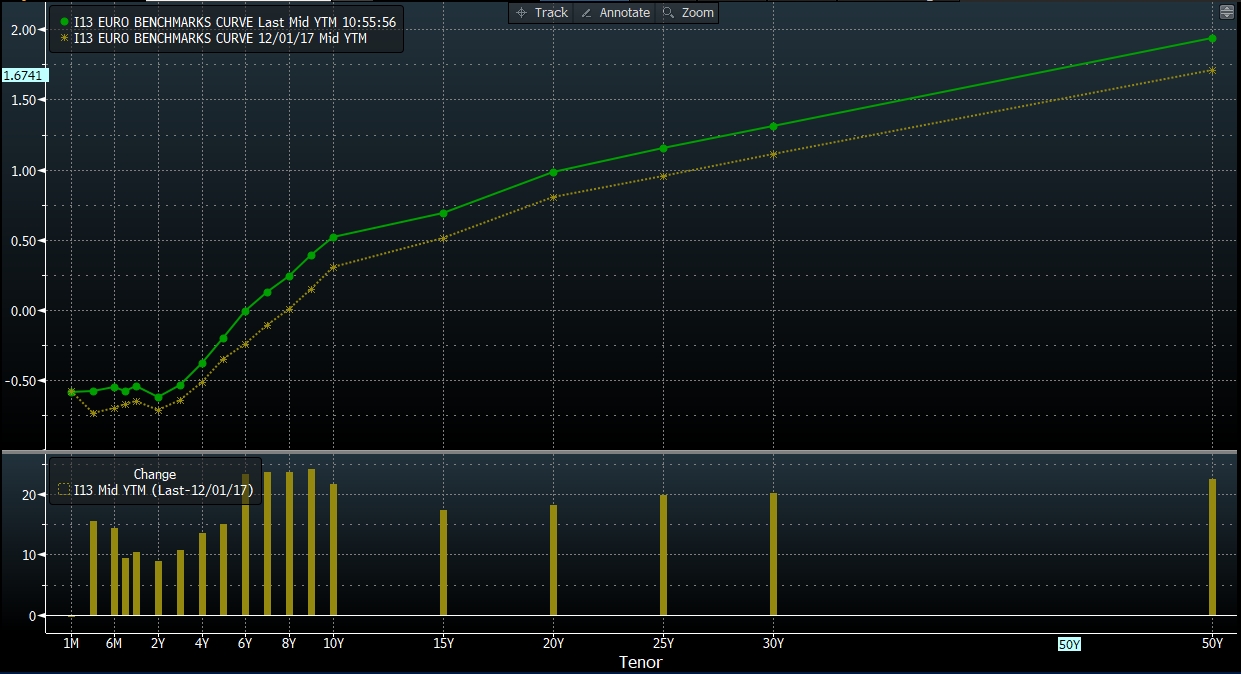

Last year the ECB announced adjustments to the asset purchasing program. It was decreased from 60 bn to 30 bn. As a result market started pricing bearish movement of European govies, what was logical conclusion that arise from the action taken by the ECB. Started December short-term European govies yields increased on average 10-15 bps. I am not supporter of taking duration risk or keeping portfolio duration above 5.

Source: Chart is created using Bloomberg terminal

How long can they rise? Well, to me, not too much in 2018, however I expect average short-term yields to be around 15 bps higher than the average of 2017. Some rumors regarding rate hike might begin started second half of this year, but I do not think there will be actual hikes earlier than 2019. Also not much at the moment is expected from political side, except elections in Italy and coalition in Germany.

What about the current situation? To be honest, at the end of the last year when I wrote my outlook for 2018 I did not expect to see technical indicators to show me what they show now so soon. In my opinion it is right time to take long position in EUR denominated papers. Technical indicators such as relative strength Index (RSI) reached level of 70, Moving Average Convergence/Divergence (MACD) line almost got concave shape, ADX trend line reached 6 month high. All this indicators support the above mentioned opinion. Current situation from technical perspective is similar to what we had at the end of June last year. Some can still wait to get confirmation from Ichimoku and moving averages and by doing so ignore some interim cash inflows.

How long can long position be kept? The problem with EUR denominated papers is something that I call “protection”. Well EUR denominated papers have several problems and “protection” is just one of them. So what is protection? I try to predict the price and the yield in the future at which I will start to make losses, simply by deducting future cash flows from current investment. As a result if USD or GBP denominated papers will start to make losses for example after 6 month if yields increase on average by 10-15 bps, for some EUR denominated papers this number can be as low as 1 or 2 bps. Thus, sometimes for EUR denominated papers if some believe that the market will definitely move opposite to the predetermined expectation it does make sense to close position with a loss. Therefore in my opinion long position taken now could be reversed after 5-7 bps gain. Position can be closed in the second half of this month or first half of the next month.

Economic Calendar

· France Industrial Production MoM

· France Industrial Production YoY

· UK Industrial Production MoM

· UK Industrial Production YoY

· UK Manufacturing Production MoM

· UK Manufacturing Production YoY

· US MBA Mortgage Applications