- EU-summit draft suggests enhanced power that should enable EU to rewrite budgets for euro area member states that violate the debt and deficit rules.

- Cyprus applies for EFSF/ESM assistance and the Greek Finance Minister steps down due to health problems.

- 28 Spanish Banks downgraded between 1-4 notches by Moody’s.

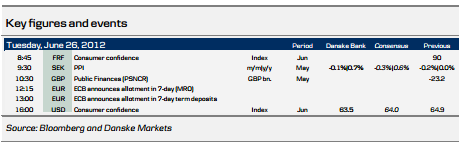

- Thin global calendar with US consumer confidence as the main release.

The downbeat sentiment from the European session continued overnight, with news from the peripherals dominating the media picture. Last night Cyprus became the fifth euro area country to apply for assistance. The Cypriot government said it had “informed the appropriate European authorities” that it would request aid from the EFSF/ESM. The Cypriot economy and bank sector have suffered from the problems in Greece and the request came just a few days before the deadline to recapitalise one of the country’s largest banks, see FT.

FT also runs a story on the potential outcome of the EU summit. According to a draft EU could enhance its power enabling it to rewrite budgets for euro area member states that violate the debt and deficit rules. This could be one approach to form a fiscal union, with EU authorities serving as a euro area Finance Ministry. Germany insists on increased control over national budgets as a condition for any pooling of member states’ credit risk. The draft also proposes the formation of a common EU bank supervisory.

The Greek Finance Minister, Vassilis Rapanos, steps down due to health problem (he had not been formally sworn in yet). Different options for his replacement have been mentioned. The new Greek government has stated that it will renegotiate the existing memorandum, which includes a two-year extension of the current budget deficit targets, see WSJ.

28 Spanish Banks were downgraded between 1-4 notches by Moody’s last night. Moody’s writes that “these actions follow the weakening of the Spanish government's creditworthiness, as captured by Moody's downgrade of Spain's government bond ratings to BAA3 from A3 on 13 June 2012,” see Moody’s press release.

Risk appetite deteriorated yesterday on negative news out of Cyprus, Greece and Spain and the negative sentiment carried over to the US equities. The S&P500 ended down 1.6%. In Asia stock indices are trading in negative territory. Nikkei is down 1.1% and Hang Seng is down 0.1%. In FX markets EUR/USD has traded sideways overnight and is broadly unchanged around 1.250 this morning.

Global Daily

Focus today: The global calendar looks thin today with US consumer confidence as the main release. We expect consumer confidence measures to take a hit, as the European debt crisis and weakness in the labour market start to take their toll on US optimism. We have already seen a significant fall in the first release of the University of Michigan confidence indicator in June and expect the conference board figure to drop moderately to 63.5 from 64.9 today. Market attention is likely to remain on news about the outcome of

the EU summit.

Fixed income markets: Even before its start the markets are already disappointed with the outcome of the EU summit. Or so it seems when looking at yesterday’s price action. The leaked EU document and comments from Merkel choked growing market optimism that this EU meeting would be a blockbuster. Not that significant progress cannot be made at the summit but there are no quick fixes and time is running out as the recession deepens in Italy and Spain. We stick to our long-held recommendations of only being long bond markets in Germany, the US and the Nordics.

Fixed income markets: Even before its start the markets are already disappointed with the outcome of the EU summit. Or so it seems when looking at yesterday’s price action. The leaked EU document and comments from Merkel choked growing market optimism that this EU meeting would be a blockbuster. Not that significant progress cannot be made at the summit but there are no quick fixes and time is running out as the recession deepens in Italy and Spain. We stick to our long-held recommendations of only being long bond markets in Germany, the US and the Nordics.

FX markets: There are no specific events to focus on in the FX market so attention is on the EU summit later in the week. It seems that more and more market participants fear a disappointing outcome and the easy way to play that view would be to sell the euro. Hence, renewed downside risk to EUR/USD and EUR/GBP today.

Scandi Daily

Sweden: Swedish May PPI this morning is usually not a market mover and we doubt it will be this time. We expect it to print -0.1% m/m / 0.7% y/y as a result of falling electricity prices pulling down domestic producer prices and as export companies normally cut prices in May. There will be more interesting data with bearing on GDP growth over the next couple of days, such as trade balance and retail sales. We doubt these will have weakened to an extent that will trigger a rate cut from Riksbank next week; the market is currently pricing about 13bp rate cut.

Be alert instead that the Swedish FSA may release a report this week proposing new higher risk weight to banks’ mortgage lending, from 7% towards 15%. That would raise banks’ cost and most likely hurt profitability.

There are no major market events in Scandinavia today.

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research analyst’s personal view about the financial instruments and issuers

covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation by the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of the Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. Employees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the

Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over-all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate

finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be

obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be

considered as, an offer to sell or a solicitation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without

limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not

undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S.

Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors”.

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.