Investing.com’s stocks of the week

The triumphant return of the US economy was heralded once again yesterday by a much better than forecast retail sales number that suggested that, for the time being, US households are dealing well with the impact of tax increases and petrol price rises. Sales without the essentials of fuel and food also rose by 0.4% and although some shop spending was lower it looks like the consumer is holding its own for now at least. Whether this has been supported by some consumers receiving tax rebates will emerge through the next three weeks.

The dollar regained some of its recent strength having traded back from its most recent highs prior to the announcement. This was hardly driven by too much in the fundamental sense although political moves out of China that could limit stimulus measures in that region won’t have helped. Most of the weakness is likely down to profit taking following a great move for the dollar index over the past few months.

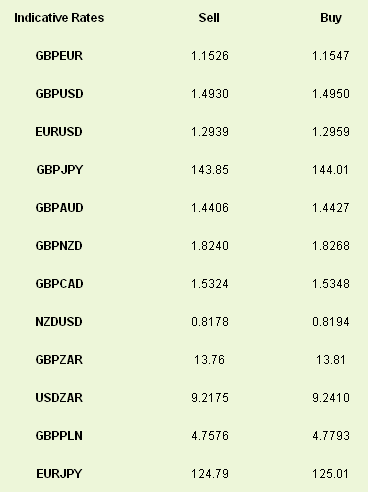

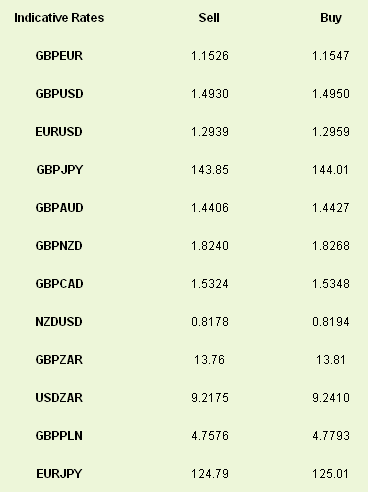

The profit taking on USD had helped sterling yesterday morning with GBPUSD moving back towards the 1.50 level. GBP/EUR was dragged above 1.15 by a weak single currency as Eurozone industrial production fell by 0.4% in January. Germany and France both posted negative figures last week and you have to wonder just how bad it would have been without Germany’s overall strength – much like with all Eurozone data at the moment.

Combine that data with an Italian bond auction that, while far from disastrous, saw yields rise and demand fall for Italian paper. At least one Italian election was completed overnight though.

The speed of interest rate cuts from the Reserve Bank of Australia may slow through the rest of the year following the best Aussie payrolls announcement in 13yrs. 71,500 jobs were added in February and this pushed AUDUSD to a 1-month high.

Market focus today will be on the Eurozone. The latest EU summit in Brussels begins today with topics such as a Cypriot bailout, the lack of an Italian government and a breakdown in troika talks in Greece will dominate. Factor in chatter about wanting an interest rate cut from the ECB, reducing the strength of the euro and the general ongoing recession and you have a tinderbox of issues.

Away from Brussels we also have a Spanish auction of longer-term bonds that looks a lot like a country loading up when the yields are low, and retail sales that are expected to slip by more than 11% in the month of January.

The dollar regained some of its recent strength having traded back from its most recent highs prior to the announcement. This was hardly driven by too much in the fundamental sense although political moves out of China that could limit stimulus measures in that region won’t have helped. Most of the weakness is likely down to profit taking following a great move for the dollar index over the past few months.

The profit taking on USD had helped sterling yesterday morning with GBPUSD moving back towards the 1.50 level. GBP/EUR was dragged above 1.15 by a weak single currency as Eurozone industrial production fell by 0.4% in January. Germany and France both posted negative figures last week and you have to wonder just how bad it would have been without Germany’s overall strength – much like with all Eurozone data at the moment.

Combine that data with an Italian bond auction that, while far from disastrous, saw yields rise and demand fall for Italian paper. At least one Italian election was completed overnight though.

The speed of interest rate cuts from the Reserve Bank of Australia may slow through the rest of the year following the best Aussie payrolls announcement in 13yrs. 71,500 jobs were added in February and this pushed AUDUSD to a 1-month high.

Market focus today will be on the Eurozone. The latest EU summit in Brussels begins today with topics such as a Cypriot bailout, the lack of an Italian government and a breakdown in troika talks in Greece will dominate. Factor in chatter about wanting an interest rate cut from the ECB, reducing the strength of the euro and the general ongoing recession and you have a tinderbox of issues.

Away from Brussels we also have a Spanish auction of longer-term bonds that looks a lot like a country loading up when the yields are low, and retail sales that are expected to slip by more than 11% in the month of January.