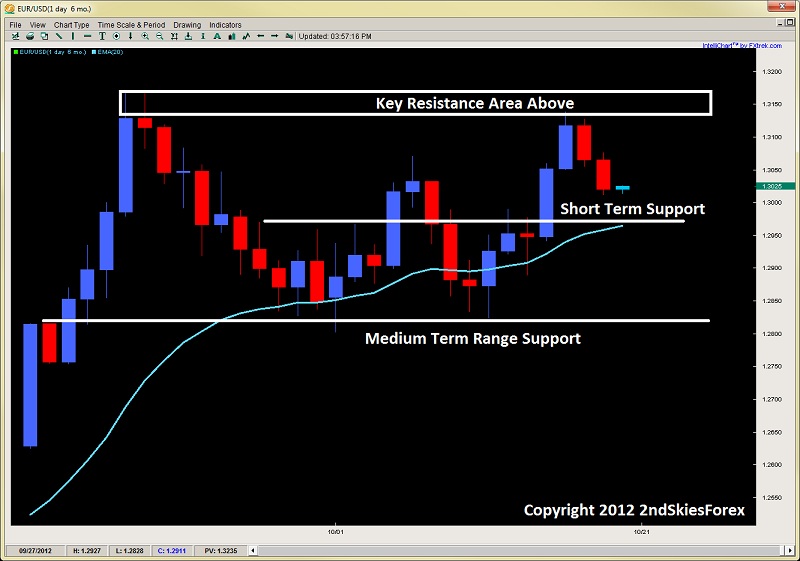

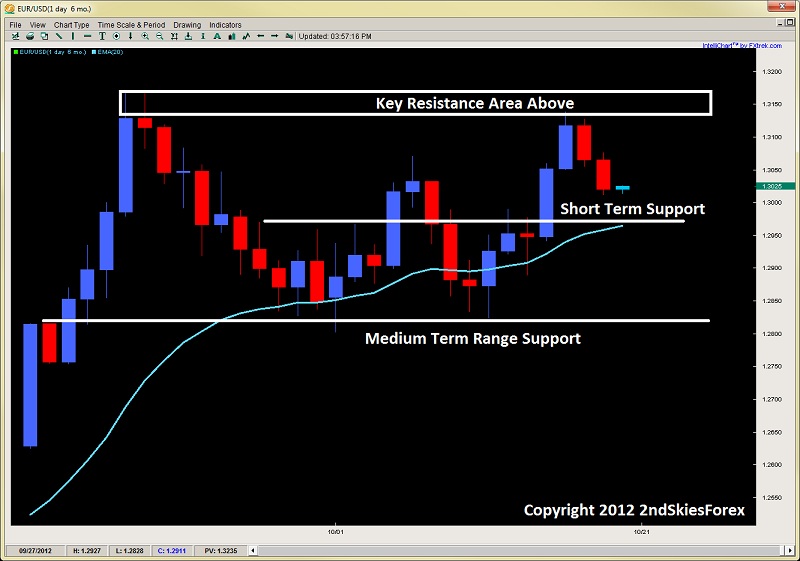

EUR/USD

Starting last week strong, but fading to end the week, the euro rejected just shy of the resistance level I discussed last week, topping out at 1.3141. For the month of October, it has built up a series of slightly HL’s (higher lows) and HH’s (higher highs) so a slow buildup of buyers here. More aggressive bulls can look around 1.2975 as a possible longs, or wait for a deeper correction towards the range bottom at 1.2821 before entering. Bears can meanwhile look for shorts at 1.3160 and 1.3141 if price shows corrective weakness heading into the levels. But for now, range play dominates.

GBP/JPY

After a 5 day rally, the GBP/JPY found resistance at 128.25 forming a pin bar rejection in the process. Although the last major swing was down and formed a LL (lower low), the last upswing formed a HH suggesting an increase in volatility. Key resistance for bears lies between 128.25-128.81 so bears can watch for price action signals here, while bulls can look for longs just sub 125 looking for at least a return back to 127 so a solid reward play there.

GBP/JPY" title="GBP/JPY" width="940" height="554">

GBP/JPY" title="GBP/JPY" width="940" height="554">

Dow Jones

Having its single biggest losing day in 4 mos (ironically on the anniversary of Black Friday in 1987), the Dow Jones index shed over 230+pts while forming a LH in the process. It is currently sitting just above a support level just sub 13300, but if the aggressive selling from Friday continues, we could see a drop to 13000 follow shortly after. Bears can look for breakout pullback setups below the 13300 or wait for a pullback towards 13550 but we could be seeing kinks in the armor of this uptrend since June.

Silver

Failing to close above $35 after an impressive run from $26.50, Silver has been forming a series of bearish impulsive legs, followed by corrective legs which then continue with further selling. This is interesting to say the least, considering over 2.6 million ounces were withdrawn from the Comex on Friday.

The actual total was 4.16 million ounces, but 1.6 million ounces were deposited, thus the 2.6m net outflows. One has to wonder how such physical supply could be scooped up in such a large amount but not have an upward effect on spot prices.

I suspect this is due to paper short manipulation, and will rear its head soon with sharp upward price movements. Short term, one has to be bearish until $32.50 is breached. Bulls can look for longs at $31.25 which was the August swing high and pin bar rejection. Bears can look for corrective pullbacks towards $32.50 targeting the former mentioned swing high.

Original post

Starting last week strong, but fading to end the week, the euro rejected just shy of the resistance level I discussed last week, topping out at 1.3141. For the month of October, it has built up a series of slightly HL’s (higher lows) and HH’s (higher highs) so a slow buildup of buyers here. More aggressive bulls can look around 1.2975 as a possible longs, or wait for a deeper correction towards the range bottom at 1.2821 before entering. Bears can meanwhile look for shorts at 1.3160 and 1.3141 if price shows corrective weakness heading into the levels. But for now, range play dominates.

GBP/JPY

After a 5 day rally, the GBP/JPY found resistance at 128.25 forming a pin bar rejection in the process. Although the last major swing was down and formed a LL (lower low), the last upswing formed a HH suggesting an increase in volatility. Key resistance for bears lies between 128.25-128.81 so bears can watch for price action signals here, while bulls can look for longs just sub 125 looking for at least a return back to 127 so a solid reward play there.

GBP/JPY" title="GBP/JPY" width="940" height="554">

GBP/JPY" title="GBP/JPY" width="940" height="554">Dow Jones

Having its single biggest losing day in 4 mos (ironically on the anniversary of Black Friday in 1987), the Dow Jones index shed over 230+pts while forming a LH in the process. It is currently sitting just above a support level just sub 13300, but if the aggressive selling from Friday continues, we could see a drop to 13000 follow shortly after. Bears can look for breakout pullback setups below the 13300 or wait for a pullback towards 13550 but we could be seeing kinks in the armor of this uptrend since June.

Silver

Failing to close above $35 after an impressive run from $26.50, Silver has been forming a series of bearish impulsive legs, followed by corrective legs which then continue with further selling. This is interesting to say the least, considering over 2.6 million ounces were withdrawn from the Comex on Friday.

The actual total was 4.16 million ounces, but 1.6 million ounces were deposited, thus the 2.6m net outflows. One has to wonder how such physical supply could be scooped up in such a large amount but not have an upward effect on spot prices.

I suspect this is due to paper short manipulation, and will rear its head soon with sharp upward price movements. Short term, one has to be bearish until $32.50 is breached. Bulls can look for longs at $31.25 which was the August swing high and pin bar rejection. Bears can look for corrective pullbacks towards $32.50 targeting the former mentioned swing high.

Original post