The last 24 hours have been a veritable roller coaster for financial markets as ongoing volatility from the UK referendum result continues to simmer.

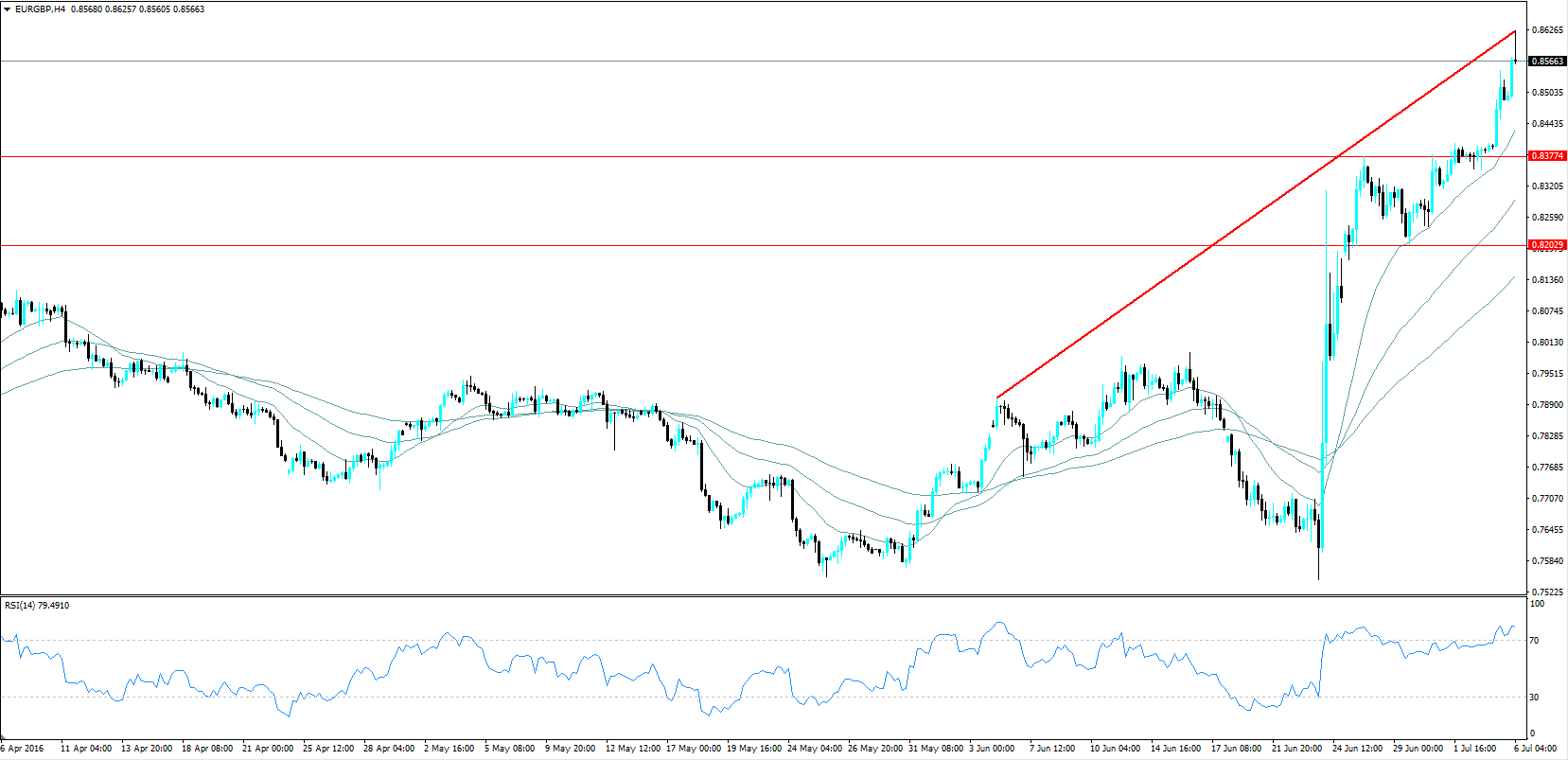

Despite the highly negative event, the currency pair has fared relatively well over the past few weeks as the euro has sharply appreciated against the pound, rallying from the depths of 0.7545 to its current high of 0.8574. However, the short side could be beckoning as the technical indicators start to signal that a pullback is a real possibility.

In fact, a cursory review of both the 4-hour chart shows that the RSI Oscillator is strongly within overbought territory currently. In addition, an inverted hammer pattern has just appeared in the last candle which is likely to predispose the pair to a corrective pullback.

Also, price action is currently facing a key resistance/swing point around the 0.8584 mark from October 2015 which is likely to complicate any further bullishness. Subsequently, there is a growing case for a short side correction for the pair in the coming days which could potentially see it reversing back towards the 0.82 handle in extension.

Ultimately, the euro-pound has had a meteoric rise of late, but its over-bought status and position near to a reversal zone means that we are likely to see a corrective pullback in the coming days back towards the 0.8202 handle.

However, there are some fundamental drivers which are complicating the technical outlook in the form of ongoing instability within the United Kingdom.

The ultimate implementation of the Brexit vote still appears to be somewhat up in the air and whilst a lack of certainty remains there will be some strong volatility sweeping through markets which will need to be monitored.