For some time now the euro has been sliding lower on the charts against most currencies, from the yen to the US dollar, its climbing abilities have certainly slowed. Many traders have taken notice and for the most part the euro has been in a steady decline for some time.

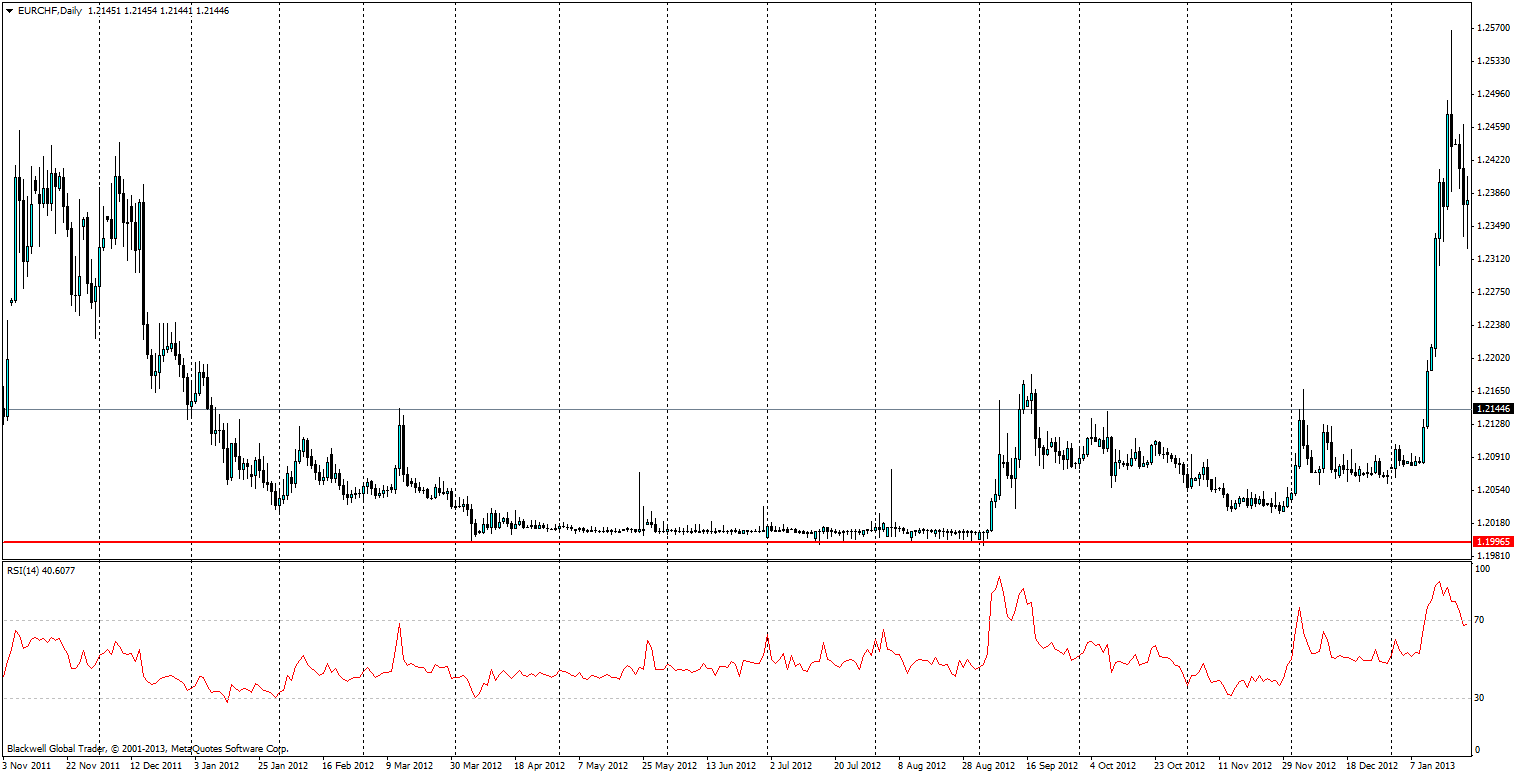

The EUR/CHF is an interesting pair, as during the trouble in the EU as Greece looked on the verge of collapsing, the Swiss tried to stop the capital flows into their country which would overvalue their currency. In response they created a floor on the charts to protect their currency, and its export competitiveness. This floor has held for some time and for a long time faced a lot of pressure from markets.

Many probably thought that such a floor might not hold, and that another Black Friday might appear for some lucky FX traders. However, that was not the case and as can be seen below, there is certainly a floor in place and it's likely to hold when it receives pressure again.

So, with a floor in place at 1.2007 it seems unlikely that anything will push through this level, and the Swiss Central Bank will defend this floor at any cost in order to protect its economy; which has so far weathered all the storms.

The EUR/CHF has a downward sloping wedge on the charts, the volatility that was abundant in the earlier phases of the year has now disappeared as people see less value in big moves as it nears the current floor in place.

However, there is certainly plenty of value in the EUR/CHF and certainly a long (time frame) term position will not be eaten alive by swap rates. Currently going short seems the most attractive option for the vast majority of traders, and with the trend lines holding strong, it certainly seems we will find ourselves pushing on the floor within the next month or so.

Around 145 pips currently sit between the present price and the floor, and traders will be looking to eat up the space in the current weeks to come. It’s not a big move, but it’s looking like a safe trade that many will look to take advantage of in the coming weeks.

A tight stop loss just above the present trend line will however provide protection against a breakout which seems implausible given the current state of the european economy. With a take profit just above the current floor traders should look for a long term trade which provides a stable trade.