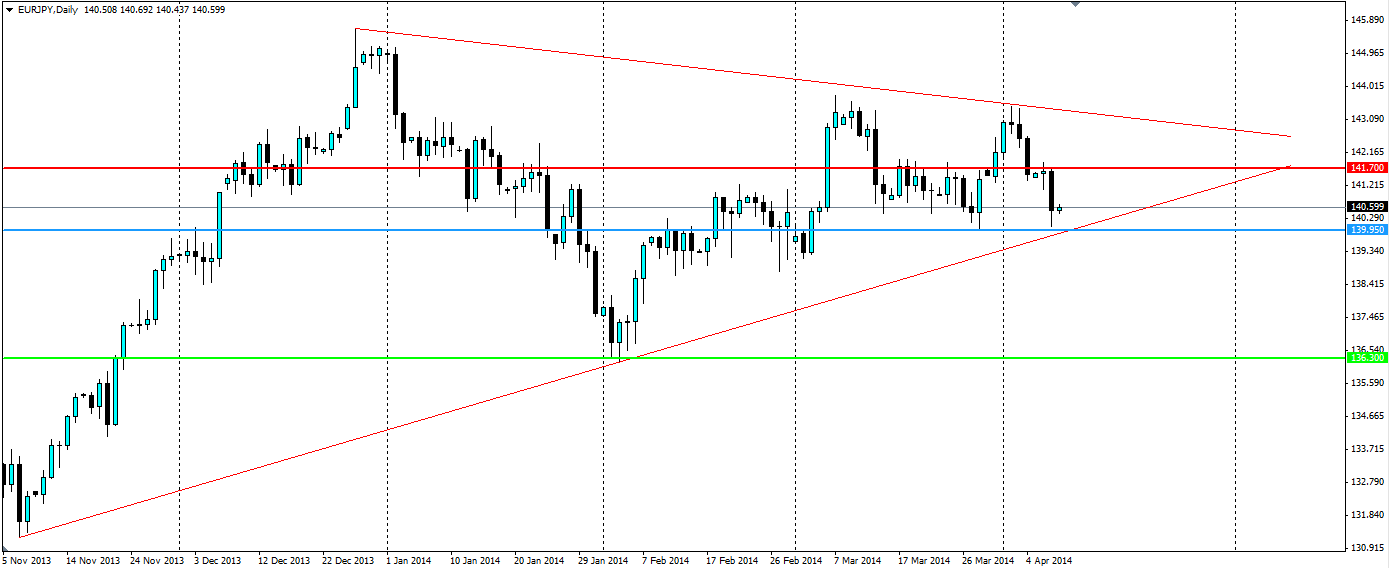

The current situation in both Japan and Europe leave the possibility for market movements more than likely. Throw into the mix a very nice looking pennant and we have an extremely volatile situation that could be rather lucrative. If we set Stop entry positions either side of the triangle, we can pick up the movement if any serious news comes out of either Japan or Europe. Keep in mind that if the pair keeps trading within the pennant, we can move our entries closer together in line with the slopes of the pennant.

We look to set a Stop buy around 143.36, with a stop loss back inside the shape at 142.5. As for the upside, an obvious target is the top of the pennant at 145.66. However, beyond that, we are getting into territory not seen sinceSeptember 2008, so it may be difficult to tell where the next target is. If the news is game changing, we could see the continuation of the long-term trend line. There was support at 153.5, however, this may no longer be in play, so traders should manage the position with a trailing stop loss.

If the news shifts the market to the downside, we want to catch that too, so if we set a Stop Sell just outside the pennant, we should be positioned nicely. The 140.00 level looks like it is providing support, so set a stop below this to catch it if it breaks. 141.70 may be a good place for the stop loss in case the market does not properly break out. In terms of targets, 136.30 was a low hit in Feb and beyond that, 131.22 is the bottom of the pennant which could be tested if the news is big enough. We may even see a downward trend form that takes the pair below the 100.00 level last seen in 2012.

Summary

Both Japan and Europe are in precarious positions and their respective positions have similarities. Keep both eyes fixed on any macroeconomic news and comments from the respective central banks as to if and when intervention may come. Profits will come to those who set themselves up to take advantage of the technical pattern currently in play between these two currencies.