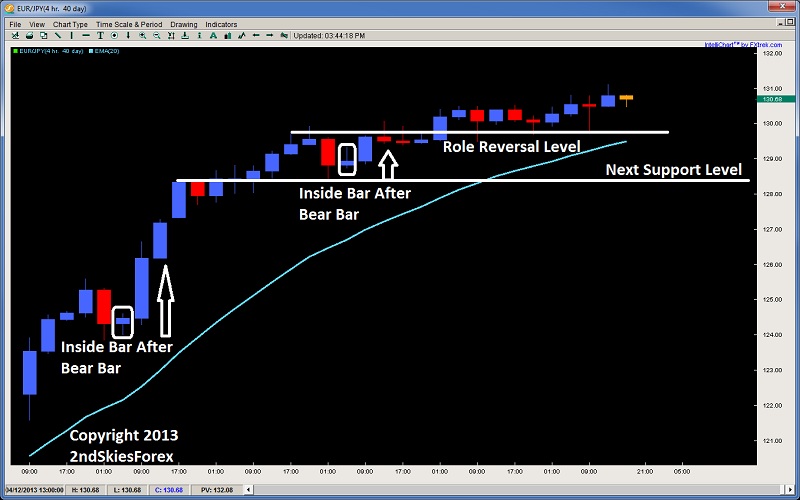

EUR/JPY

On Tuesday’s fx market commentary covering the EURJPY, I mentioned the following;

“You will notice that after the last two strong bearish bars, the pair formed a small inside bar….If the selling evaporates after a large bear bar in a strong bull trend forming an inside bar, this usually means it’s being bought on the cheap since the sellers could not produce any follow through.”

This is exactly how the price action played out after the inside bar, with the 130 resistance level I marked acting as support and launching higher. Today the pair just peaked above 131, only to sell off about 40 pips below the big figure. Although the trend is still up along with momentum, the latter has waned a little, likely having a hard time finding buyers wanting to chase the trend at this point.

Key pullback levels to get long are 129.54, 128.51 and 127.81, for a medium term target of 134.42 and 138.39. I think pullbacks should be considered great opportunities to get long, for I think this trend will go farther than most anticipate.

EUR/JPY" title="EUR/JPY" width="1096" height="868">

EUR/JPY" title="EUR/JPY" width="1096" height="868">

Original post

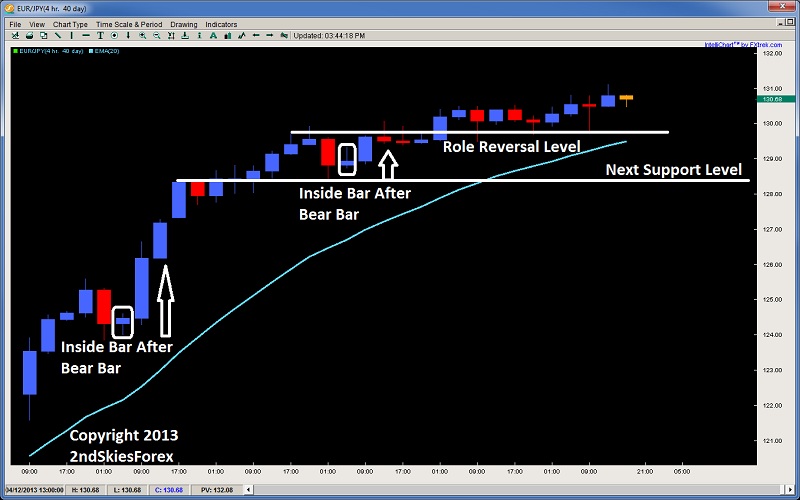

On Tuesday’s fx market commentary covering the EURJPY, I mentioned the following;

“You will notice that after the last two strong bearish bars, the pair formed a small inside bar….If the selling evaporates after a large bear bar in a strong bull trend forming an inside bar, this usually means it’s being bought on the cheap since the sellers could not produce any follow through.”

This is exactly how the price action played out after the inside bar, with the 130 resistance level I marked acting as support and launching higher. Today the pair just peaked above 131, only to sell off about 40 pips below the big figure. Although the trend is still up along with momentum, the latter has waned a little, likely having a hard time finding buyers wanting to chase the trend at this point.

Key pullback levels to get long are 129.54, 128.51 and 127.81, for a medium term target of 134.42 and 138.39. I think pullbacks should be considered great opportunities to get long, for I think this trend will go farther than most anticipate.

EUR/JPY" title="EUR/JPY" width="1096" height="868">

EUR/JPY" title="EUR/JPY" width="1096" height="868">Original post