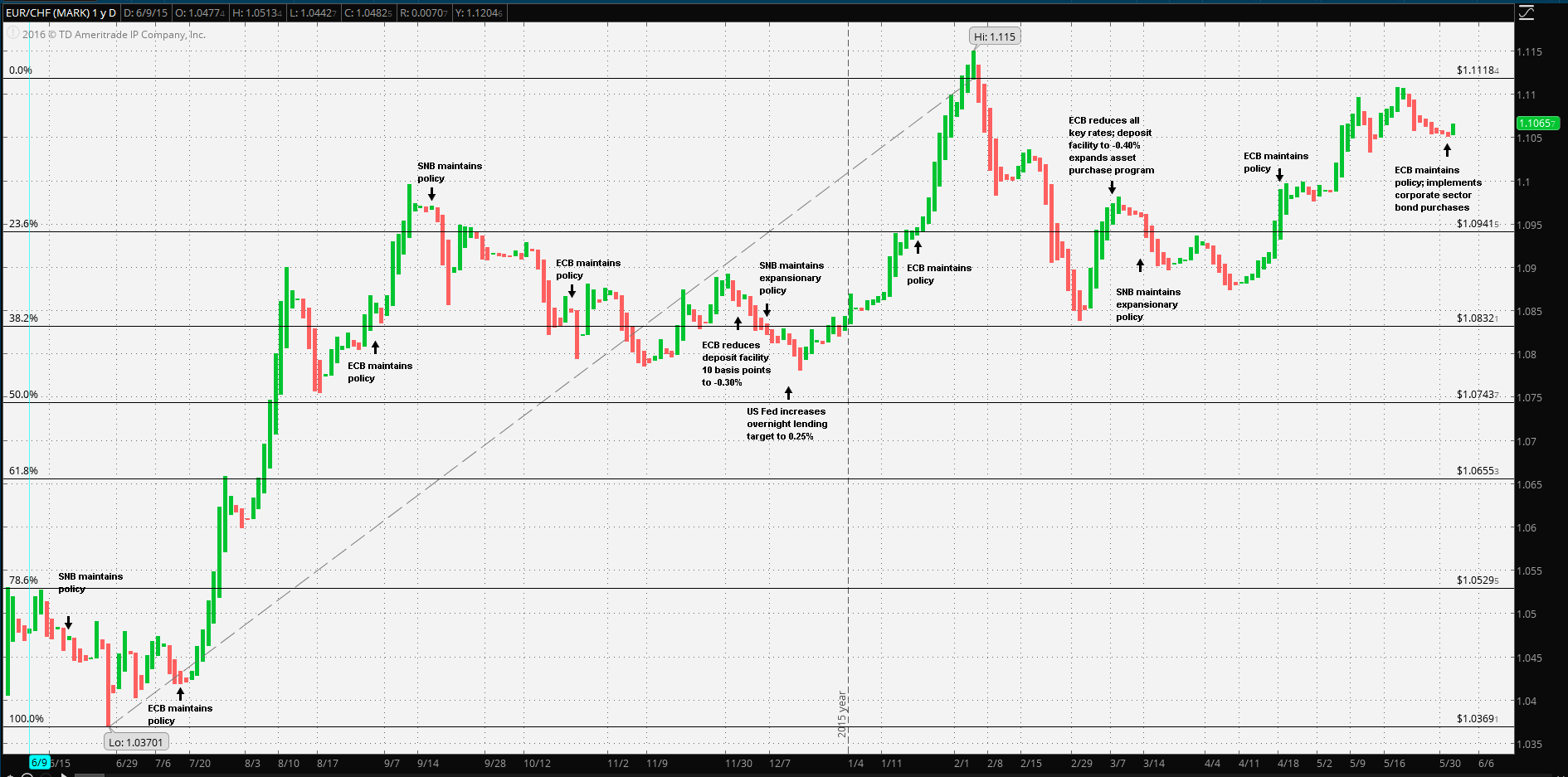

Early in 2015, the SNB simultaneously unpegged the franc and lowered its sight deposit rate 50 basis points to -0.75%. At the time the assessment noted “...exceptional overvaluation of the Swiss franc...”, and at the same time it noted its action as an “...exceptional and temporary measure...”.

In every subsequent monetary assessment, the SNB board has noted the significantly overvalued franc and its commitment to defend in, including direct currency intervention. The point is, as a member of European Free Trade Association, European Economic Area, a signatory to the Bilaterals II and numerous other agreements, the SNB would no doubt like to return to CHF 1.20 per euro, albeit via a free floating franc.

Interestingly, in its most recent policy assessment press release of March 17, the SNB seemed to indicate the perhaps longer-than-expected maintenance of expansionary policy, and went as far as reminding readers of the 2015 policy action by noting continued low EU growth: “...In the medium term, the main factors dampening inflation are the globally low inflation levels and the lacklustre outlook for the global economy... ...for 2015 as a whole, the Swiss economy recorded growth of just under 1%. This confirms the SNB’s assessment at the time of the minimum exchange rate discontinuation...”

The point of the matter is just this. The SNB’s responsibility, like any other central bank, is to create a positive economic environment. The Swiss economy is heavily dependent on bilateral trade with its EU associates. A CHF 1.20 euro would likely lead to better rates of Swiss GDP growth.

To achieve this, SNB must overcome two obstacles. First, the franc ‘safe haven reserve’ status and second, EU expansive monetary policy. It should be noted that the spread between the SNB sight rate and ECB deposit facility is currently at -35 basis points.

As to the first obstacle, it seems that the SNB is using all the tools at its disposal. As to ECB monetary policy, it’s a no win situation: further ECB expansion would strengthen the franc relative to the euro; inaction may result in continued slow EU growth, which in turn affects the Swiss economy.

It’s likely that upward pressure on the franc will continue until after the Brexit vote. The reasons are obvious in that respect. There are few other currencies which may serve as a safe haven until the decision is made and markets react. Other possible choices are the US dollar or possibly Norwegian krone, but outside of that it is the Swiss franc. The SNB will likely intervene directly if there is a tsunami of capital inflow.

So what is the current thinking of the ECB? In his opening remarks in Vienna following the June 2 Monetary Policy Council meeting, President Draghi reiterated the policy stance of the ECB. Although no change in policy was made, corporate sector bond purchases will commence on June 8. This would increase the pool of assets available to meet the target of €80 billion per month.

Along with the expansion of the eligible purchase assets announced at the March meeting, President Draghi also noted that “...Additional stimulus, beyond the impetus already taken into account, is expected from the monetary policy measures still to be implemented...”; possibly an indication that no further new actions will occur until those have been implemented with the caveat that “...Governing Council will closely monitor the evolution of the outlook for price stability and, if warranted to achieve its objective, will act by using all the instruments available within its mandate...”

The assessment of the EU economy was upbeat, along with noting that emerging markets were inhibiting better growth: “...the economic recovery in the euro area continues to be dampened by subdued growth prospects in emerging markets, the necessary balance sheet adjustments in a number of sectors and a sluggish pace of implementation of structural reforms...” and risk is still ‘tilted’ to the downside.

There was only one mention of Brexit in the statement, and that was tied in with downside risks: “...Downside risks continue to relate to developments in the global economy, to the upcoming British referendum and to other geopolitical risks...”

However, in his summation, Mr. Draghi went beyond monetary policy, criticizing government inaction: “...strongly echoed in both European and international policy discussions, in order to reap the full benefits from our monetary policy measures, other policy areas must contribute much more decisively... ...Structural reforms are necessary in all euro area countries...” This is important to note, as this message has been echoed by several advanced economy bank governors.

Returning to the point of the whole matter, the ECB is unlikely to act except in an extreme circumstance. The SNB has pushed its defensive policy to the limit of efficacy and will likely intervene directly when the situation warrants. Hence, it’s likely EUR/CHF will remain range bound at CHF 1.0820 resistance and CHF 1.112 support, excluding a reaction to the Brexit referendum.

Disclaimer: CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.