- Loonie plagued by plummeting crude

- EUR bucks spread market message

- European Court of Justice takes center court

- A tale of opposing CPI’s

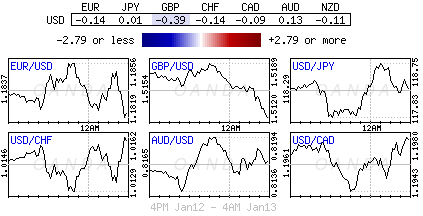

Currently, there are many moving parts in Capital Markets that has investors bracing themselves for an extended clear out at a moments notice. The knock on effect throughout the various asset classes from plummeting crude prices has global bourses seeing red; bond yields printing new lows, and commodity currencies experiencing some of the worst runs against the U.S. dollar in a number of years.

The renewed weakness in the price of oil, and subsequent lower equity prices, combined with inflation expectations, is pushing U.S Treasury yields even lower and back towards front end price levels seen 18-months ago. The U.S benchmark 10-year yield is again trading near the mid-October “flash” crash yield of +1.865% and this despite a plethora of upcoming new issues. The U.S Treasury is scheduled to sell +21b U.S 10’s early afternoon.

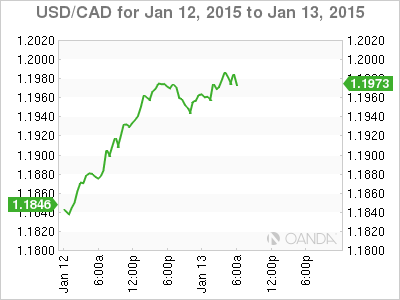

Loonie sees red as “black-stuff” plummets further

The break below $45bbl for WTI crude has hit the currencies of oil producing nations hard throughout Asian overnight and the euro session this morning. Canada’s ‘looni’ dollar outright has managed to post new five-year highs ($1.1987), while USD/NOK ($7.77) and USD/RUB ($65.55) have been able to reverse recent downticks and are now looking to be heading towards their own recent highs. For the CAD in particular, U.S dollar stop losses above $1.2000 are believed to be large and dealers expect the inevitable. Any further drop in oil (today already down -2.7%) is expected to feed into linked currencies. Option traders are already reporting good demand for strikes above $1.25 and $1.30. A sustainable follow through was last witnessed in 2008. There is no Canadian key data on the horizon to provide the CAD with any support. Next up is manufacturing sales on January 20 and Canadian CPI three-days later. The “black-stuff” remains the loonies biggest influencer near-term. After last Friday’s disappointing employment numbers USD pullback have been rather limited. Until market dynamics change, this will remain the current game plan.

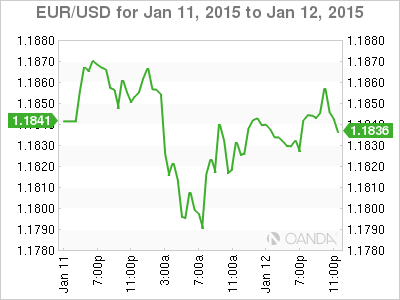

EUR/USD still bucking message from rates market

The 19-member single unit continues to trade within an arms length of the overnight lows (€1.1800) despite US/German spreads shifting further in favor of a EUR rebound. The rate market indicates that both the 2’s and 10-year Treasury/Bund spread has narrowed a further 2bps from the EU open and 5pbs from last Friday’s non-farm payroll survey. A narrowing of spreads would suggest an uptick in the level of support for the EUR. The two particular spreads have managed to compress 18 and 26bps respectively since late December. Nevertheless, it seems that speculators wish to continue to ignore the rates market and bet on expectations for a January 22 QE announcements. The shift in thinking seems to also be favoring selling EUR strength rather than adding to current EUR short position on any break lower.

Do not be surprised to see the EUR continue to hover around the €1.18 handle ahead of tomorrow’s EU Top Court (ECJ) non-binding advice on ECB’s Outright Monetary Transaction Mechanism. The Advocate General is due to rule on Germany’s challenge of the ECB’s more limited OMT program, which allows the ECB to buy sovereign bonds of eurozone countries in its aid program. The most import question is whether the ECB would have a priority over other creditors in the event of a default. Germany argues that that if the ECB does not and its bond holding can be written down, it would be an illegal act of monetary financing. What investors only need to worry about is that if the European Court of Justice sides with Germany, Draghi and company will have a much harder time delivering an effective QE program. This particular outcome could instigate a rather nasty whip snap price reaction from the EUR.

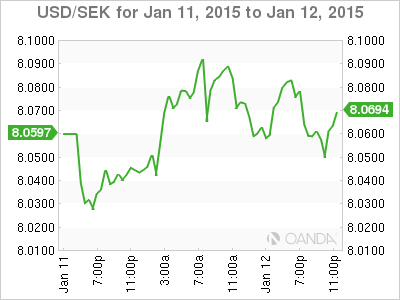

A tale of opposites from Central Banks

Sweden’s December CPI came in much hotter than expected this morning, but is unlikely to sway the Riksbank from again lowering its rate path outlook. It fell -0.3% on the year, which was smaller than the -0.5% drop expected. The main support came from ticket prices for foreign flights. This component happened to boost CPI m/m by +0.1% more than expected. The headline surprise managed to give the SEK a boost. USD/SEK plummeted from $8.0890 to $7.9734, while EUR/SEK tumbles from €9.57 to €9.48 and NOK/SEK from 1.0425 to 1.0340. The December reading should now be capable of reducing the probability that the CB will implement unconventional measures at next months monetary policy meeting.

In contrast, the U.K economy experienced the slowest annual growth in consumer prices in ten years. The UK December joint CPI reading was lowest since comparable records began in 1989. The annual rate of inflation fell to +0.5% from +1% the previous month. The usual suspects provided the lower price pressures – fall in food prices coupled with plummeting price of oils and fuels. The decline marks the first time that annual inflation has been more than 100bps below the BoE’s +2% inflation target. The dramatic shift now requires Governor Carney to write a letter of explanation to Chancellor Osborne explaining the reasons for the fall and how U.K policy makers intend to lift inflation back to target. The letter will be published on February 18 along with the MPC minutes.

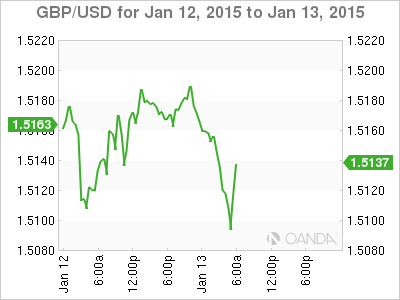

The weak inflation headline has managed to see GBP extend its declines (£1.5076 – a six-month low). Nevertheless, low inflation experienced by the U.K is different to that in mainland Europe. In the eurozone, falling prices are a symptom of a struggling economy; sluggish prices in the U.K are driven mostly by cheaper oil and food. This would suggest that low inflation could actually boost the British economy (far quicker than the eurozone), as households get a boost to their discretionary incomes. This is certainly what Prime Minister Cameron should be focusing on ahead of the U.K’s general election in May. Even Carney and company expect the current weaker inflation spell to prove transitory and have even signaled that they still expect their next move will be to raise interest rates rather than further QE. The fixed income market sees the BoE raising interest rates later this year or in Q1 2016.