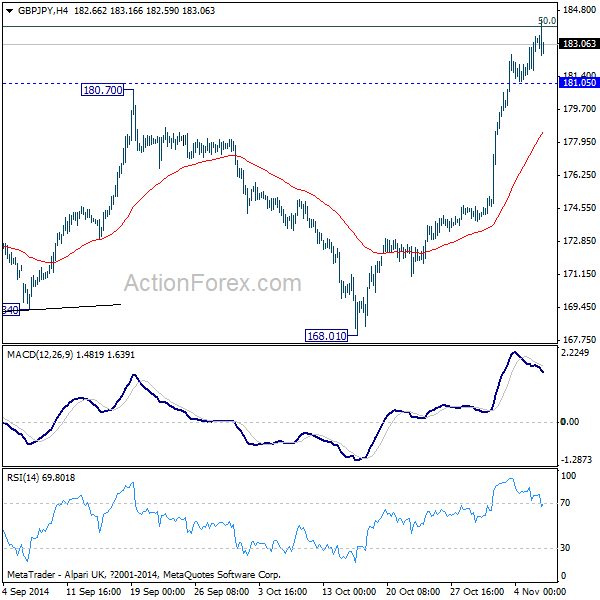

GBP/JPY Daily Outlook

Daily Pivots: (S1) 181.24; (P) 181.66; (R1) 182.22;

GBP/JPY lost some momentum after hitting long term fibonacci level of 183.96. But with 181.05 minor support intact, further rise is still expected. Sustained trading above 183.96 will target 190 psychological level next. Though, below 181.05 will indicate short term topping and bring consolidations first before staging another rise.

In the bigger picture, the strong support form 55 week EMA argues that up trend form 116.83 is still in progress. Break of 50% retracement retracement of 251.09 to 116.83 at 183.96 will pave the way to 61.8% retracement at 199.80, which is close to 200 psychological level. On the downside, nonetheless, break of 168.01 should now confirm medium term reversal.

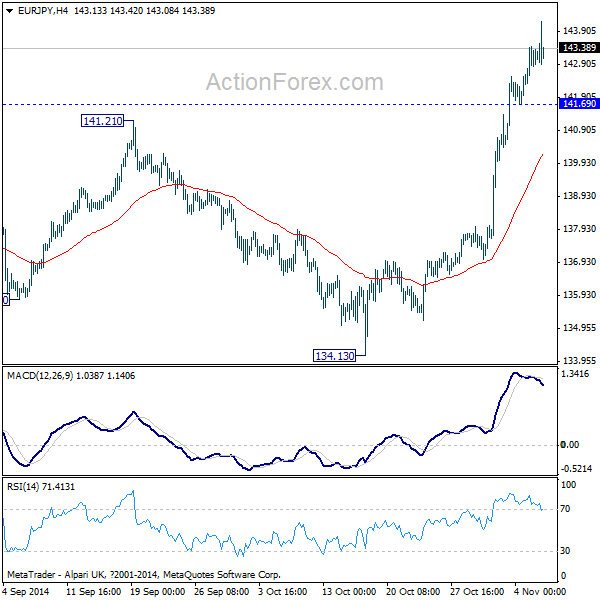

EUR/JPY Daily Outlook

Daily Pivots: (S1) 142.52; (P) 142.98; (R1) 143.61;

EUR/JPY lost some upside momentum after hitting 144.21. But still, with 141.69 minor support intact, further rise is expected to retest 145.68 high. Break will resume larger up trend. Meanwhile, break of 141.69 will indicate short term topping and bring consolidations first before staging another rally.

In the bigger picture, the failure to sustain below 55 weeks EMA and last week's strong rebound argues that up trend from 94.11long term bottom is still in progress. And, it's possibly ready to resume too. Break of 145.68 will target 76.4% retracement of 169.96 to 94.11 at 152.59 next. Nonetheless, break of 134.13 support will extend the corrective pattern from 145.68 lower to 38.2% retracement of 94.11 to 145.68 at 125.98.