Why the U.S. dollar still reigns supreme

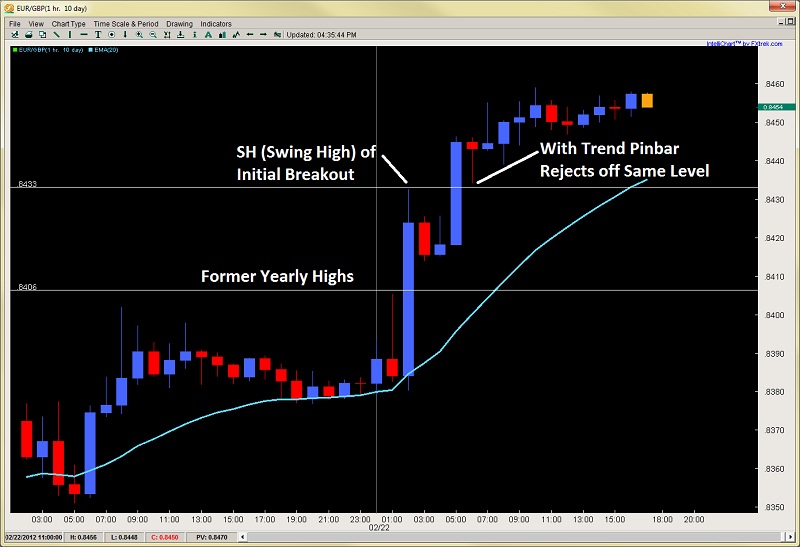

After starting off the year being voted most boring pair to trade for Jan. and Feb., the EUR/GBP has woken up out of its slumber by the bulls on parade which today have taken out the yearly high and key resistance at .8407 with a closing print of .8456. This is a strong breakout bar with good clearing distance suggesting this is the Real McCoy (at least for now).

EUR/GBP" title="EUR/GBP" width="800" height="527" />Bulls can watch for a possible breakout-retest of either the daily resistance level at .8407 as mentioned above, or take a look at the intraday 1hr chart which offered a slightly different picture showing a pause right around .8433 which was a SH in the breakout move, caused a brief consolidation, the another breakout bar followed by a with trend pinbar rejecting off this level so intraday traders can look for a long here. targeting just shy of .8500 which we believe is the next upside resistance.

EUR/GBP" title="EUR/GBP" width="800" height="527" />Bulls can watch for a possible breakout-retest of either the daily resistance level at .8407 as mentioned above, or take a look at the intraday 1hr chart which offered a slightly different picture showing a pause right around .8433 which was a SH in the breakout move, caused a brief consolidation, the another breakout bar followed by a with trend pinbar rejecting off this level so intraday traders can look for a long here. targeting just shy of .8500 which we believe is the next upside resistance.

Gold – Intraday Pinbar Sparks Breakout

After starting the day consolidating towards yesterday’s highs and just below the key resistance at $1762.90, Gold was stuck in a bull flag but then created a great intraday price action setup to get long and participate in the breakout by forming a pinbar which actually gave a false break trapping intraday traders short on the break of the flag, then rocketing up $25 in a matter of hours. Many of our price action traders caught this setup for an almost 4:1 R:R ratio exiting on the close of the bar and have now exited the trade.

In terms of how to get in now, we are looking for a breakout-pullback to the $1762.90 level previously mentioned but with price hanging around the highs suggests very little profit taking thus likely higher prices.

In terms of how to get in now, we are looking for a breakout-pullback to the $1762.90 level previously mentioned but with price hanging around the highs suggests very little profit taking thus likely higher prices.

EUR/GBP" title="EUR/GBP" width="800" height="527" />Bulls can watch for a possible breakout-retest of either the daily resistance level at .8407 as mentioned above, or take a look at the intraday 1hr chart which offered a slightly different picture showing a pause right around .8433 which was a SH in the breakout move, caused a brief consolidation, the another breakout bar followed by a with trend pinbar rejecting off this level so intraday traders can look for a long here. targeting just shy of .8500 which we believe is the next upside resistance.

EUR/GBP" title="EUR/GBP" width="800" height="527" />Bulls can watch for a possible breakout-retest of either the daily resistance level at .8407 as mentioned above, or take a look at the intraday 1hr chart which offered a slightly different picture showing a pause right around .8433 which was a SH in the breakout move, caused a brief consolidation, the another breakout bar followed by a with trend pinbar rejecting off this level so intraday traders can look for a long here. targeting just shy of .8500 which we believe is the next upside resistance.After starting the day consolidating towards yesterday’s highs and just below the key resistance at $1762.90, Gold was stuck in a bull flag but then created a great intraday price action setup to get long and participate in the breakout by forming a pinbar which actually gave a false break trapping intraday traders short on the break of the flag, then rocketing up $25 in a matter of hours. Many of our price action traders caught this setup for an almost 4:1 R:R ratio exiting on the close of the bar and have now exited the trade.

In terms of how to get in now, we are looking for a breakout-pullback to the $1762.90 level previously mentioned but with price hanging around the highs suggests very little profit taking thus likely higher prices.

In terms of how to get in now, we are looking for a breakout-pullback to the $1762.90 level previously mentioned but with price hanging around the highs suggests very little profit taking thus likely higher prices.