The EUR/AUD is an unlikely pair, but one that has received a large amount of attention overnight on the back of a solid technicalsetup.

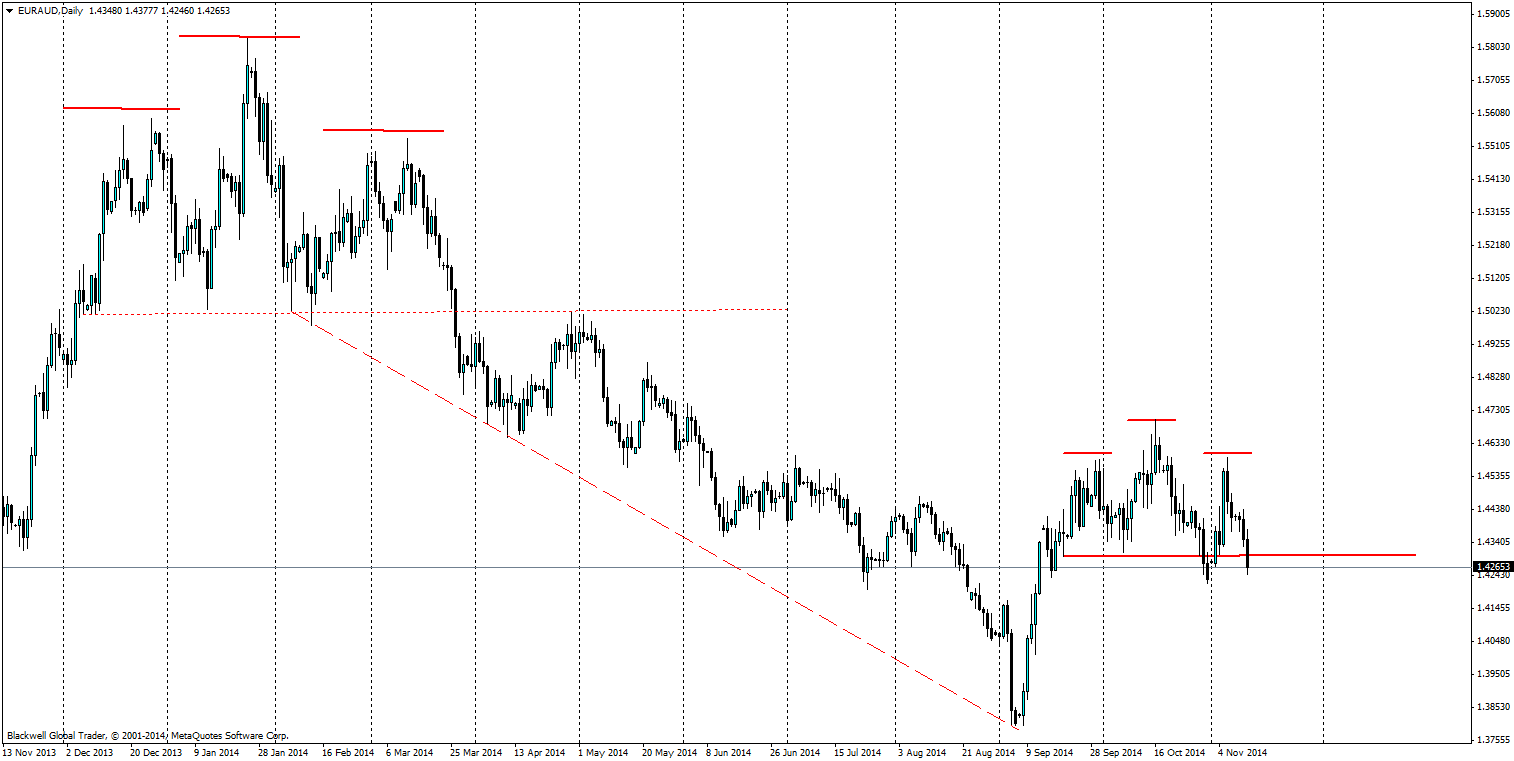

The EUR/AUD has been a solid mover in the market and has routinely shown strong head and shoulder patterns in the marketplace. Currently it looks like the confirmation we were looking for was found overnight. As we saw the recent shoulder form over the start of the month; followed by a strong movement lower through the neck line lower to confirm the downward trend.

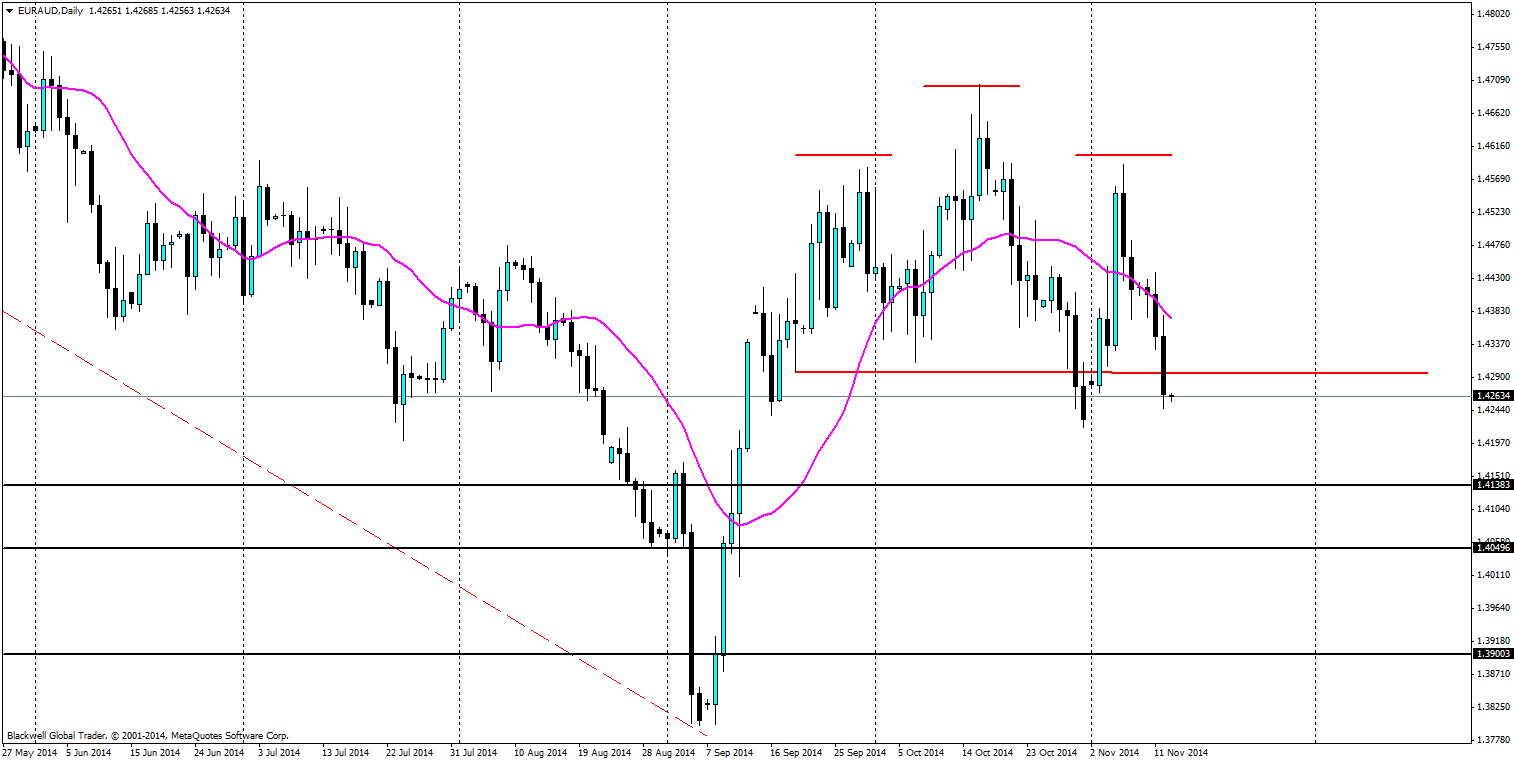

A closer look at the chart and we find there are some strong levels on the way down which markets will likely look to respect. These can be found at 1.4138, 1.4049 and 1.3900, the levels listed below are likely to act as support in the market. However, a dip below them could also see them easily turned into resistance levels as well. It’s also worth noting when talking about support and resistance that the market will respect the 20 day moving average as the market slips lower, and it would not surprise me to see the market bounce off this level as it slides below, as people look for entry points when momentum trading.

Overall, the Euro is having a struggle in the market, while the Australian dollar is still finding some support out there with its high interest rates and economy which punters tend to favour; especially when compared to the Euro. So with the likely hood of QE on the horizon for the Euro and the fact it will push it lower, followed by Australia’s sit on the fence attitude at present. We may see as a result the EUR/AUD fall from a technical and fundamental perspective.