Forex News and Events

SNB about to step back in the ring

The reaction of the Swiss franc to Donald Trump’s election as 45th President of the United States has been mixed. The CHF has now fallen more than 1.70% against the greenback from its pre-election level. Within the G10 complex, the Helvetic currency fell the most against the pound sterling as investors fled the single currency. Indeed, apart from commodity currencies, the EUR has suffered serious losses since last Wednesday, falling 3.40% against the pound and 2.65% against the USD.

This broad debasement has accentuated pressure on EUR/CHF, which is now testing the 1.07 level, a level which is widely seen as a trigger point for SNB intervention. The likelihood of the SNB stepping in to intervene has therefore substantially increased. EUR/CHF briefly tested 1.0688 this morning before bouncing back to 1.0702.

BoJ: Kuroda concerned by TTP

Bank of Japan Governor Kuroda gave his much anticipated reaction to Trump’s victory early this morning in Nagoya. In his address, Kuroda spoke about the TPP (Trans-Pacific Partnership) and the benefits that both US and Japanese economies would miss as a result of President-elect Trump wishing to implement strong protectionist measures in order to stimulate the domestic economy.

While the overall pre-election sentiment towards a Trump victory was that it would be a disaster for market, it seems that, at least so far, the contrary is happening, drawing parallels to the Brexit. For the time being, the demand for dollar has spurred and markets are assessing a very strong likelihood of a December rate hike.

TPP aside, Kuroda acknowledged that Trump’s election had actually provided some reprieve as the USD/JPY is trading at a 5-month high, which is much welcomed news for the island nation.

Concerning Japan's monetary policy, we expect the status quo to continue for some time with no additional easing foreseen in the near term. The next monetary policy meeting will be held on 20th December and it is clear that a continued market rally, a dollar increase and a Fed rate hike is all the BoJ can expect by then.

USD/JPY - Breaking 200-Day Moving Average.

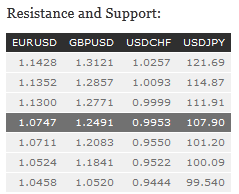

The Risk Today

EUR/USD is weakening after Trump's election to almost 11-month low. The pair is however still in a medium-term range. Expected to see further continued decline. In the longer term, the death cross indicates a further bearish bias despite the pair has increased since last December. Key resistance holds at 1.1714 (24/08/2015 high). Strong support is given at 1.0458 (16/03/2015 low).

GBP/USD is bouncing within uptrend channel after breaking resistance at 1.2557 (04/11/2016 high) while hourly support is given at 1.2354 (09/11/2016 low). Strong resistance stands far away at 1.2771 (05/10/2016 high). The short-term technical structure suggest further strengthening. The long-term technical pattern is even more negative since the Brexit vote has paved the way for further decline. Long-term support given at 1.0520 (01/03/85) represents a decent target. Long-term resistance is given at 1.5018 (24/06/2015) and would indicate a long-term reversal in the negative trend. Yet, it is very unlikely at the moment.

USD/JPY 's buying pressures are growing. Hourly resistance at 105.53 (28/10/2016 high) has been broken. Key support can be found at 100.09 (27/09/2016). Expected to see further upside moves. We favor a long-term bearish bias. Support is now given at 96.57 (10/08/2013 low). A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems absolutely unlikely. Expected to decline further support at 93.79 (13/06/2013 low).

USD/CHF continues to push higher. The pair lies within a resistance area where sales pressures are likely to increase. The pair has already largely retraced, yet further upside moves are likely to happen before reloading bearish positions. Expected to monitor support at 0.9999 (25/10/2016 high). In the long-term, the pair is still trading in range since 2011 despite some turmoil when the SNB unpegged the CHF. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours nonetheless a long term bullish bias since the unpeg in January 2015.