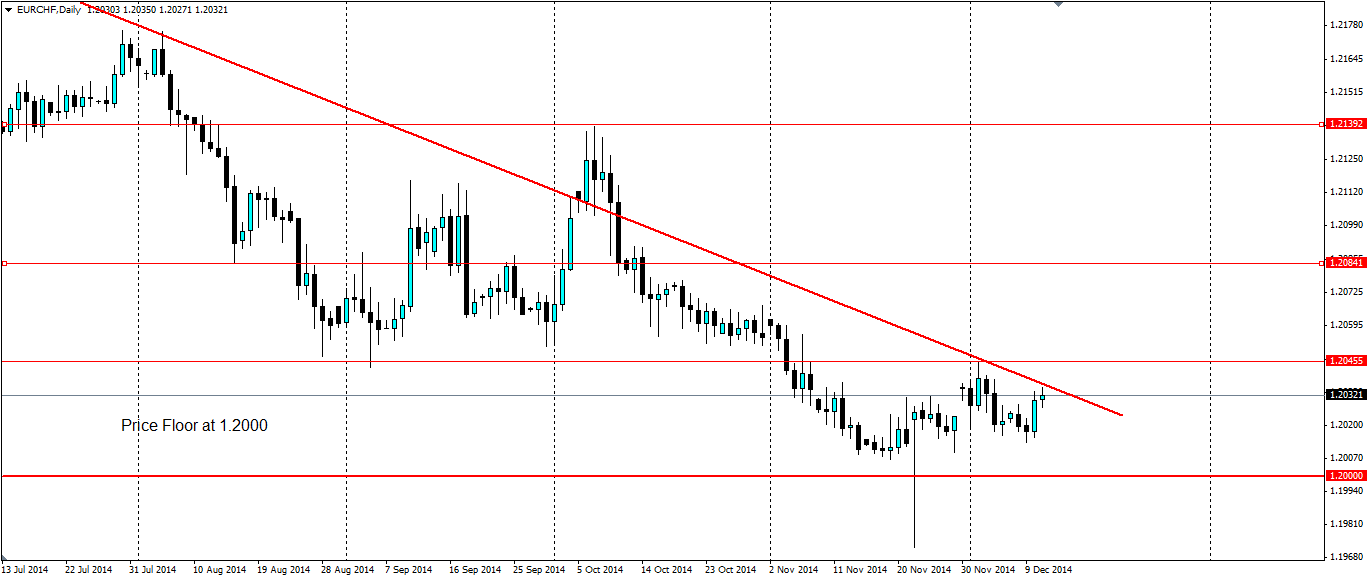

The Euro - Franc pair has been in an interesting descending triangle for some time. The trend line has been tested several times, but with a price floor in place, it will be the trend that gives way.

The EURCHF pair is a dream setup for long term traders. The only way a long position could lose is for the Swiss National Bank to abandon their price floor at 1.2000. That is rather unlikely as they are using it to fight deflation and have continually pledged to defend it with “unlimited resources”.

Tonight will see the SNB convene to set interest rates. The LIBOR is already at 0.00%, but there has been talk at the SNB of dipping into negative territory. We have already seen this from the ECB, hence the appreciation of the Franc towards the price floor. Inflation in Switzerland is flat at 0.0% m/m and has been hovering around this mark for quite some time.

Switzerland is invariably linked to the EU and their troubles. So with the ECB dipping into negative rate territory, it was no surprise to see the SNB talk about it. Could we see them follow suit tonight?

If they do the trend line will no doubt be invalidated. Anyone looking to go long on the pair could set a stop entry above the next level of resistance at 1.20455, with a stop loss back inside the trend line or even under the price floor, giving your stop loss the protection of the unlimited reserves of the SNB.

Look for further resistance at 1.2084 and 1.2139 as these will both act to hold the price up if there is a breakout. Either way, as we get to the sharp end of the triangle, something will need to give and it is not likely to be the price floor.