The meeting of EU members yesterday was successful in that the fiscal compact agreement proposed by Germany was passed. All countries apart from the UK and the Czech Republic signed up to the agreement to balance budgets and bring deficits lower although the actual detail on penalties and so called “exceptional circumstances” break clauses will work.

This is merely a sideshow to the real problem that is Greece, and that particular problem has not been moved forward an inch. One EU politician remarked yesterday that a resolution would be forthcoming “in the next days”. The fact that he left out a number would be funny if it wasn’t so symptomatic of the fact the a resolution is still a long way off.

This combined with a fairly lacklustre Italian debt auction saw the euro gradually weaken throughout the session moving back into the 1.30s in EURUSD and to the high 1.19s in GBPEUR. The Italian auction wasn’t disastrous, far from it, but in contrast to the stellar auctions that we have seen from Spain from example the difference in yields was not massive. The main headline was that the yield on the 10yr note issued declined from an all-time high of 6.98% to 6.08%; good news but there must have been some disappointment that the yield was unable to breach that 6% level.

The dollar has weakened overnight however as month end rebalancing flows by investment banks and pension funds have caused them to sell the greenback. Some “risk-on” moves have been seen from an FT report that that European banks will be looking for up to double the amount of money they requested in December from the ECB’s LTRO operation. The new auction is due on Feb 29th but the figures that some are talking about are astronomical. The previous auction saw EUR489bn of loans given out; there is every possibility we could see more than EUR1trillion come next month’s event.

Data so far today has been poor with German retail sales slipping by 1.4% in December compared with an expected jump of 0.8%. While the retail sector is not as important to the German economy as it is to the British, it is obvious that a 1.4% fall will not do the national accounts any good at all. We remain by our prediction that the German economy will contract by 0.2% in Q4.

Moves will be unpredictable today as end-of-month flows and rumours are likely to drive markets. The main macro news is US Consumer confidence due at 15.00. Last week’s Uni of Michigan study showed further positivity and investors will be looking for an increase despite the slightly softer GDP number for Q4.

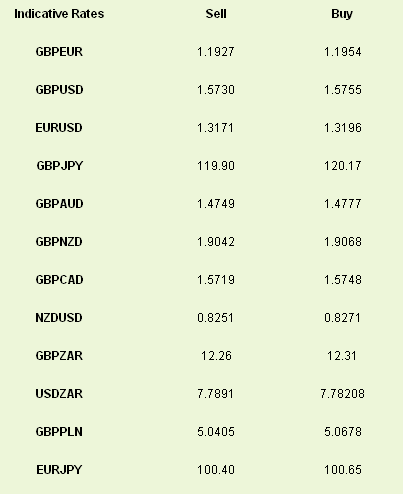

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EU Summit to Focus on Greek Issues

Published 01/31/2012, 09:10 AM

Updated 07/09/2023, 06:31 AM

EU Summit to Focus on Greek Issues

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.