Key Points:

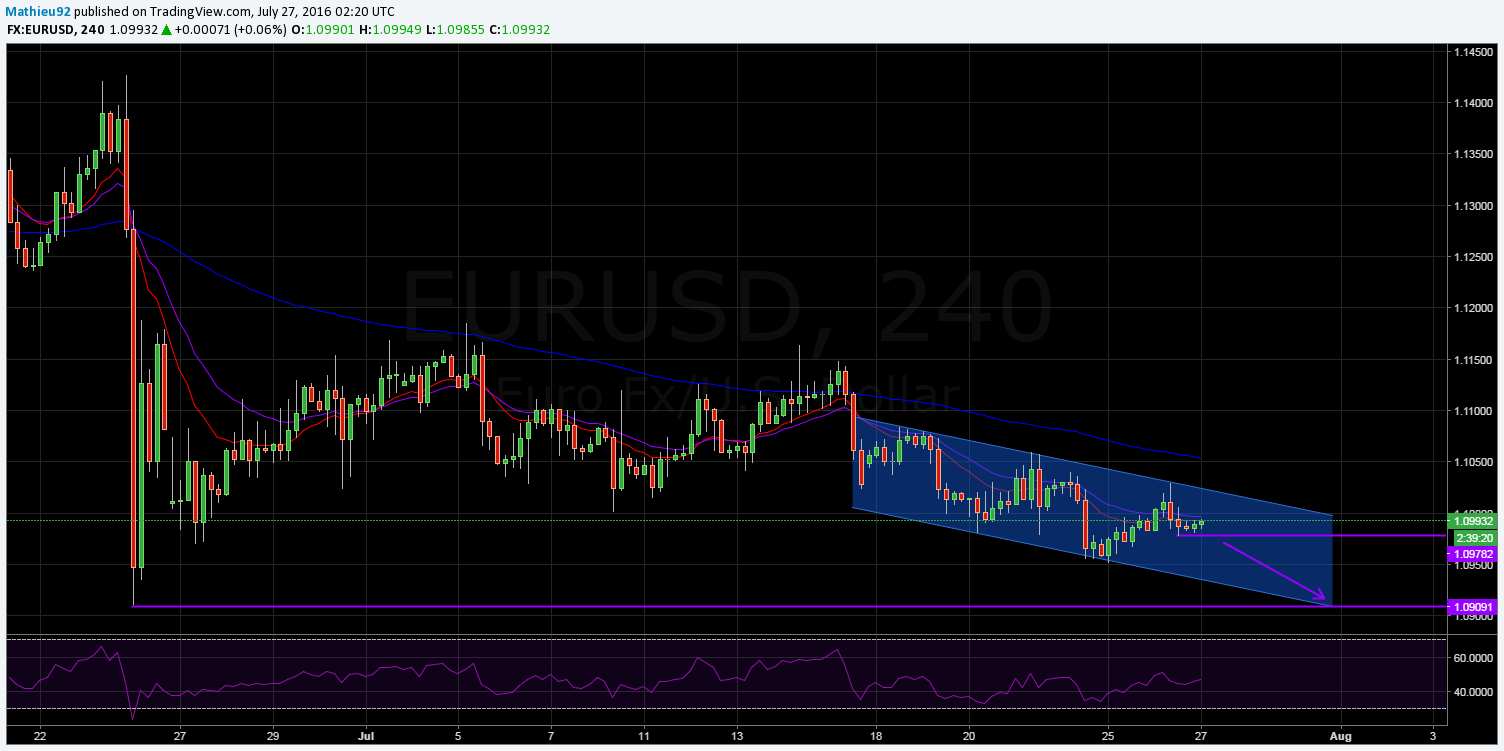

- Strongly bearish EMA activity.

- Bearish channel still in place

- Long-term low could be challenged.

The euro continues to be in decline this week but now faces a robust zone of support which could dampen the bear’s momentum to some extent. However, if they do manage to push through the current level, the resulting tumble could take the EUR Significantly lower in the short term. This being said, the spectre of the FOMC meeting still hangs over the market at present which, as usual, could impact the EUR/USD heavily.

Taking a look at the H4 chart, there is a relatively strong downtrend present which is demonstrated by the bearish channel formation. Having tested both constraints fairly consistently, the euro is looking fairly set to follow the pattern lower in the absence of a major fundamental shake-up. Additionally, both the H4 and daily EMA activity remain highly suggestive of a firm downtrend taking hold.

Whilst the medium to long-term bearishness of the euro is somewhat self-evident, just when the pair is ready to have another surge lower in the short term is somewhat unclear. At present, the EUR/USD is encountering some strong pushback from the 1.0978 zone of support.

A possible reason why this level is proving so difficult to break through is that it coincides with the 78.6% Fibonacci retracement level. Consequently, it could take some stronger US or weaker EU fundamental results in the lead up to the FOMC meeting to see support broken.

The Parabolic SAR is also providing some strong signals that the pair is ready to begin its tumble anew. Specifically, the daily reading is highly bearish which could mean that the euro might continue to decline in the medium to long-term. More importantly however, the H4 reading is on the verge of changing from bullish to bearish which could see selling pressure mount over the next 24 hours.

In the event that the EUR does surge lower, the resulting fall could take it as low as the 1.0912 mark which represents the lows seen during the Brexit referendum. This level is also in line with the daily S1 support which should limit the pair’s ability to extend far beyond 1.0912. However, a long-term bottom does exist at around the 1.0829 level which could be challenged in the longer term.

Ultimately, there is significant pressure mounting which should see the EUR continue to decline going forward. In the short term, a break in the current support could see the pair travel back to the Brexit lows at around the 1.0912 mark.

Additionally, if the channel holds firm, it could see long-term bottoms challenged seriously. However, as always, the FOMC meeting could prove to be a major disruptive force this week and is worth keeping in mind going forward.