Investing.com’s stocks of the week

Key Points:

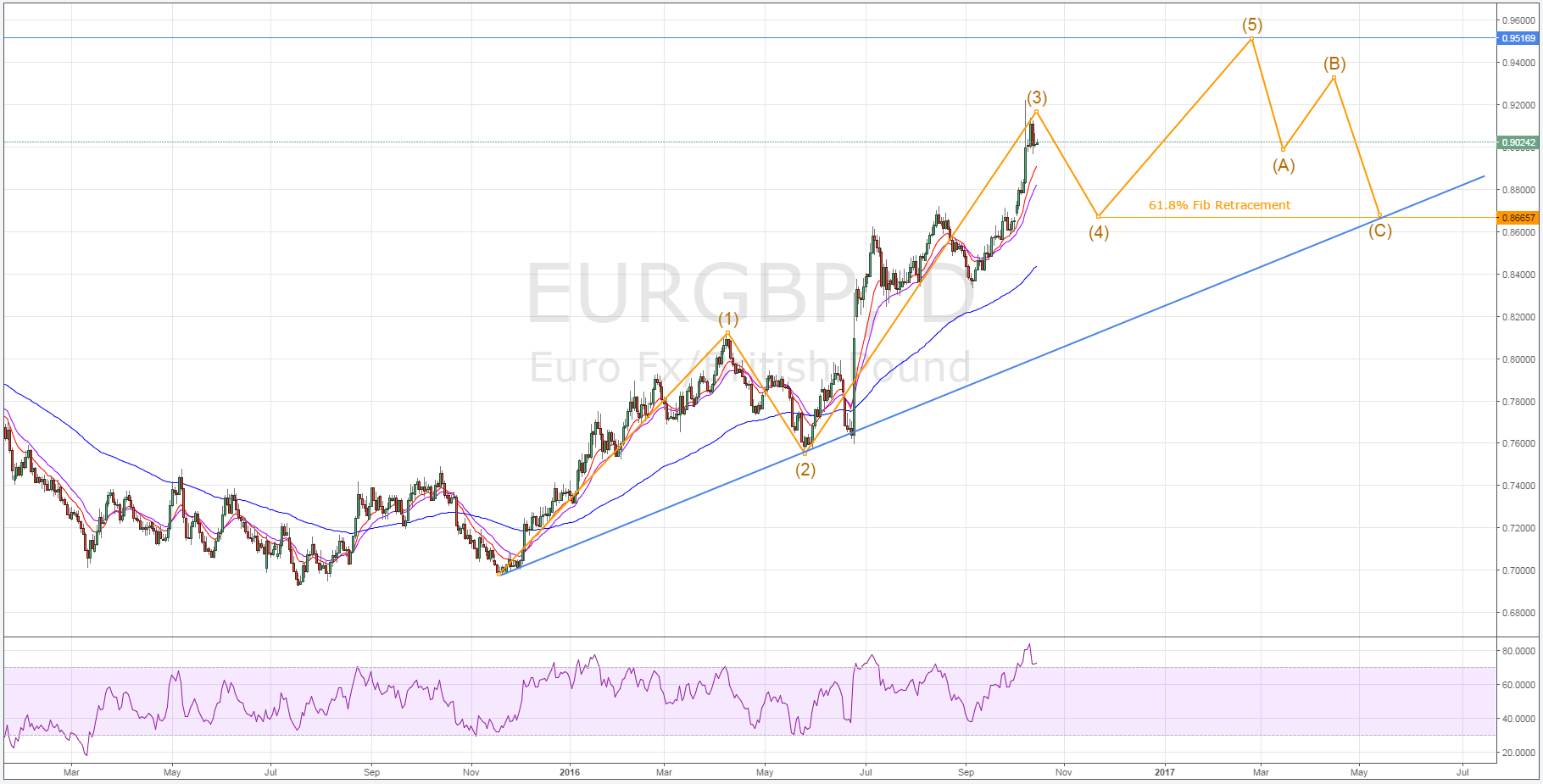

- Elliott wave in full swing.

- 100 day EMA remains highly bullish.

- Parity is on the cards but the 0.95 handle could prove troublesome.

Courtesy of HSBC, speculation is now circulating whether the EUR/GBP could reach parity and, as a result,it might be worth taking a look at the pair and how we might see it behave in the coming weeks. Currently, it looks like this march towards parity could very well be possibility due to an Elliott wave but, by the same token, this wave could also see the pair run into trouble around the 0.95 handle.

As is made clear below, the EUR/GBP has been broadly following an Elliott wave higher since November last year. In fact, the pair is now at the end of the 3rd leg of the pattern and looking ready to retrace. The move should bring the EUR/GBP back to around the 0.8665 mark which represents the 61.8% Fibonacci retracement level. Subsequently, it is expected that the pair reverses around this price and begins the final leg which could take it up to about the 0.9516 mark.

An imminent reversal is likely for a number of reasons, primarily however, the recent movement of the RSI readings into overbought territory should be a major driver of an uptick in selling pressure. In addition to the RSI readings, the switch in the H4 Parabolic SAR indicator from bullish to bearish is likewise encouraging a shift in sentiment for the pair. Combined, these two readings should see the 4th leg complete over the next week or so.

After making its retracement, the 5th and final leg of the wave should see the EUR/GBP make its way towards the 0.9516 mark. Presently, this final wave is looking fairly certain given the strong bias seen in the daily EMA activity. However, in the medium-term, it is likely that the end point of this leg will prove to be a top for the pair and a corrective ABC wave should occur after this long-term zone of resistance has been met. As a result of said corrective wave, the EURGBP will then begin its descent which should end when the pair comes back into conflict with the long-term trend line at the 0.8665 price.

However, point C will prove to be a crucial moment in forecasting the pair’s future as a reversal here will go a long way in confirming the uptrend and, by extension, speculation that parity can be reached. If support holds, there remains a solid chance that another Elliot wave could begin which will provide the momentum needed to push the pair through the 0.95 handle and up to parity.

Ultimately, the future of the EUR/GBP is highly dependent on fundamental factors which somewhat limits the efficacy of long-term technical forecasts. However, with the general deterioration of the pound due to Brexit concerns, a fundamentally weaker GBP is a fairly safe bet. Consequently, the fundamental and technical bias should remain fairly in-sync moving forward, which is good news for the EUR bulls out there.