The euro was able to close out last week's session with moderate gains against several of its main currency rivals following an ECB decision to ease rules for funding struggling banks in the eurozone. That being said, the EUR remained under pressure following the credit rating downgrade of 15 major international banks earlier in the week. Turning to this week, investors will be closely watching a summit of EU leaders, scheduled to take place on Thursday and Friday. Any announcements regarding new ways to help combat the region's debt crisis may boost the common-currency.

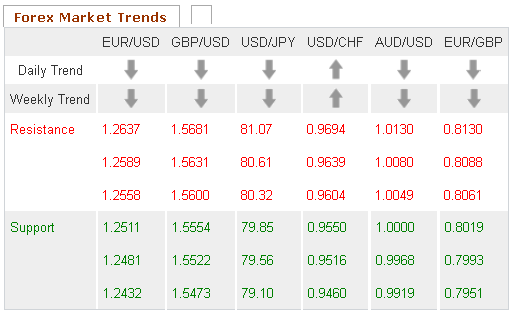

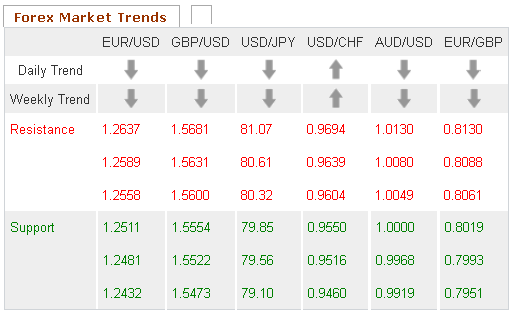

The US dollar was able to extend its recent bullish trend against both the British pound and Japanese yen on Friday, as investors remained risk-averse following the release of a batch of data that signaled a slow-down in the global economic recovery. The GPB/USD, which was trading as high as 1.5632 early in the European session, dropped to 1.5556 by the afternoon. Eventually the pair staged a slight recovery to close out the week at 1.5585. The USD/JPY continued moving up throughout the day, eventually gaining some 40 pips to close the week at 80.42.

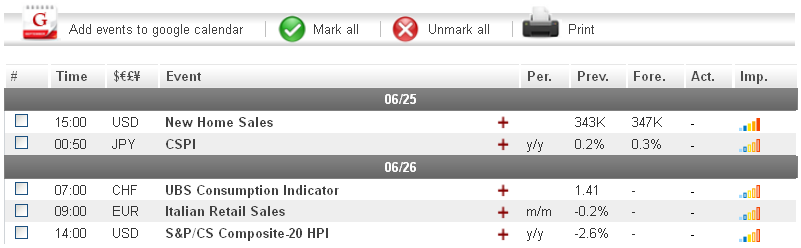

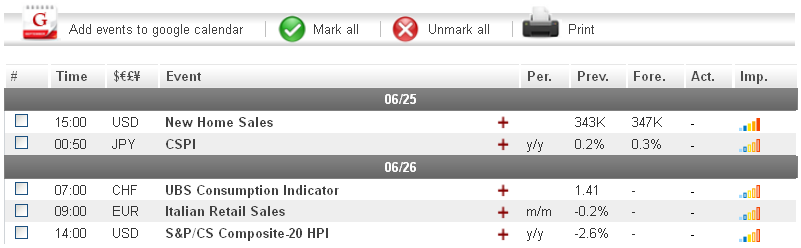

Turning to today, a slow news day means that the dollar could see further gains if investors decide to keep their funds with safe-haven assets. That being said, traders will want to pay attention to the US New Home Sales figure, set to be released at 14:00 GMT. While analysts are forecasting today's news to come in slightly above last month's figure, it should be noted that the housing sector remains one of the biggest obstacles to the US economic recovery. If today's news comes in below the expected 347K, the dollar could give up its recent gains.

EUR - Negative Global Data Weighs Down On Euro

The euro was able to close out last week's trading session with gains against the Japanese yen, but remained bearish against other currencies, including the Australian dollar. Analysts attributed the EUR/JPY's upward trend to renewed focus toward Japan's trade deficit. The pair advanced close to 50 pips before finish out the day at 101.10. Against the AUD, the euro fell over 50 pips during the European session, reaching as low as 1.2458 before staging a slight upward recovery to finish the week at 1.2486.

Turning to this week, investors will be closely watching a summit of EU leaders scheduled to take place on Thursday and Friday. Data out of Germany released last week signaled that the region's debt crisis may be affecting the biggest economy in the eurozone. EU leaders are under intense pressure to announce new plans to combat the debt crisis when they meet this week. If they fail to reach a consensus about how to best boost the eurozone's struggling economies, the EUR could see losses in the coming days.

Gold - Gold Moves Up Amid Eurozone Economic Worries

After tumbling earlier in the week, gold saw a modest increase in price late in Friday's trading session. The upward movement was attributed to fears regarding the eurozone economic recovery, which caused investors to shift their funds to safe-haven assets. Gold finished out the day at $1572.37 an ounce, up from $1557.84 hit during morning trading.

This week, gold could see further gains if news out of the US and eurozone comes in negative. In addition to the EU summit later in the week, traders will also want to pay attention to the US New Home Sales, CB Consumer Confidence and Core Durable Goods Orders figures, set to be released in the coming days. Any disappointing news could help gold extend its bullish trend.

Crude Oil - Crude Oil Recovers From 8-Month Low

Crude oil saw mild gains during Friday's trading session after hitting an eight-month low earlier in the week. Potentially severe weather threatened to disturb production in the US, resulting in the bullish movement. Crude finished the week at $80.05 a barrel, up from $77.52 hit earlier in the day.

This week, analysts are warning that any gains made by crude oil could be temporary and the commodity is likely to see volatility due to any news out of the eurozone. Traders will want to pay attention to the outcome of the EU summit as well as an Italian bond auction, scheduled for Friday. Should demand for Italian bonds come in below predictions, it may result in further risk-aversion in the marketplace, which could result in losses for crude oil.

Both the Relative Strength Index and the Williams Percent Range on the weekly chart are very close to dropping into oversold territory, signaling that an upward correction could take place in the coming days. Traders will want to keep an eye on both of these indicators. Should they drop further, it may be a sign to open long positions.

GBP/USD

Long-term technical indicators show this pair range-trading, meaning that no defined trend can be predicted at this time. Traders may want to take a wait-and-see approach, as a clearer picture is likely to present itself in the coming days.

USD/JPY

The daily chart's Slow Stochastic has formed a bearish cross, indicating that downward movement could occur in the near future. Additionally, the Williams Percent Range on the same chart is currently in the overbought zone. Opening short positions may be a wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range is approaching overbought territory, indicating that a downward correction could take place in the near future. This theory is supported by the Relative Strength Index on the same chart, which is currently near 70. Going short may be the wise choice for this pair.

The Bollinger Bands on the daily chart are narrowing, indicating that this pair could see a price shift in the near future. Furthermore, the MACD/OsMA on the same chart has formed a bearish cross, signaling that the price shift could be downward. This may be a good time for forex traders to open short positions ahead of a possible downward breach.

Economic News

USD - Safe-Haven Dollar Benefits From Risk AversionThe US dollar was able to extend its recent bullish trend against both the British pound and Japanese yen on Friday, as investors remained risk-averse following the release of a batch of data that signaled a slow-down in the global economic recovery. The GPB/USD, which was trading as high as 1.5632 early in the European session, dropped to 1.5556 by the afternoon. Eventually the pair staged a slight recovery to close out the week at 1.5585. The USD/JPY continued moving up throughout the day, eventually gaining some 40 pips to close the week at 80.42.

Turning to today, a slow news day means that the dollar could see further gains if investors decide to keep their funds with safe-haven assets. That being said, traders will want to pay attention to the US New Home Sales figure, set to be released at 14:00 GMT. While analysts are forecasting today's news to come in slightly above last month's figure, it should be noted that the housing sector remains one of the biggest obstacles to the US economic recovery. If today's news comes in below the expected 347K, the dollar could give up its recent gains.

EUR - Negative Global Data Weighs Down On Euro

The euro was able to close out last week's trading session with gains against the Japanese yen, but remained bearish against other currencies, including the Australian dollar. Analysts attributed the EUR/JPY's upward trend to renewed focus toward Japan's trade deficit. The pair advanced close to 50 pips before finish out the day at 101.10. Against the AUD, the euro fell over 50 pips during the European session, reaching as low as 1.2458 before staging a slight upward recovery to finish the week at 1.2486.

Turning to this week, investors will be closely watching a summit of EU leaders scheduled to take place on Thursday and Friday. Data out of Germany released last week signaled that the region's debt crisis may be affecting the biggest economy in the eurozone. EU leaders are under intense pressure to announce new plans to combat the debt crisis when they meet this week. If they fail to reach a consensus about how to best boost the eurozone's struggling economies, the EUR could see losses in the coming days.

Gold - Gold Moves Up Amid Eurozone Economic Worries

After tumbling earlier in the week, gold saw a modest increase in price late in Friday's trading session. The upward movement was attributed to fears regarding the eurozone economic recovery, which caused investors to shift their funds to safe-haven assets. Gold finished out the day at $1572.37 an ounce, up from $1557.84 hit during morning trading.

This week, gold could see further gains if news out of the US and eurozone comes in negative. In addition to the EU summit later in the week, traders will also want to pay attention to the US New Home Sales, CB Consumer Confidence and Core Durable Goods Orders figures, set to be released in the coming days. Any disappointing news could help gold extend its bullish trend.

Crude Oil - Crude Oil Recovers From 8-Month Low

Crude oil saw mild gains during Friday's trading session after hitting an eight-month low earlier in the week. Potentially severe weather threatened to disturb production in the US, resulting in the bullish movement. Crude finished the week at $80.05 a barrel, up from $77.52 hit earlier in the day.

This week, analysts are warning that any gains made by crude oil could be temporary and the commodity is likely to see volatility due to any news out of the eurozone. Traders will want to pay attention to the outcome of the EU summit as well as an Italian bond auction, scheduled for Friday. Should demand for Italian bonds come in below predictions, it may result in further risk-aversion in the marketplace, which could result in losses for crude oil.

Technical News

EUR/USDBoth the Relative Strength Index and the Williams Percent Range on the weekly chart are very close to dropping into oversold territory, signaling that an upward correction could take place in the coming days. Traders will want to keep an eye on both of these indicators. Should they drop further, it may be a sign to open long positions.

GBP/USD

Long-term technical indicators show this pair range-trading, meaning that no defined trend can be predicted at this time. Traders may want to take a wait-and-see approach, as a clearer picture is likely to present itself in the coming days.

USD/JPY

The daily chart's Slow Stochastic has formed a bearish cross, indicating that downward movement could occur in the near future. Additionally, the Williams Percent Range on the same chart is currently in the overbought zone. Opening short positions may be a wise choice for this pair.

USD/CHF

The weekly chart's Williams Percent Range is approaching overbought territory, indicating that a downward correction could take place in the near future. This theory is supported by the Relative Strength Index on the same chart, which is currently near 70. Going short may be the wise choice for this pair.

The Wild Card

CAD/CHFThe Bollinger Bands on the daily chart are narrowing, indicating that this pair could see a price shift in the near future. Furthermore, the MACD/OsMA on the same chart has formed a bearish cross, signaling that the price shift could be downward. This may be a good time for forex traders to open short positions ahead of a possible downward breach.