EUR/CAD

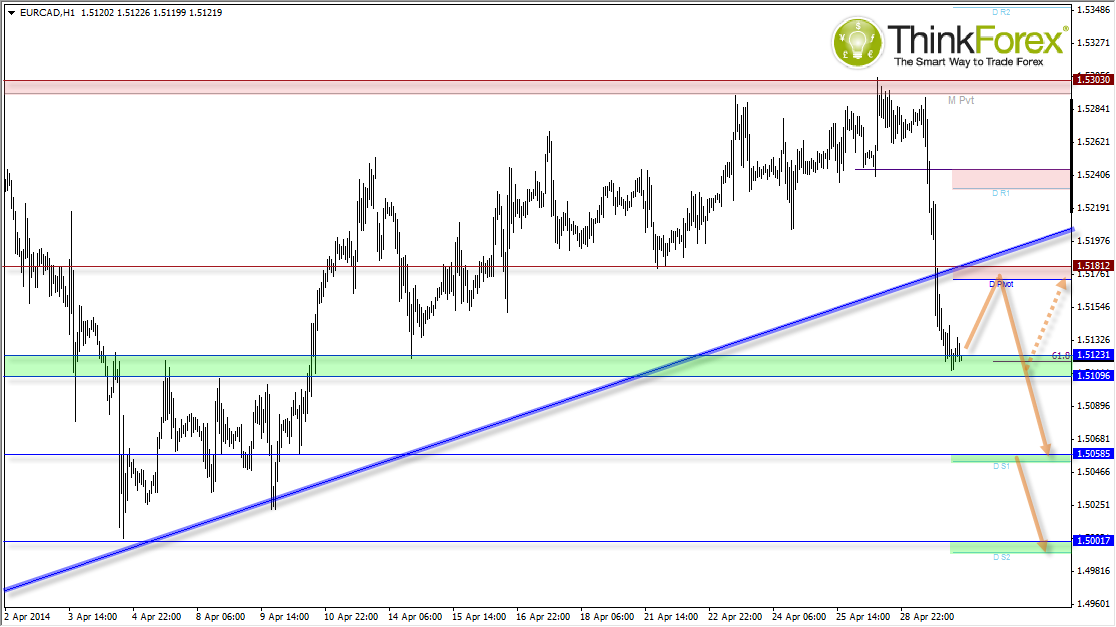

Yesterday's closed down -1%, it’s most bearish since Sep '13. The bearish engulfing candle is quite clear and closed at the low of the day, breaking a rising support line in the process. As long as we remain below the broken trendline and 1.53, technically the target remains 1.50.

The 2 reasons for the sell-off come from weak data from Europe and influx of money flow from bullish CAD investors anticipating a good number from today's GDP release. The GDP m/m is forecast as +0.2% from last month (slightly lower than the preceding 0.5%) however as long as we remain above 0% then I see no immediate threat for CAD weakness.

However, we do have a plethora of EUR data out before the CAD GDP which should mix things up a bit.

The bearish momentum on the EUR/CAD should not be ignored, hence the bias for an eventual leg down to the 1.50 target. However data from Europe may make price action a little messy before data from CAD comes out later.

If EUR Flash CPI y/y comes in at 0.8% or above then this raises the possibility of a retracement towards 1.50, but employment data from Germany and Spain could make price action messy to trade with caution. If most of the data comes in negative (like yesterday) then we could even see a break below 1.51 before CAD GDP. Under this scenario, unless we see a CAD GDP below 0% then we should be set for a further drop down top 1.50.