Market Brief

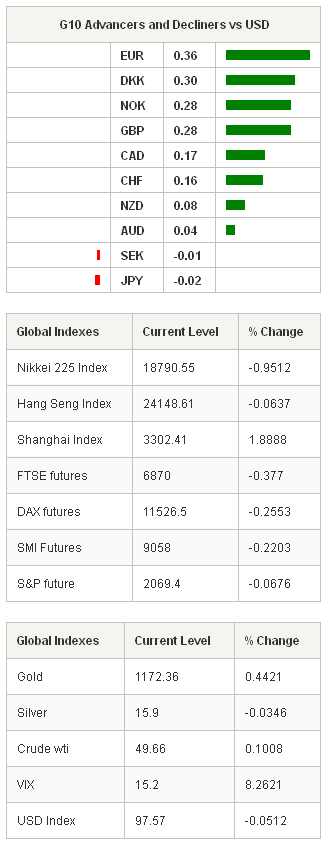

The week starts with further EUR/USD weakness as Asia sent the pair down to 1.0823 amid the US printed strong jobs figures in February. The nonfarm payrolls (295K) overbeat the market expectations (235K), the unemployment rate fell to 5.5% (from 5.7% last) with slight decrease in participation rate (from 62.9% to 62.8%). The wages, however, grew by unsatisfactory 0.1% on month (vs. 0.2% exp. and 0.5% last). The US 10-year yields advanced to 2.2575% for the first time since Dec 26th on speculations for an earlier Fed normalization. We continue seeing the first FF rate hike on June the earliest.

The divergence between the hawkish Fed and the ECB, which starts its monthly 60 billion euro sovereign purchases today, should keep the selling pressures tight on EUR/USD with parity envisaged in mid-run. In shorter-term, despite post-Draghi/NFP oversold conditions, the sentiment in EUR remains broadly negative as Greek Finance Minister Varoufakis meets his EZ counterparts to seek solution to unlock funds to enable the country to service 6.5 billion euro debt due within next three weeks. Option barriers trail below 1.10.

EUR/GBP tests bids at 0.72 and below (rebounded from 0.71820 on Friday). Given the mounting political tensions in the UK, offers at 0.70/0.72 should however counter the downside pressures in EUR.

In Japan, the economic data disappointed at week’s start. The 4Q final GDP grew 1.5% q/q annualized verse 2.2% expected, the private consumption accelerated 0.5% (vs 0.3% exp.) while business spending unexpectedly contracted 0.1% (vs. +0.2% exp.). In addition, the current account surplus narrowed from 187.2 billion to 61.4 billion yen in January. Dovish BoJ speculations lent support to USD/JPY above 120.61 in Tokyo, former resistance at 120.47/48 should now give support for a push to fresh 7-year highs (above 121.85 hit on Dec 8th).

The Chinese exports surged 48.3% on year to February, imports slumped 20.5%. The trade surplus increased from 60.03 to 60.62 billion dollars. Although the Lunar New Year should have boosted the latest trade figures, the foreign demand rose 15% since the beginning of the year, which is good news for China recovery. Good news from China didn’t halt the AUD/USD slide however. The aussie opened the week down to 0.7684 verse USD. A daily close below 0.7685 (MACD pivot) should signal bearish reversal bringing back in focus the mid-term target at 75 cents.

In the EM, USD/ZAR crossed above 12 for the first time since 2002 post-NFPs, while South African net foreign reserves declined to 41.92 billion dollar in February. Higher USD, reinforced by its negative impact on gold prices is certainly not good news for the rand and the central bank’s reserves at times they will be the most needed. With the fiscal consolidation lowering the expectations of a rate hike anytime soon, we see strengthening base at 11.40/12.00 (region including 21,50 and 100-dma at 11.7013/11.6079 and 11.4241 respectively). On a similar pattern USD/BRL advances to 3.0718 and USD/TRY hits fresh all-time-high (1.6475) as idiosyncratic political tensions add to global EM debasing.

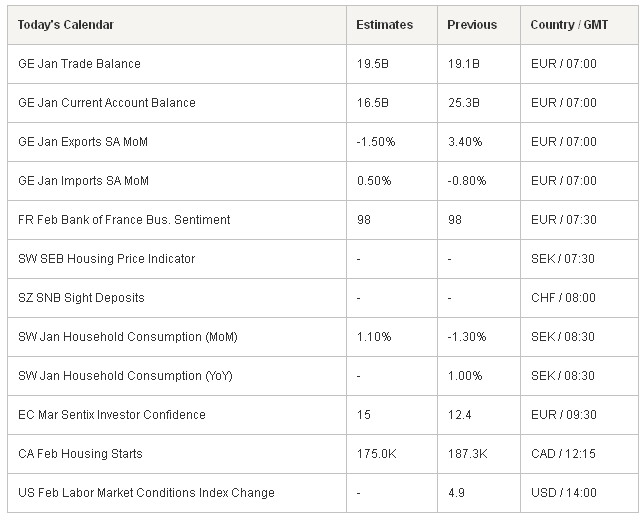

Today’s economic calendar: German January Trade Balance, Exports and Imports m/m, SNB’s sight deposits, Swedish January Household Consumption m/m and y/y and Canadian February Housing Starts.

Currency Tech

EUR/USD

R 2: 1.1114

R 1: 1.0988

CURRENT: 1.0879

S 1: 1.0765

S 2: 1.0536

GBP/USD

R 2: 1.5459

R 1: 1.5270

CURRENT: 1.5078

S 1: 1.5027

S 2: 1.4952

USD/JPY

R 2: 124.14

R 1: 121.85

CURRENT: 120.84

S 1: 119.91

S 2: 119.38

USD/CHF

R 2: 1.0240

R 1: 0.9944

CURRENT: 0.9844

S 1: 0.9722

S 2: 0.9530