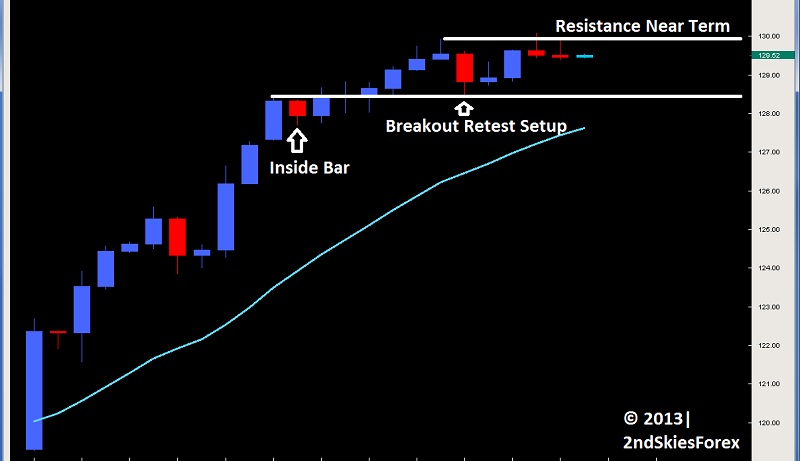

EUR/JPY

In yesterdays FX market commentary, I suggested looking for longs at the key level of 128.36. Today the pair touched just 6 pips above this, then launched 160+ pips higher, taking a peak above the 130 big figure. You will see on the chart below how it offered a great breakout retest setup of the level after the inside bar consolidations highs so hopefully you got some pips on this.

You will notice that after the last two strong bearish bars, marked A and B on the chart, the pair formed a small inside bar and then found higher ground. If the selling evaporates after a large bear bar in a strong bull trend, this usually means its being bought on the cheap since the sellers could not produce any follow through.

The pair currently is consolidating just below 130, and may need to pull back to this level again before taking out the round number. I expect pullbacks towards 128.42 and 127.78 to find buyers looking to get short JPY, so consider these opportunities to get long. Only a daily close below 127.78 will daunt my strong bullish view. Upside targets still remain at 134.45 and possibly much higher if it can clear the air up there.

EUR/JPY" title="Inside-Bar-Breakout-Retest-Setup-EUR/JPY" width="1136" height="737">

EUR/JPY" title="Inside-Bar-Breakout-Retest-Setup-EUR/JPY" width="1136" height="737">

Original post

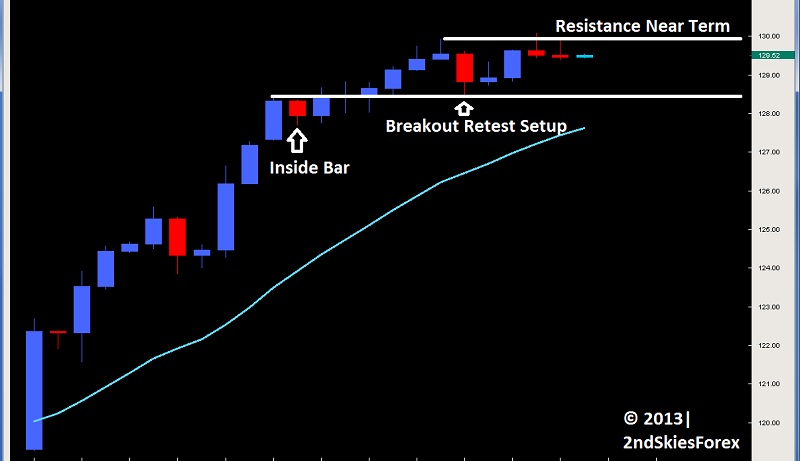

In yesterdays FX market commentary, I suggested looking for longs at the key level of 128.36. Today the pair touched just 6 pips above this, then launched 160+ pips higher, taking a peak above the 130 big figure. You will see on the chart below how it offered a great breakout retest setup of the level after the inside bar consolidations highs so hopefully you got some pips on this.

You will notice that after the last two strong bearish bars, marked A and B on the chart, the pair formed a small inside bar and then found higher ground. If the selling evaporates after a large bear bar in a strong bull trend, this usually means its being bought on the cheap since the sellers could not produce any follow through.

The pair currently is consolidating just below 130, and may need to pull back to this level again before taking out the round number. I expect pullbacks towards 128.42 and 127.78 to find buyers looking to get short JPY, so consider these opportunities to get long. Only a daily close below 127.78 will daunt my strong bullish view. Upside targets still remain at 134.45 and possibly much higher if it can clear the air up there.

EUR/JPY" title="Inside-Bar-Breakout-Retest-Setup-EUR/JPY" width="1136" height="737">

EUR/JPY" title="Inside-Bar-Breakout-Retest-Setup-EUR/JPY" width="1136" height="737">Original post