Last Friday we had some important moves in the currencies as also in the stock market. These moves had, officially, two important drivers: from one side we had ECB president, Mario Draghi, reiterating that the European Central Bank will do "whatever it takes" to get inflation in Europe and on the other, the PBOC with its surprise rate cut -- the only one in the past 2 years.

Both events made investors to dream: they are dreaming to finally see the ECB doing QE in Europe as also they are dreaming that PBOC might cut again the rates (or adopt other easing measures). The "dreams" were translated in the markets with nice rallies in the stocks as also reversals/rallies for the commodities and commodity currencies as the most significant reactions. I guess euro selling off is not a surprise to anyone anymore.

Today, the stock market continued the rally, mostly in Europe where the stocks were supported by better-than-expected data from Germany (especially the German IFO Business Climate Index now at 104.7 vs 103 expected), but the currency market is not continuing what started on Friday.

So what's different now?

Basically nothing. There were no news over the weekend to trigger a reversal in the currencies and neither today. Was Friday only a "trading-the-noise" sort of reaction? If so, how come the stocks are not giving back the gains today?

I am still convinced that we have everything we need to see new record highs in the stock market and by that also means that investors are in love with the risk. Friday somehow prove it: EUR/TRY breaking a good support at 2.7550 and making new fresh lows for 2014 at 2.7482. This week opened even lower at 2.7461. While ECB is dealing with negative deposit rates and the investors are "dreaming" at QE in Europe, Turkey is paying 8.25%.

How do we play this? Do we consider the current pullback as an opportunity to jump in short EUR/TRY thinking that next week Mario Draghi might deliver what the market wants? He said it too many times that ECB will do "whatever it takes" to see inflation in Europe. Can he take it back next week? Also from a carry trade perspective, selling euro and buying TRY is very tempting for the next few months.

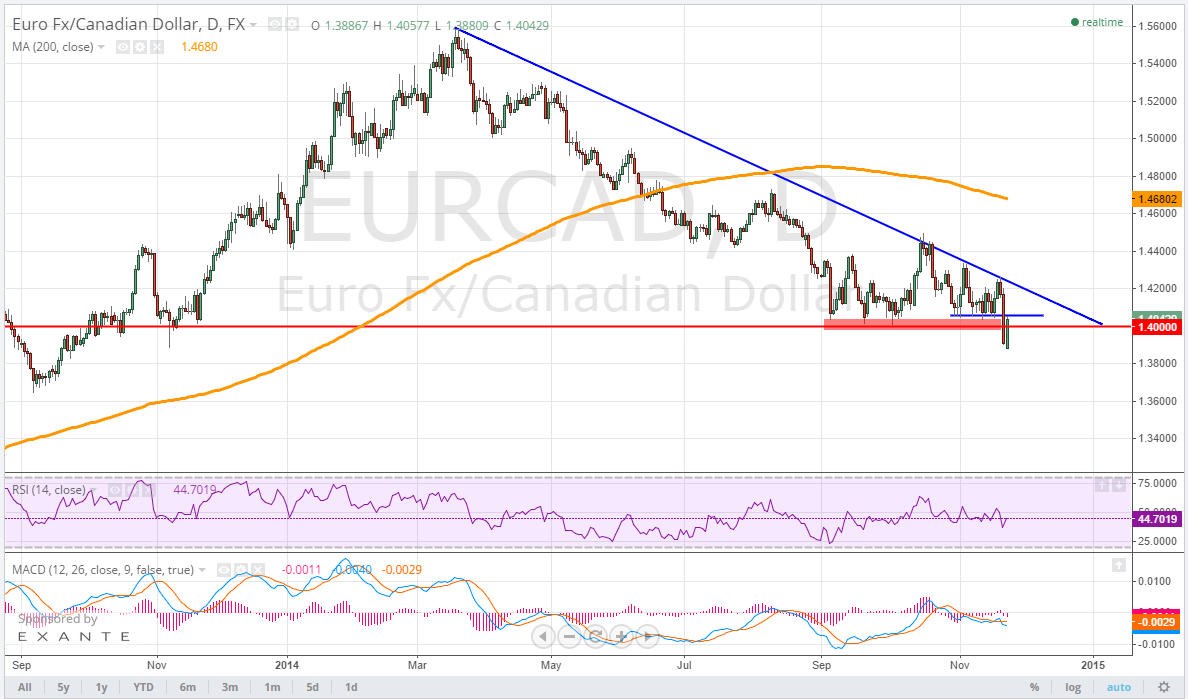

Another trade that made me asking "what's different now" is EUR/CAD. This currency pair failed to break the 1.4000 support since 4th of September. It had so many attempts since then but it failed every time in the past 12 weeks. On November 21 EUR/CAD finally broke the strong support at 1.4000 and even closed under it at 1.3912. Now, what has been changed since then that this pair wants to go back up? It even made a new lower low this week at 1.3880. Is this pullback a good opportunity to sell this pair now that the support is broken?

I would be glad to hear your opinions too. What's different now? What has changed since Friday? Or maybe I am just missing the point here and the real "issue" is what happened Friday. Is it?