Investors require "volatility for opportunity" and with today's plethora of economic releases and central bank announcements on either side of the Atlantic the market should be exposed to a significant pre-firework display, heightened by a shortened trading day ahead of the US July 4th celebrations. With the 'granddaddy' of fundamental releases, non-farm payrolls, being thrown into the mix, it makes it that much more significant.

Now that the so-called "weather effect" is completely over, today's payroll report will be an important sign of upcoming Fed policy. For Draghi and company, it's their first real showing after last months historic meet where they committed and threw almost everything at a potential euro deflation scenario. What can we expect for an encore?

ECB versus Deflation

Do not be fooled, there is much to consider. Though ECB policy officials insist there is almost no chance of deflation taking hold in the euro-zone, the latest monthly CPI estimate matched a four-year low of +0.5%, and in some peripheral countries it's even lower. If the next few inflation readings drift downward from this already very low level, the Draghi may be forced into more action - how about cutting the key deposit rate another 15 basis points to -0.25% to give banks even more incentive to lend?

Ultimately, if circumstances don't press them into action, reports say ECB officials would prefer to take six-to-nine months to judge whether the new package is creating the desired behavior. The ECB took its time considering negative rates, given that charging banks to sit on money could have unintended consequences, and now that its committed to the policy, it will need time to see if banks are following the play as it was drawn up. There is some concern that bankers may undermine the new measures because they are reluctant to boost lending in the next few as their balance sheets are under the heavy scrutiny of the asset quality review.

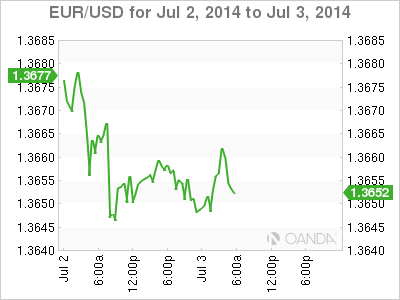

So by day's end, no policy changes are expected from the ECB, but the market will be looking for details of the package of easing measures introduced last month. Euro policy makers are expected to keep their 'dovish' tone intact, especially in the face of weak PMI's, low inflation and weak bank lending, but no action.

Swedish Central Bank Supports EUR

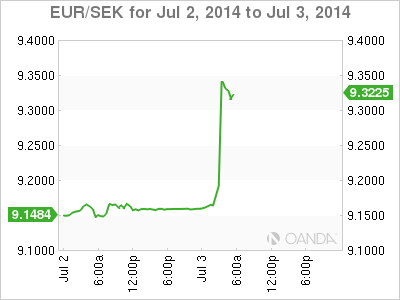

The 18-member single currency is little changed ahead of the ECB announcement (€1.3655), propped up by AUD selling insistence from the RBA and the SEK plunging to a three-and-a-half-year low after the Swedish Central Bank surprised investors this morning with a bigger than expected rate cut. The Riksbank lowered borrowing costs for the first-time in six-months to boost a flagging inflation rate (repo rate cut to +0.25% from +0.75%). The EUR/SEK has weakened by more than +2% (€9.3490). Unless the ECB president attempts to talk down the EUR (see the RBA overnight), or signals that the ECB has made further progress on its asset purchase plan, then it's unlikely that today's policy meet will have much impact outright on the EUR. Cross action is doing most of the direct supporting, but the market requires a very convincing NFP reading to move the needle.

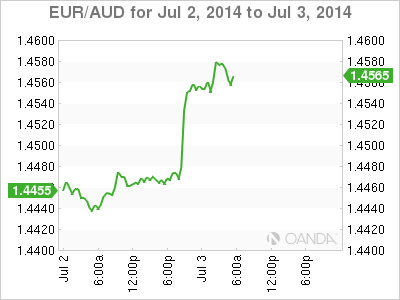

The RBA Walks The AUD Down

The Aussie is in its own space at the moment. It's a half-member to the markets most popular trade - "the carry" ($0.9375). Overnight, the AUD/USD is once again the most active cross among the dollar majors, falling sharply for the second consecutive session after hitting an eight-month high above AUD$0.95 earlier this week.

Mixed China services PMI's have taken a back seat to increasingly more "dovish" sentiment from RBA Governor Stevens and the biggest drop in retail sales since March of 2013. Stevens stated that while monetary policy is very accommodative, RBA still has ammunition on interest rates, adding that AUD is overvalued by most measures and the troubling property sector inflation may be abating.

The AUD was seen as the go-to currency of choice from a yield and it has become a very crowded trade very fast with many looking to see AUD outright hit parity in Q4. Governor Stevens needed to put the breaks on Australia's currency, a tool that Draghi has at his disposal. What is complementing the EUR's value at the moment is the unwinding of so many cross play trades that actually end up supporting the single unit in the short term. Perhaps the biggest squeeze will have to come from the USD, which has only been underperforming. An aggressive surprise from this morning's NFP would be good for starters.

Can The Dollar Get A Job Lift?

After the decidedly slow start to the year, monthly non-farm payrolls in the first-five months are now averaging over +200k new jobs, enough to keep unemployment on a downward trajectory (+6.3%). Today's forecasts (due to July 4th holidays) are for another payroll report in line with the average (+215k), though more breakout numbers like the nearly +300k jobs gained in April are not out of the question and could help ease the Fed transition into its next policy phase and certainly an argument for a stronger dollar across the board.

Both Bunds and Treasury's are doing their jobs and pushing lower, taking out some technical support, as traders eye a higher than expected US jobs report. While consensus hovers around the average, a few dealers are looking for a print between +250k - +290k making it the largest job gain in 18-months and a boom for market volatility. Numbers like this will allow the Fed to proceed to its next phase with little market objection. A disappoint headline and investors are still exposed to opportunity volatility!

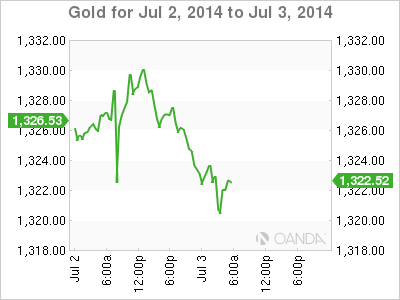

Commodity players are bracing themselves

Given yesterday's ADP employment print coming in well above expectations (+281k vs. +205k), positions have likely have likely been adjusted somewhat to account for an upside risk to the June employment report ($1,322). Given the factors all lined up against the yellow metal - positioning, weak physical demand, and potential strong employment - any sign of resilience against stronger data will please the metal "bulls." On the flip side, weaker US data will only ever promote the "general hopeful" mood that investors have of late towards the metal.