Key Points:

- Price action reaches lower range constraint.

- Stochastics exit oversold territory.

- EUR/GBP likely to retrace to top of current range.

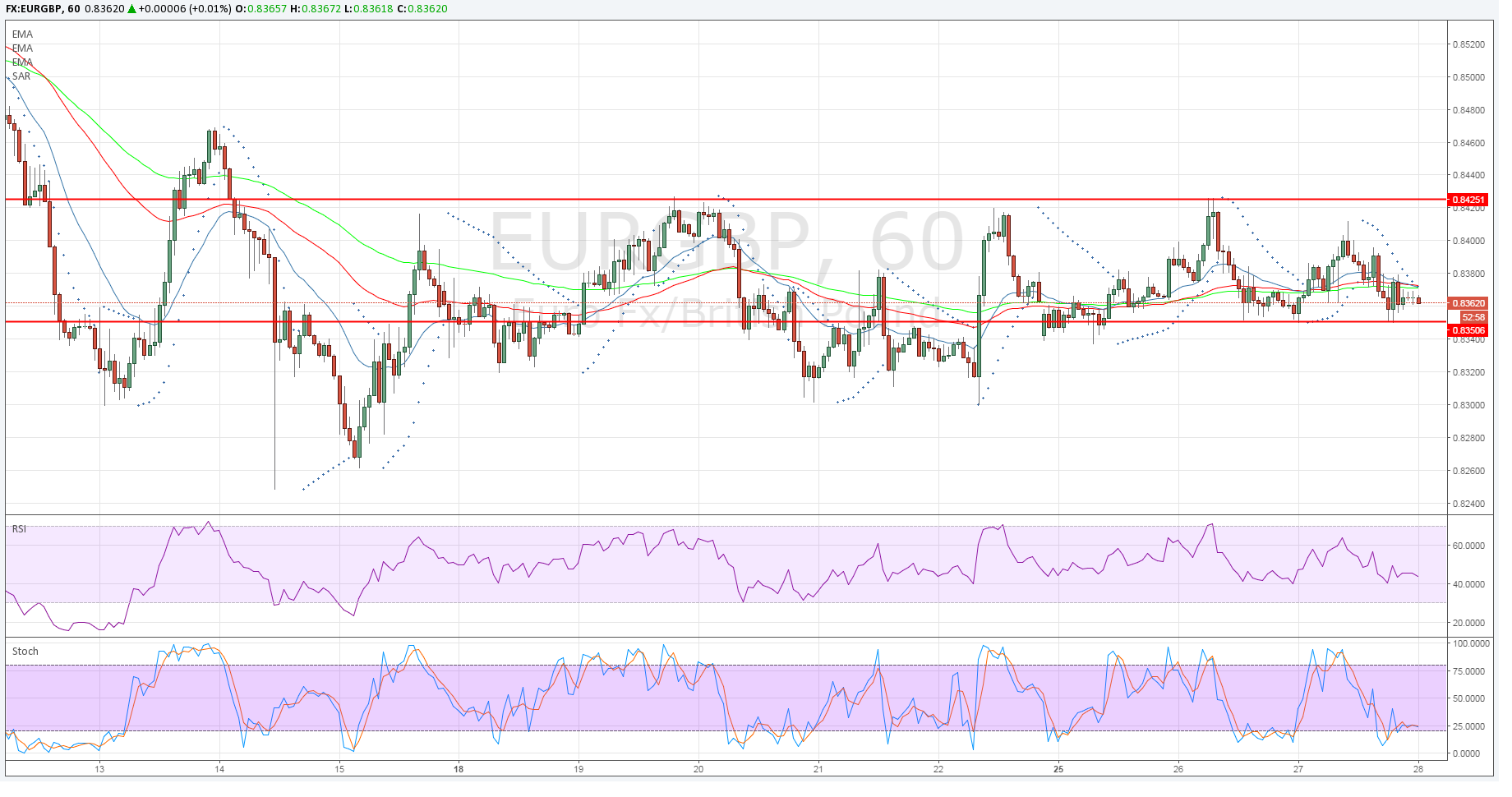

The Euro-Pound pair has been relatively range bound over the past few weeks as it has largely traded between 0.8350 and 0.8425. However, the past few days has seen the pair steadily declining towards the lower constraint before commencing a small consolidation phase. Subsequently, there is plenty of scope for a retracement towards the top of the range based on a history of reversal from this level over the past few weeks.

A cursory review of the technical indicators also seems to support the view that there is likely to be a bullish leg added in the coming days. In particular, the stochastic oscillator (1-hr time frame) has recently exited over-sold territory whilst RSI appears to be flattening andis nearing over-sold. In addition, the 20, 60, and 100 Hour EMA’s have all flattened and converged near to price action’s current position which is interesting given their role as a key long position entry point previously.

From a fundamental perspective, there are also some key economic data points which are due out over the next 24 hours and likely to buoy the Euro. In particular, the UK House Price data is forecast to decline from 0.2% to 0.0% m/m whilst the nationwide HPI is likely to fall into contraction around the -0.2% level. Subsequently, there are plenty of fundamental reasons to expect a small appreciation for the Euro given the high probability of one of these data releases providing a negative result.

Ultimately, given the technical and fundamental indicators, the Euro is probable to rally against the Pound within the current range structure. However, before considering any long entry look for a strong bullish candle to pierce the 100-Hour MA and be prepared to cut your gains at the top of the channel because, at this stage, a sharp rally beyond the 0.85 handle is unlikely. In addition, consider your Euro exposure on Friday (09:00 GMT) given that the EU Flash CPI Estimates and GDP figures are due out. These are critical events and you could see some sharp volatility around their releases that could invalidate a longer term trade.