EURGBP Finds The Channel

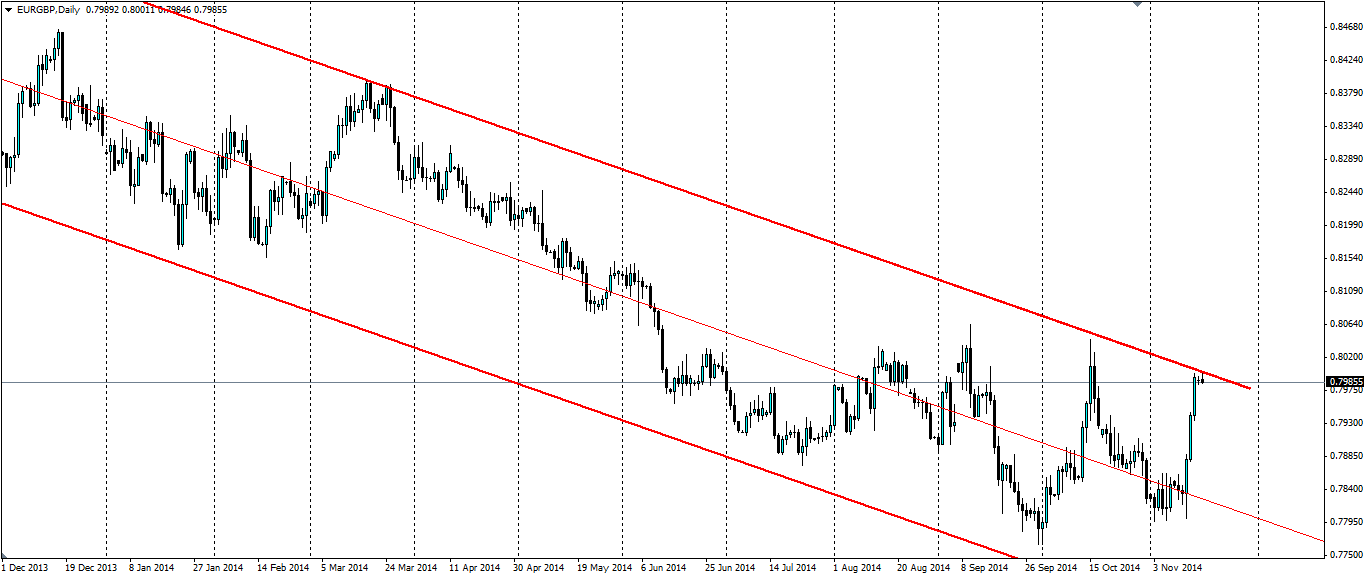

There is a nice steady downward sloping channel that has been in play on the EUR/GBP daily chart for over a year now. The price has used the middle of the channel as a point of reference but now looks to find resistance at the top.

Source: Blackwell Trader

The channel exists for fundamental reasons; namely the stimulus packages that have been released by the ECB as they fight deflation and low growth. The situation in the UK is a little different; growth has been comfortable at 0.8% q/q and inflation in the positives, albeit falling.

The pound has come under a bit of pressure last week as the prospect of an interest rate rise becomes less likely until later next year as inflation continues to fall. The Bank of England released its monthly inflation expectations report and it expects inflationary pressures to continue to diminish. It also expects growth to fall from 3.2% to 2.9% next year.

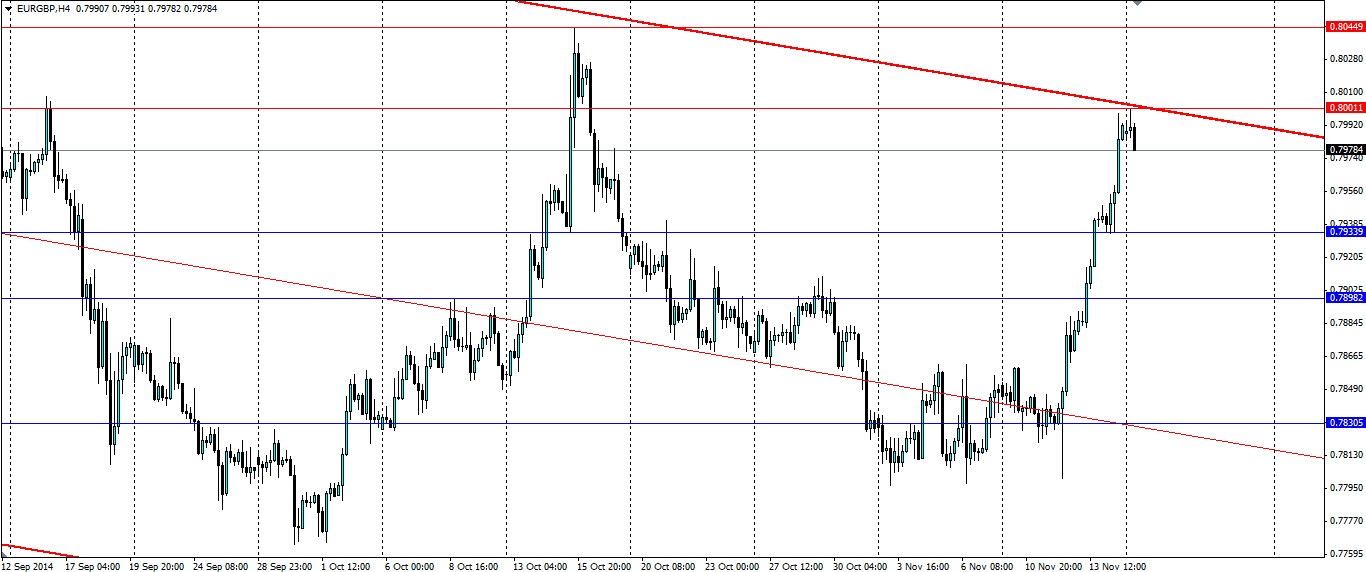

The result is that the EUR/GBP has found resistance at the top of the bearish channel at the psychological 0.8000 level and it now looks to reject off it. It is possible that we could see another test of the trend line, however, given that the UK is fundamentally in a better position than the EU, and many expect the ECB to release another round of stimulus, a movement back towards the bottom of the channel looks the most likely outcome.

For a movement lower, look for the levels at 0.7934, 0.7898 and 0.7830 to potentially hold up the price. These levels of support could all act as targets for a movement lower. The price may also look for the middle of the channel to act as dynamic support.

The bearish channel on the EUR/GBP daily charts looks to be in control and the price will likely reject off it. The UK being fundamentally stronger than the EU at this point will likely act as a driver along with the strong rejection off the 0.8000 mark.