Talking Points

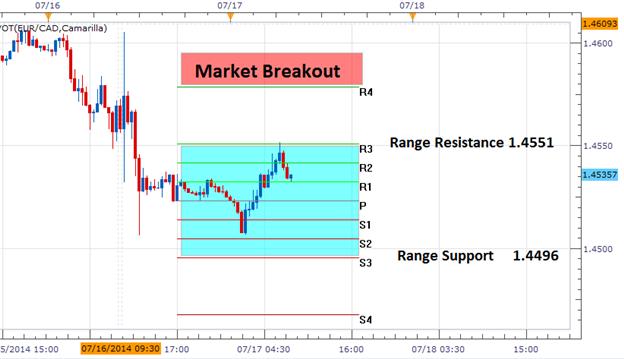

- EUR/CAD reaches Intraday Resistance at R3

- Range reversal targets sit at S3, pivot support

- A move above R4 would signal a reversal to higher highs

(Created using FXCM’s Marketscope 2.0 charts)

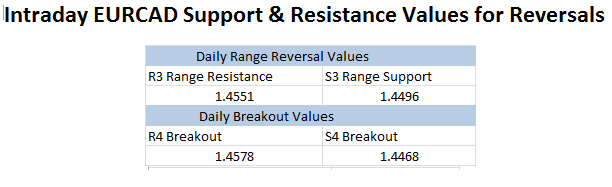

Trading began slow overnight for the EUR/CAD, but picked up during the early morning, Euro Zone CPI news release. While prices did not breakout, a push was made towards range resistance at 1.4551 as denoted by the R3 camarilla pivot point. With price below this value, reversal traders can consider new sell entries in the event of an early morning price reversal. Range support for the EUR/CAD currently stands at the S3 camarilla pivot and can create potential range targets below 1.4496.

Range traders should be cautioned if price moves above the R4 camarilla pivot point. A move beyond 1.4578 would signal a short term move towards higher highs, and denote a change to a breakout based trading environments. Above this value, range trading should be concluded and traders may consider entries with the markets new influenced direction. A move below the S4 pivot would be considered a bearish continuation of the EUR/CADs current trend, again allowing for new breakout entries to be considered.

---Written by Walker England, Trading Instructor