The September Euro futures contract surged Friday morning after Euro-leaders agreed to relax conditions on emergency loans for Spanish banks. This news also opens the door for a similar aid package for Italy. The decision which took place after lengthy discussions by the Euro Zone leaders eliminated the requirement that taxpayers get preferred creditor status on aid to Spanish banks. Furthermore, they also found a way to recapitalize lenders directly with bailout funds. This will take place once Europe sets up a single banking supervisor.

After several days of worrying that the European Summit wouldn’t produce anything substantive, investors embraced the news in a big way with the Euro rallying over 2.0%. In hindsight, it looks as if the Euro Zone leaders went into the meeting looking for ways to reduce market pressure as rising interest rates in Italy and Spain were threatening to divide the Euro Zone and weaken the global economy.

Friday’s short-term decision calmed fears and uncertainty as the Euro regained several technical resistance levels. Since this is a fast fix to a long-term problem, it’s difficult to say how long the euphoria will last, but this is just one of the many forms of interventions and measures the European Union can work with and this one seems to be doing what it was designed to do.

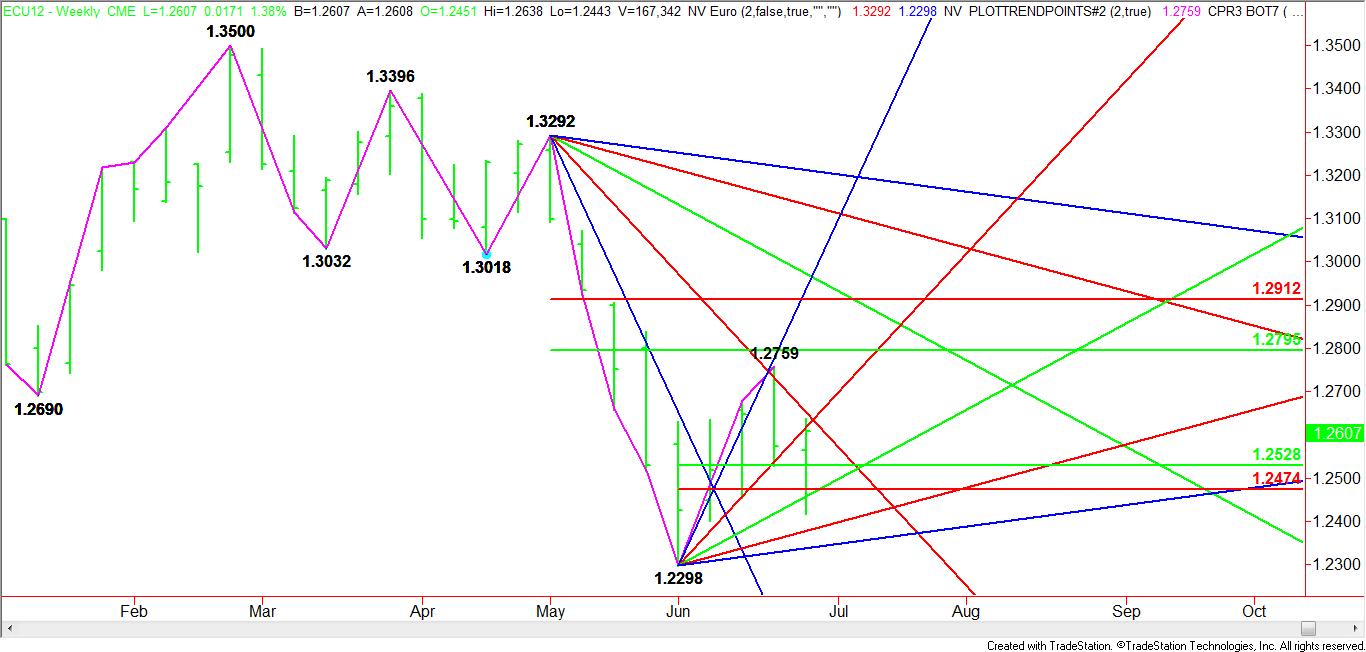

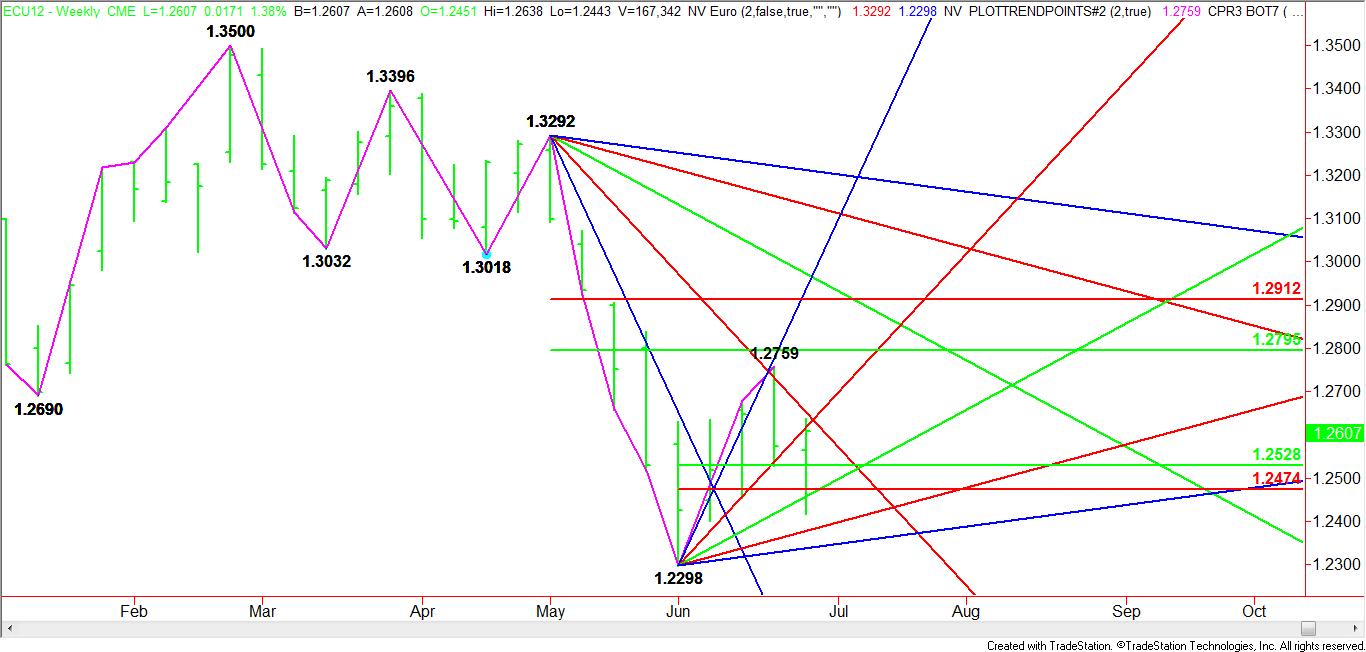

Technically, although the Euro sold off earlier in the week, the market never really developed the bearish tone present almost a month ago. The move over the past two weeks actually amounted to a little more than a Fibonacci retracement of the short-term rally from 1.2298 to 1.2759. The key retracement zone is 1.2528 to 1.2474.

Now that the Euro has regained this zone, it becomes new support. On the upside, a downtrending Gann angle from the 1.3292 top is at 1.2618. A move through this angle will put the market in a position to test the mid-June top at 1.2759. Before getting too excited about an impending breakout through the last main top, traders should realize that another major retracement zone is at 1.2577 to 1.2617.

Overall it was a good week for the September Euro. What started out as a bearish scenario for the Euro because of uncertainty regarding the outcome of the European Summit, turned out to be better than expected because the politicians did something right for a change and eliminated some of the uncertainty overhanging the Euro.

After several days of worrying that the European Summit wouldn’t produce anything substantive, investors embraced the news in a big way with the Euro rallying over 2.0%. In hindsight, it looks as if the Euro Zone leaders went into the meeting looking for ways to reduce market pressure as rising interest rates in Italy and Spain were threatening to divide the Euro Zone and weaken the global economy.

Friday’s short-term decision calmed fears and uncertainty as the Euro regained several technical resistance levels. Since this is a fast fix to a long-term problem, it’s difficult to say how long the euphoria will last, but this is just one of the many forms of interventions and measures the European Union can work with and this one seems to be doing what it was designed to do.

Technically, although the Euro sold off earlier in the week, the market never really developed the bearish tone present almost a month ago. The move over the past two weeks actually amounted to a little more than a Fibonacci retracement of the short-term rally from 1.2298 to 1.2759. The key retracement zone is 1.2528 to 1.2474.

Now that the Euro has regained this zone, it becomes new support. On the upside, a downtrending Gann angle from the 1.3292 top is at 1.2618. A move through this angle will put the market in a position to test the mid-June top at 1.2759. Before getting too excited about an impending breakout through the last main top, traders should realize that another major retracement zone is at 1.2577 to 1.2617.

Overall it was a good week for the September Euro. What started out as a bearish scenario for the Euro because of uncertainty regarding the outcome of the European Summit, turned out to be better than expected because the politicians did something right for a change and eliminated some of the uncertainty overhanging the Euro.