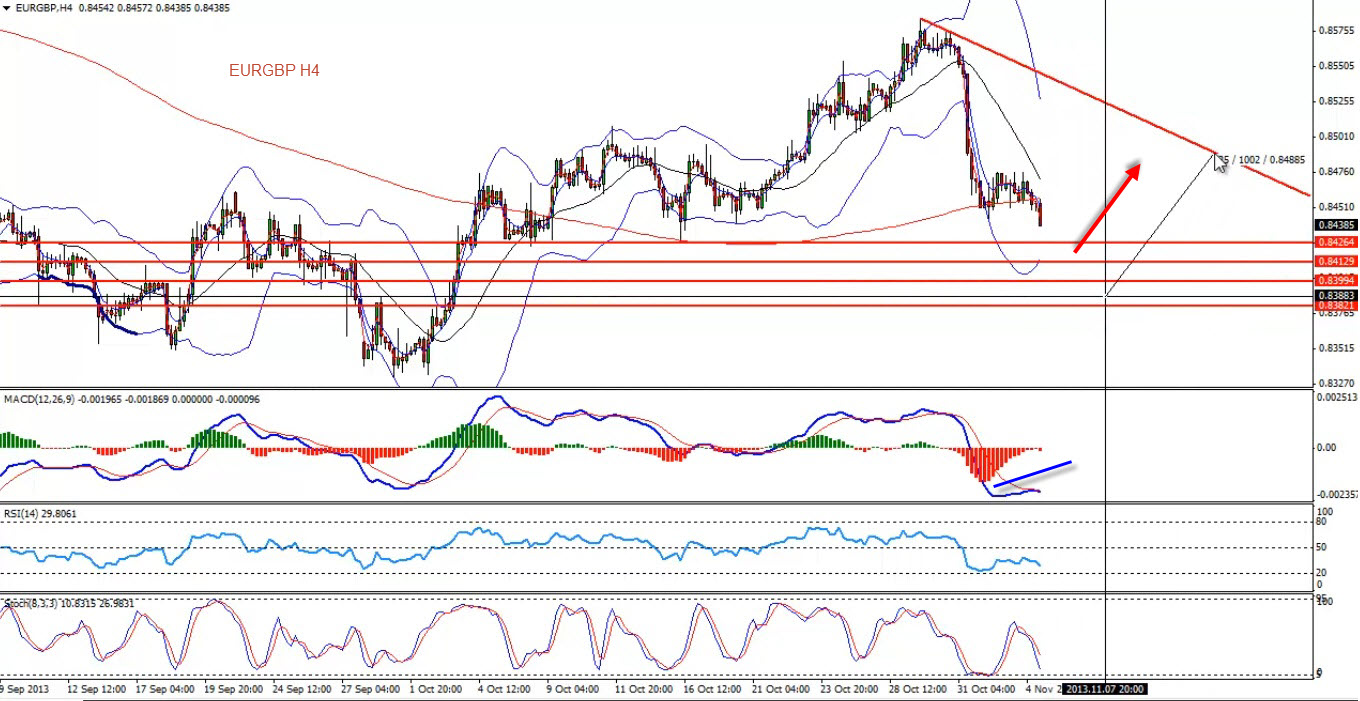

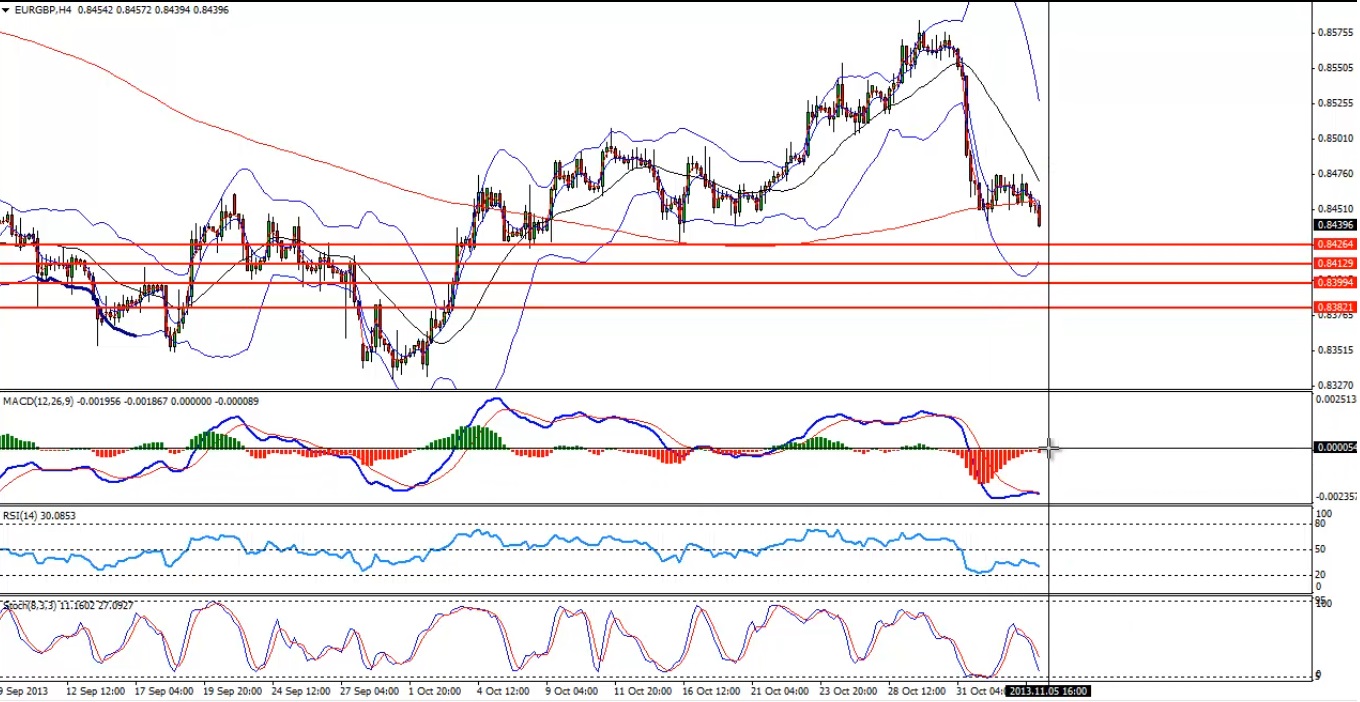

We have been talking about EUR/GBP for quite some time, and now I think the pair is likely to form a bottom soon. There is a bullish hidden divergence forming on the daily chart as seen in the chart below, and the pair is also approaching some of the critical support levels. So, I think we should look to buy EUR/GBP from the lower levels. EUR/GBP Chart" title="EUR/GBP Chart" height="703" width="972">

EUR/GBP Chart" title="EUR/GBP Chart" height="703" width="972">

There is a divergence forming on the 4 hour chart as well. So, we will look to buy EUR/GBP from any of the support levels such as 0.8410 and 0.8390 as shown in the chart below. In order to jump into a buy trade, we need the pair to drop a bit lower at around these levels, make a stop and form a divergence on the 1 hour chart along with a bullish candle pattern on the 1 hour. EUR/GBP " title="EUR/GBP " height="703" width="972">

EUR/GBP " title="EUR/GBP " height="703" width="972">

Initial target should be around the down-move trend line as plotted on the chart below and final target could be around the last highs. Stop should be placed below the last low. EUR/GBP Chart" title="EUR/GBP Chart" height="703" width="972">

EUR/GBP Chart" title="EUR/GBP Chart" height="703" width="972">

Reviewing yesterday’s events and trades

Some of the key fundamental data was released from the Euro zone yesterday, including German, French and Italian manufacturing PMI, which remained steady around the expected levels. Euro zone composite PMI too remained at 51.3 as expected. Furthermore, UK construction PMI jumped 0.5 points higher from 58.9 to 59.4, which helped GBP/USD to recover some of the lost ground. Earlier in the Asian session, RBA announced the interest rates with no change at 2.50%, but mentioned again that exchange rates are ‘uncomfortably high’, which weighed on AUD/USD.

Fundamental Outlook for the day

Today, ISM Non-Manufacturing PMI figure is scheduled to be released for the US, which is expected to decline 0.4 points from the previous reading of 54.4. Moreover, The Investor’s Business Daily (IBD), TechnoMetrica Institute of Policy and Politics (TIPP) Economic Optimism Index rates is also lined up in the US session, which is expected to rise from 38.4 to 41.1. Other than this, New Zealand’s employment data will be released in the next Asian session with the employment rate expected to fall from 6.4% to 6.3%.

This analysis is taken from today’s Daily Market Forecast, which also includes trade opportunities on: EUR/USD, EUR/NZD, USD/CAD, EUR/CHF, NZD/USD, GOLD and DAX.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/GBP: Potential Short Term Buy Opportunity

Published 11/05/2013, 11:41 PM

Updated 07/09/2023, 06:31 AM

EUR/GBP: Potential Short Term Buy Opportunity

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.