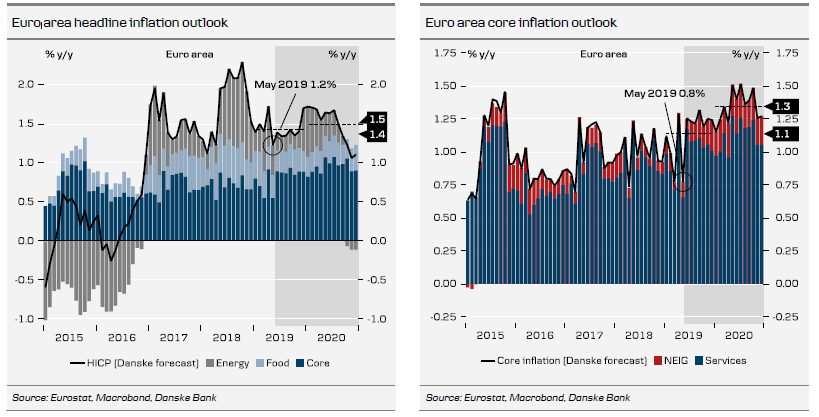

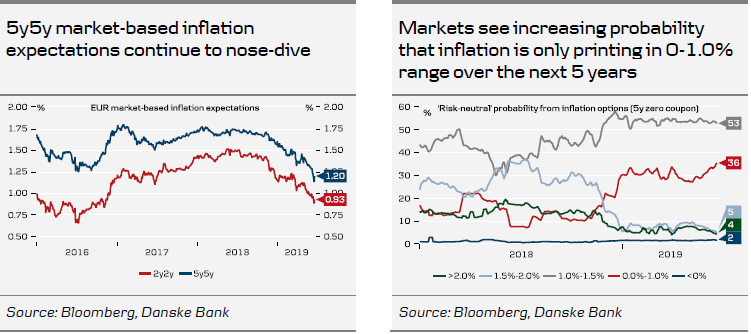

It is difficult for markets to be optimistic on the outlook for euro area inflation currently . Indeed, the slide in 5y5y market-based inflation expectations to a new all-time low of 1.13% suggests that investors' patience with the ECB's 'delayed, not derailed narrative' has run its course. Looking at the probability distribution from inflation options, markets are attaching a greater than 50% probability that euro inflation will print only between 1.0-1.5% over the next five years.

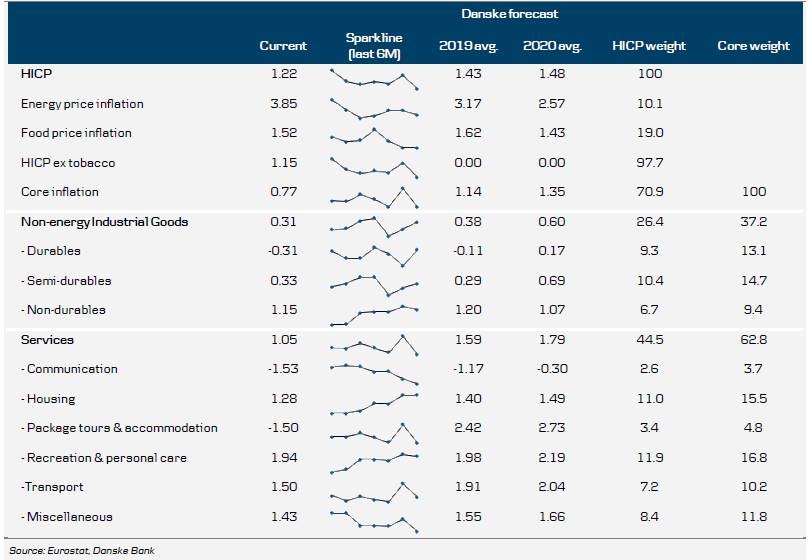

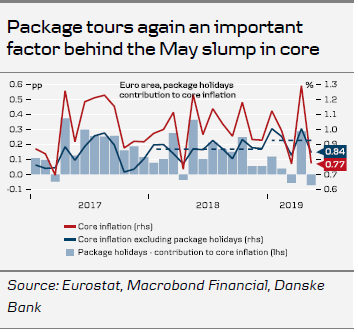

Nonetheless, the details of the final May HICP painted a less bleak picture about the state of underlying inflation pressures than the flash release suggested. Details revealed that calendar effects due to the differing timing of Whitsun in 2018 (May) and 2019 (June) were again an important driver of the decline in core inflation by 52pp back to 0.77% - just like the Easter effect in March in April. Services related to package tours & accommodation accounted for 57pp of the total 89pp drop in service price inflation during the month and excluding this volatile item, euro area core inflation is still showing signs of acceleration compared to 2018 (see chart). On another positive note, inflation in services related to recreation & personal care held steady at 1.94%.

Although NEIG inflation rose only marginally to 0.31%, inflation in durable goods picked up some speed in May (from -0.43% to -0.31%), which could be an early sign that the impact of a weaker effective EUR is starting to filter through. Indeed, higher import prices have signalled a turnaround for some months now (see also Inflation under the microscope: simmering, not boiling ).

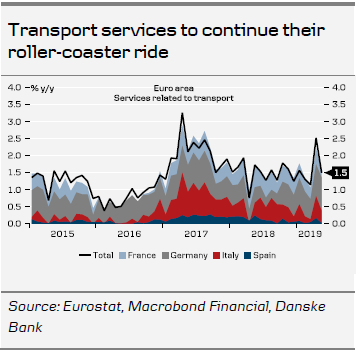

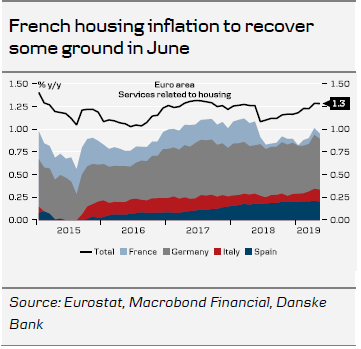

We expect the inflation roller-coaster to continue in June , as base effects remain in the driver's seat when the 'Whitsun effect' will give an artificial boost to travel-related core inflation items such as package tours and transport services, and the base effect from last year's cut in French social housing costs drops out. Hence we look for core inflation to recover back to 1.3% in June, but we will probably have to wait until July for a 'clean' measure of the true underlying inflation picture. We still track euro area core inflation at rates of 1.2-1.3% by year end (see table on page 2).

Overview euro area inflation outlook