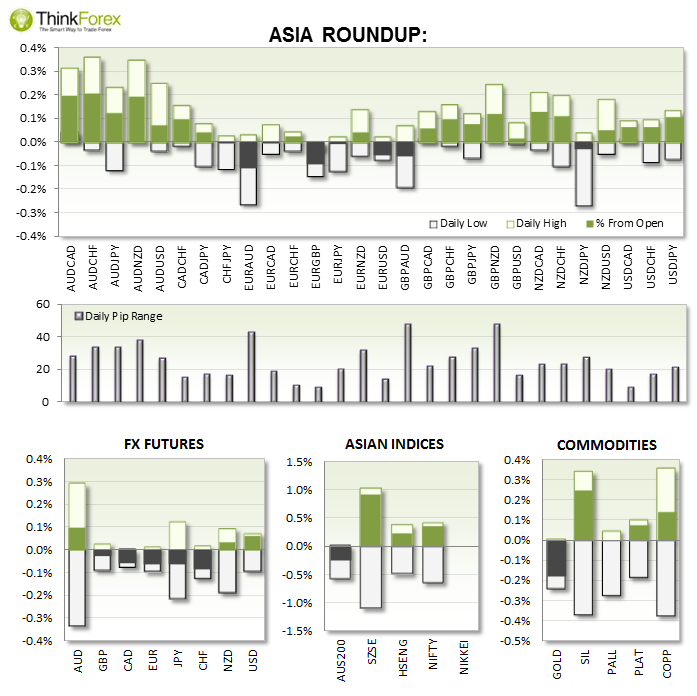

- AUD Retail sales beat expectations of 0.3% to come in at 0.6%, a 5-month high; MI Inflation gauge edged higher to 0.2% up from 0% last month; AND job advertisments up 0.3% compared to 4.4% last month

- NZD ANZ Commodity Prices accelerated their decline to come in at -2.4% vs -0.9% previously.

UP NEXT:

- No red news today so moves may be limited. The 'yellow' news tend to be nice to know numbers but not likely to provide any sustainable volatility to their respective markets.

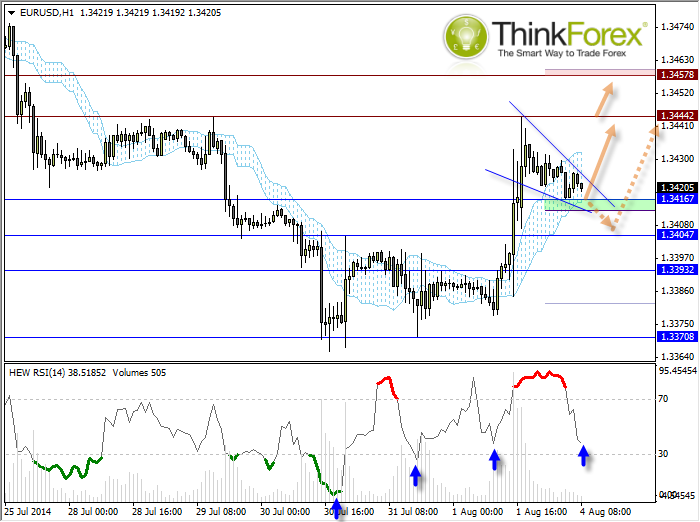

EUR/USD: Potential bullish wedge forms at support

The 'Equilibrium Cloud' aims to show aims to show dynamic support and resistance. Whilst the cloud istelf trades sideways price has found support above it and price coild up within a potential Bullish Wedge.

The fact this pattern has appeared after an impulsive breakout suggests there is room for one another high, although the pattern itself targets the base of the pattern at the 1.3444 highs.

With little news out tonight moves may be limited so the lower targets may be a more sensible approach.

The 'Rapid RSI' also suggests a cycle low may be approaching, although take note that as the indicator points down then momentum is technically still bearish.

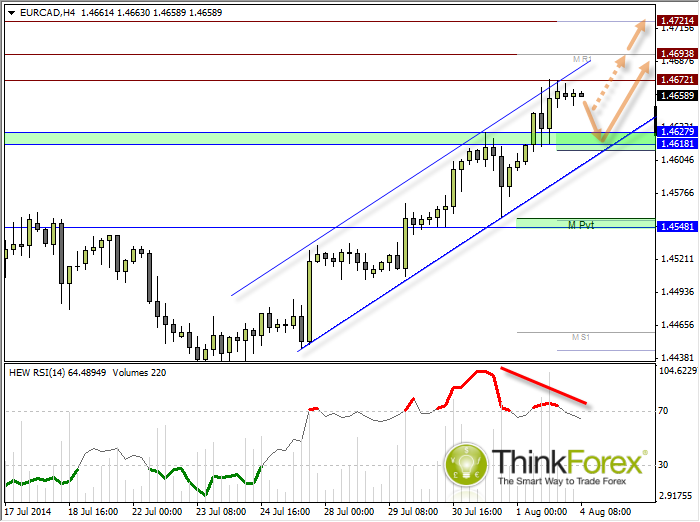

EUR/CAD: Seeking buy setups above 1.4620

The intraday charts are within a steady uptrend and broke above July's high on Friday. Having stalled at 1.467 resistance and RSI is pointing down whilst creating a bearish divergence the near-term bias is for a retracement before the bullish trend continues.

This leaves potential for a counter-trend trade but these tends to carry extra risk, so an alternative approach is to await the [suspected] retracement towards a support zone and seek bullish setups in line with the established trend.

1.4610-27 provides a potential zone of support with the bullish trendline, Weekly S1 and previous S/R levels. Targets are 1.4693 and 1.4721.

A break below 1.4610 warns of a deeper retracement and targets 1.4590 support.