A channel inside a wedge gives us an entry point when looking to follow fundamentals and short the Euro against the Aussie.

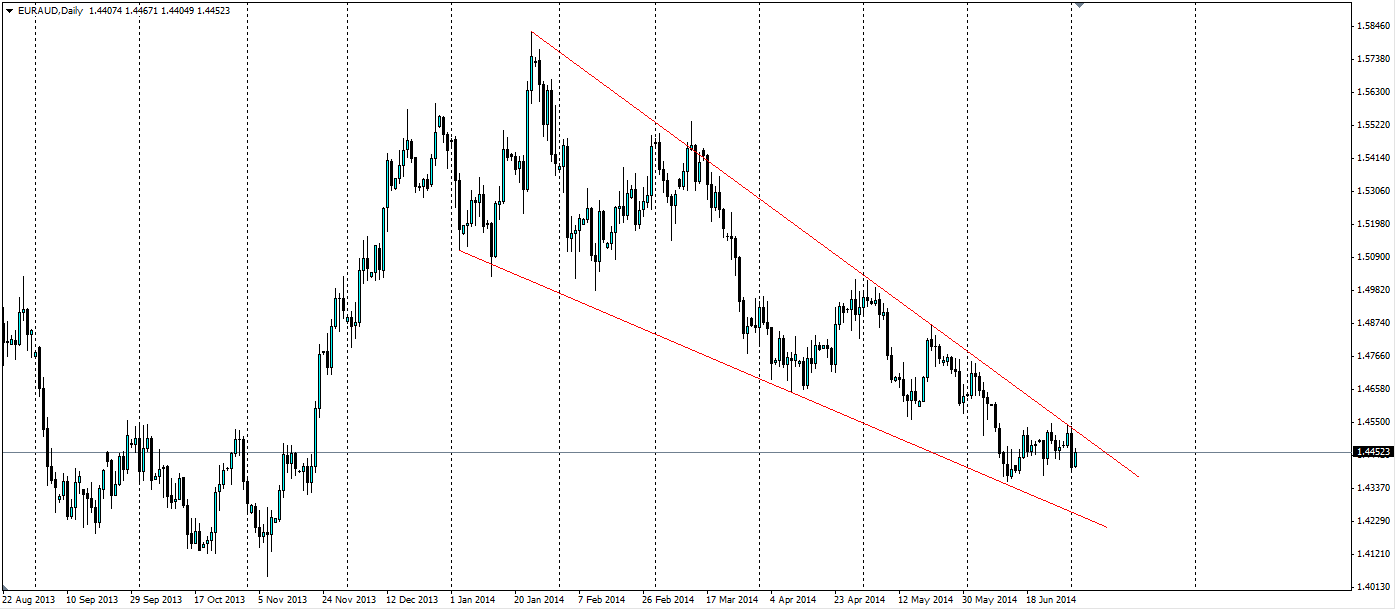

The dominating feature on the EUR/AUD D1 chart is the downward sloping wedge that has been in play since the beginning of the year. The Euro, as many traders know, is not a bad short given the fundamentals and the prospects for more easing. Taking the Euro short against the Aussie gives us a carry trade, in the form of the interest rate differential, along with upside potential from the depreciating Euro and an Australian economy that is facing an improving situation.

HSBC’s Chinese manufacturing PMI report released yesterday was a boost for the Aussie dollar as a figure of 50.7 (down slightly from 50.8) was the first consecutive months of expansion for China since the beginning of the year. Yesterday was also the day the Reserve Bank of Australia held their interest rates steady at 2.50%. They also said “In the board's judgement, monetary policy is appropriately configured to foster sustainable growth in demand and inflation outcomes consistent with the target”. The market liked this, and sent the Australian dollar surging. Certainly the outlook for Australia looks rosier than it did three to six months ago.

The Euro has a big week this week, with the European Central Bank press conference on Thursday. There is a distinct possibility we will see the ECB talk about further easing to add to the policies enacted at the beginning of June as inflation remains stubbornly low at 0.5% year on year. The ECB may even apply shock tactics and announce a Quantitative Easing programme, but this is seen as an outside chance.

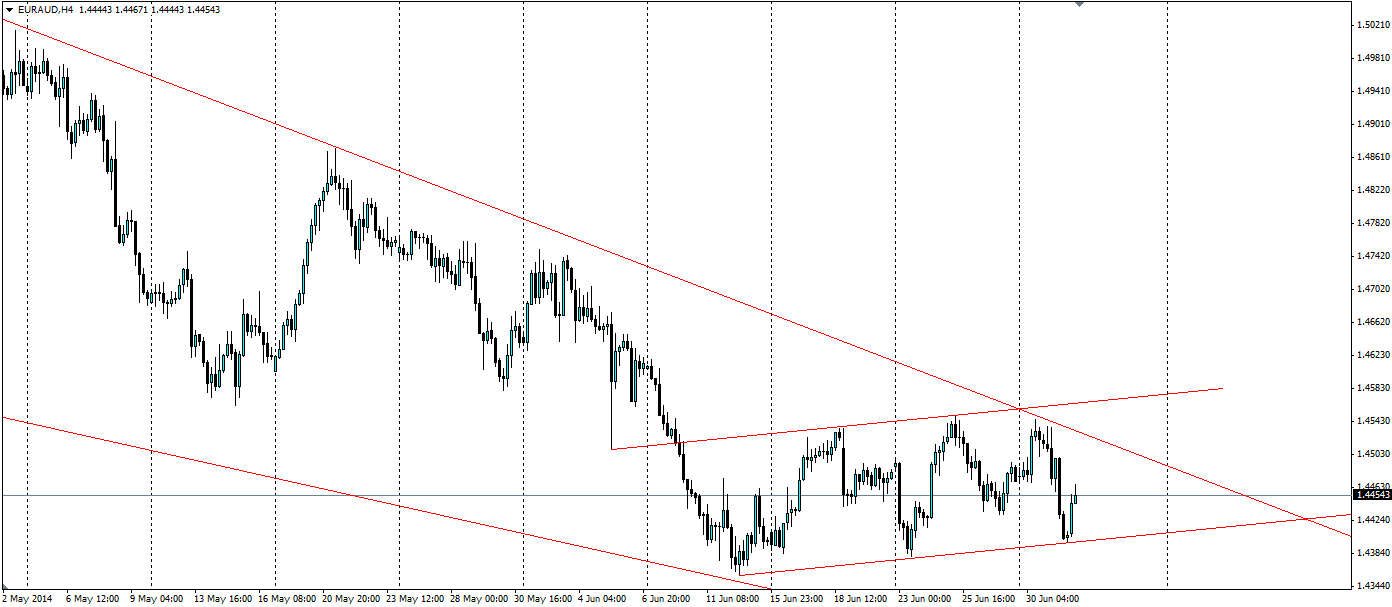

Following the wedge down is a decent play, however, where do we enter? Looking closer at the EUR/AUD H4 chart, we can see a channel within the wedge that the price is following. This smaller channel is likely to be trumped by the longer term channel, which provides us with two possible entry points.

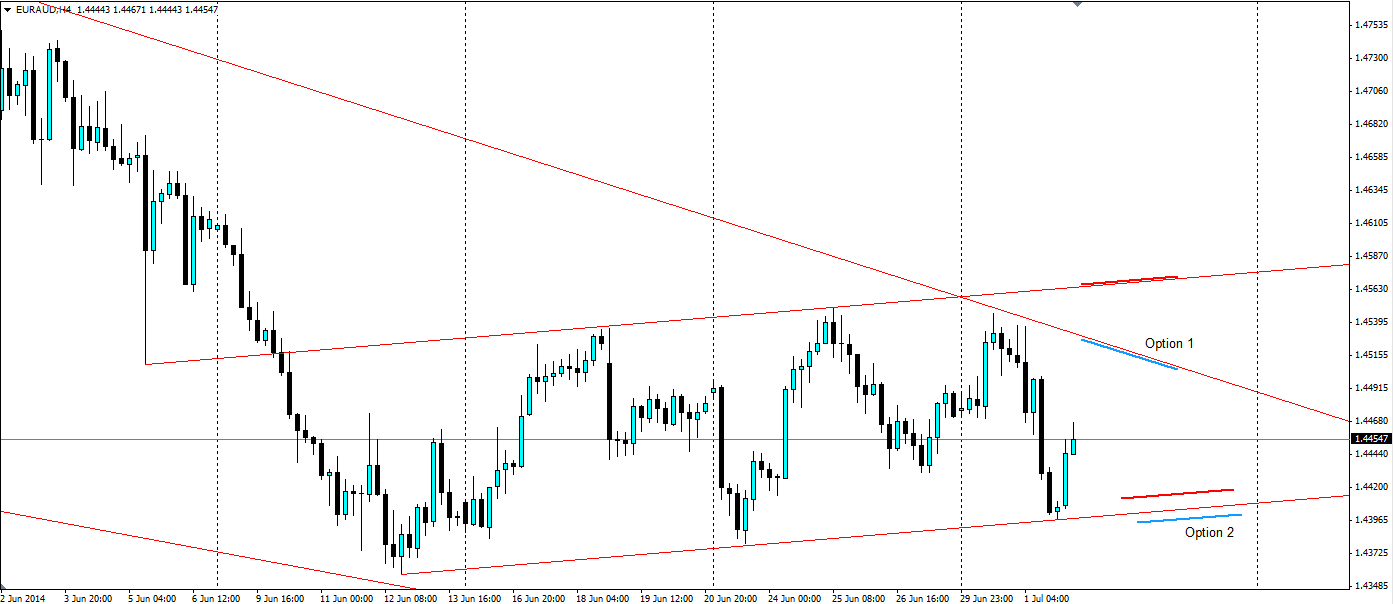

Firstly, it is looking likely we will see the price test and reject off the upper level of the main wedge. A sell order (in blue) can be put in with a stop loss (in red) above both channels to minimise downside in case the price breaks out of both. There is no set level that the price will test on the dynamic upper trend line, so an entry point should be managed closely.

The sound option involves setting a sell stop order to enter when the support gives way and the small channel breaks down. An entry will be set below the channel (in blue) with a stop loss (in red) back inside the channel in case the breakout is a false one.

A short term channel has formed inside a long term wedge on the EUR/AUD charts. This channel is likely to break down and the wedge will resume its downward movement which provides traders two different options to enter.