Earlier today, I wrote an article that basically tried to stay as far away from the central bank drama as possible by relaying the message to “Avoid the Noid.” The “Noid” in this instance is the noise that will be created by the European Central Bank decision tomorrow where they are expected to introduce Quantitative Easing to the tune of at least €50 billion per month. Before the ECB could take the stage though, the Bank of Canada stole a little bit of the spotlight by unexpectedly cutting interest rates from 1.0% to 0.75% this morning. In this article though, instead of avoiding all the volatility that appears destined to occur over the next 24 hours, we are going into the belly of the beast and seeking an opportunity sandwiched between the last acting and next to act major central banks.

In retrospect, it appears all of the central banks whom have been active lately, including the Swiss National Bank, BoC, and Danmark's Nationalbank among others, are either preparing for something substantial from the ECB or this is all just a coincidence. Personally, I think it’s the former. That being the case, then the rumored QE of €50 billion per month from the ECB may be just that, a rumor. There is a possibility that ECB President Mario Draghi and his cohorts go above and beyond that figure to effectively stamp out any doubt of their willingness to do “whatever it takes” in saving the Eurozone.

This harkens back to 2012 on the verge of the London Summer Olympics when rising 10-year yields were slowly choking the windpipe of the European Union. While Draghi’s “whatever it takes” speech served to rally the troops without substantial action back then, it appears that option is no longer available, and he will have to actually do something this time around.

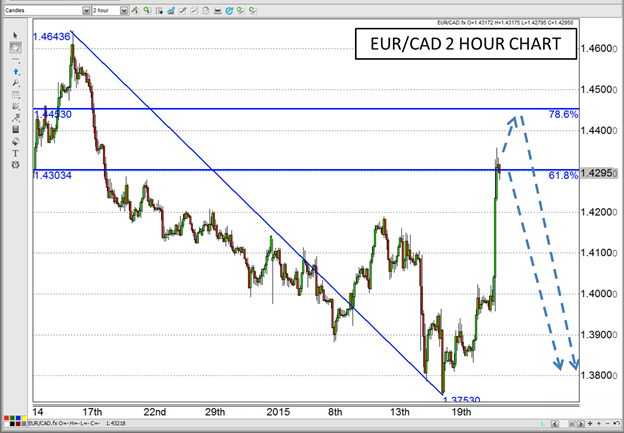

With that in mind, there is the possibility the ECB’s actions exceed the market’s expectations with either more QE than anticipated, or expected QE with a larger than anticipated rate cut to further negative territory. Draghi may want the market to take a deep breath and say, “WHOA!” upon realizing what they have done. If that is the case, the surprise action by the BoC and the market move thereafter could be small potatoes in comparison, and the nearly 400 pip rise in the EUR/CAD could be reversed violently.

As recent market volatility has taught us, sometimes the market can move a lot further than we originally envision, so proceeding with EXTREME CAUTION is advised. While nobody is expecting nearly the carnage wrought by the SNB with their shenanigans last week, it isn’t out of the realm of possibility for the ECB to do something that no one sees coming.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).