One of the currency crosses that I see getting a lot of attention lately on both social media and our book at Vantage FX is EUR/CAD.

Following this daily EUR/CAD support level that we featured on the blog back in February, longs were the obvious play and traders obliged.

But after a 750 pip rally, the pullback as the longs started to cover hit. Something you can then clearly see with a 350 pip straight line drop from the last swing high.

From a technical point of view however, nothing has actually changed. Price is still above the higher time frame support level and if you perceive this latest fall as healthy long covering then you expect the shorts to be absorbed and a new push higher.

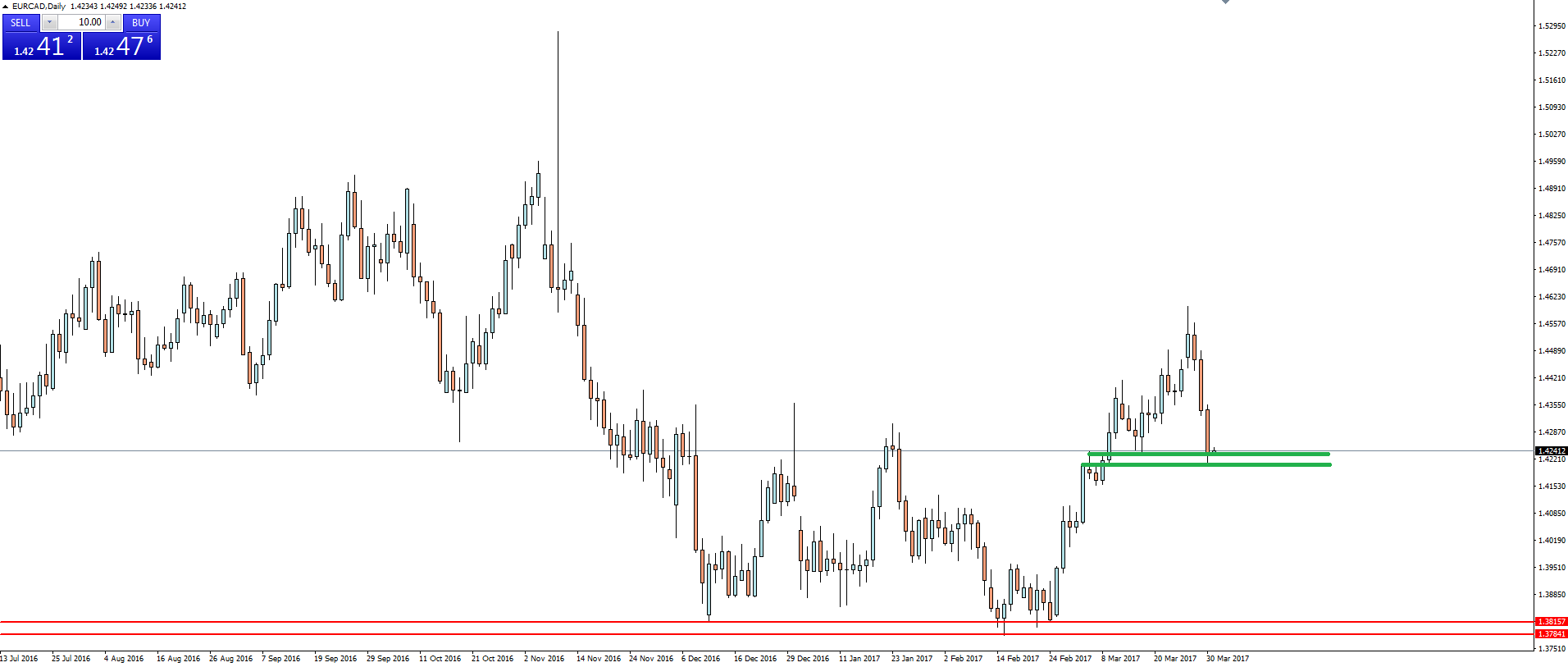

Taking a look at the daily chart now, look I want to highlight where price has pulled back to now:

EUR/CAD Daily:

This is a nice little area of interest that has acted as short term support/resistance in the past and if you subscribe to the above opinion of this just being a healthy pullback then this is an area to watch how buyers react within.

Just keep in mind that you can see around 175 pips below the marked level, there is another one of these areas of interest. Wait and see how price reacts around them, but if you’re still long from the daily support level, then you have the pips and room to use either of these levels to manage your risk around if you add into your position.

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.