Forex News and Events

Swiss franc should remain under pressure (by Arnaud Masset)

I year ago to the day, the Swiss National Bank decided to unpeg the Swiss franc from the single currency, triggering a tsunami on the FX market. Besides the obvious immediate negative effects, which affected mainly market participants, the long-term effects on the Swiss economy have begun to appear only gradually throughout the year. Initially, people were expecting the effects to be disastrous on the Swiss economy but it has to be noticed that it wasn’t as bad as predicted. However, we believe that Swiss companies already used all the possible tools at hand to protect both their business and their employees by reducing substantially their margins and cutting costs at maximum. The first cracks on the economy started to appear in late 2015 and the downside adjustment process will continue over the year ahead, the economy just went through the easy part; now starts the tough one. The pressure on the labour market will increase gradually while certain companies will likely relocate to cheaper place as the long-term effect of a strong CHF start to kick in.

As a consequence the upward pressure on the Swiss franc should weaken to some extent as investors find better investment opportunities abroad. However, we believe that this effect will mitigated by the political uncertainties from the European complex -- Brexit, Podemos in Spain, Greek debt crisis and deflationary pressure -- as well as the rising probability of an increase of the ECB’s QE. We therefore expect EUR/CHF to move sideways in 2016 but we definitely do not exclude some volatile moves. The SNB will likely remain sidelined as it doesn’t have the firepower to fight the ECB; however President Jordan can still cut rates further if needed. EUR/CHF is holding ground above 1.09 in spite of an overwhelming global risk-off sentiment.

Markets look to US retail sales data (by Yann Quelenn)

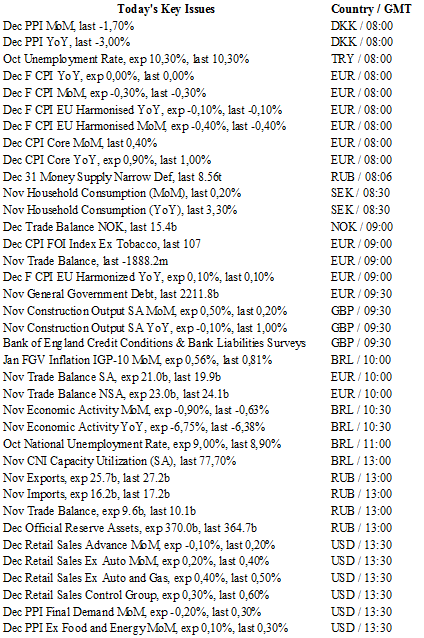

This Friday will reveal some important US data including December retail sales, PPI and industrial production. The EUR/USD is set to move today as last week’s strong NFP did not provoke the expected dollar rally. We believe that the markets are holding out for more data to assess the truly state of the US economy. December's Fed minutes seem upbeat, favouring four rate hikes in 2016.

Retail sales will also be put under the microscope. Consensus is for a weak print at -0.1% m/m vs prior 0.2%m/m. Despite low commodity prices, it turns out that fewer automobiles were purchased in December even if overall car sales jumped to a fifteen-year high in 2015. The better job-market conditions have not yet driven Americans to spend as much as they were spending before the crisis. Moreover, higher interest rates may increase downside risks for overall spending.

In the near future, we think that retail sales should go higher as money saved from the lingering low commodities price should push consumption up. Additionally, University of Michigan sentiment is expected to show that the US economy is doing better, however, despite this we believe that there is still a lag between changing a consumption mindset from a recession economy toward a recovering economy.

Crude Oil - Holding Below 30.00.

The Risk Today

Yann Quelenn

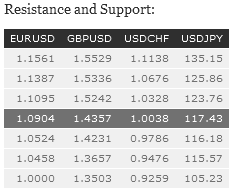

EUR/USD keeps on riding the downtrend channel. Hourly resistance may be found at 1.1096 (28/10/2015 low) while hourly support can be found at 1.0524 (03/12/2015). Expected to monitor resistance implied by the upper bound of the downtrend channel. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD keeps on weakening and is now heading toward key support at 1.4231. Hourly resistance is given at 1.5242 (13/12/2015 high). Stronger resistance can be found at 1.5336 (19/11/2015 high). Expected to show continued weakness. The long-term technical pattern is negative and favours a further decline towards the key support at 1.4231 (20/05/2010 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is pushing lower. Hourly resistance lies at 123.76 (18/11/2015 high). Expected to further decline towards hourly support at 116.18 (24/08/2015 low). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF's uptrend momentum keeps going as long as the pair remains in the upward channel. Hourly support is located at 0.9876 (14/12/2015 low) while hourly resistance can be found at 1.0125 (05/01/2015 high). Expected to monitor support implied by uptrend channel. In the long-term, the pair has broken resistance at 0.9448 and key resistance at 0.9957 suggesting further uptrend. Key support can be found 0.8986 (30/01/2015 low). As long as these levels hold, a long term bullish bias is favoured.