Market Brief

US data released yesterday was broadly mixed, as both the ISM manufacturing and Markit manufacturing PMI topped expectations, contradicting regional manufacturing indicators released earlier this week which pointed towards a broad based contraction of the sector.

The ISM gauge improved to 51.3 in May from 50.8 in the previous month, beating median forecast of 50.3, while the Markit PMI edged up to 50.7 from 50.5 first estimate and above consensus of 50.5. However, the measure slid from 50.8 in April.

Looking into the details, the Markit report showed that the US manufacturing sector continues to lose momentum as output fell for the first time since September 2009, while new orders growth remained subdued. Regarding the ISM survey, the headline gauge was helped by a strong pick up in price paid and supplier deliveries. However, production eased to 52.6 from 54.2 and a backlog of orders fell below 50 to 47 from 50.5.

All in all, the US manufacturing sector is definitely not out of the woods yet, as there is currently no sign of any real and sustainable improvement. On the short-end of the yield curve, rates recovered slightly amid the release but were not able to erase the loss of the previous day, suggesting that the market was not (entirely) fooled by the data.

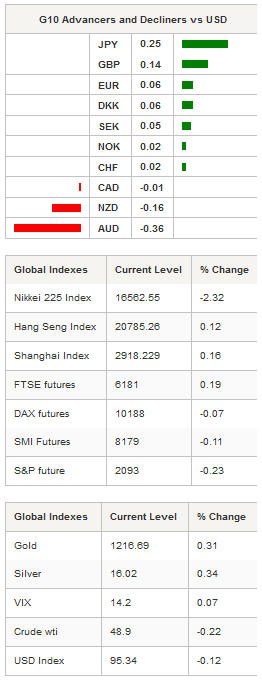

On Wednesday, 2-year yields climbed to 0.90% from 0.86% earlier in the day, and failed to provide support to the greenback as the dollar index continued to fall during the Asian to reach 95.20, down 0.50%.

The South Korean won got a boost amid the release of better-than-expected growth figures. The final read of the Q1 GDP printed above expectations at 2.8%y/y from 2.7% first estimates and consensus. USD/KRW eased to 1,186, down 0.55% from 1,194 at the opening of the trading session.

Precious metals were on fire during the Asia session as traders reacted to the latest data from the US, which cast a shadow over a June rate hike. Gold surged 0.31% in Tokyo after gaining 0.50% in New York, while silver added 0.34% overnight and above the $16 threshold. Platinum was up 0.33% and palladium 0.32%.

EUR/USD is currently testing the 1.1217 resistance (high from May 26th) ahead of this afternoon’s ECB meeting. However, we do not expect the pair to move the latter as traders will prefer to remain sidelined before the end of the meeting, even though the ECB is expected to stay on hold. In such an environment, we expect EUR crosses to trade sideways during most of the day.

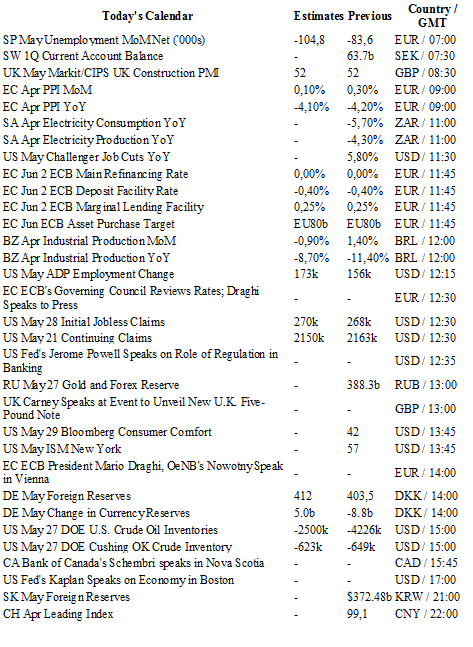

Today traders will be watching Markit/CIPS from the UK; PPI, ECB rate decision and Draghi’s press conference from the Eurozone; industrial production from Brazil; initial jobless claims, ADP employment change and crude oil inventories from the US.

Currency Technicals

EUR/USD

R 2: 1.1349

R 1: 1.1243

CURRENT: 1.1202

S 1: 1.1098

S 2: 1.1058

GBP/USD

R 2: 1.4770

R 1: 1.4654

CURRENT: 1.4431

S 1: 1.4386

S 2: 1.4300

USD/JPY

R 2: 113.80

R 1: 111.91

CURRENT: 109.03

S 1: 108.72

S 2: 106.25

USD/CHF

R 2: 1.0093

R 1: 0.9956

CURRENT: 0.9874

S 1: 0.9751

S 2: 0.9652